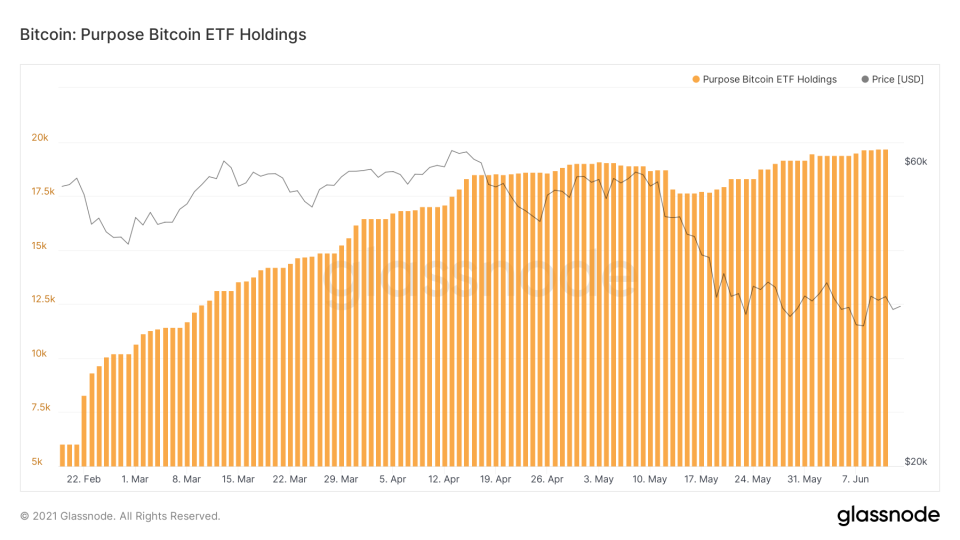

Canadian Purpose Bitcoin ETF Holdings at an All-Time High

The Purpose Bitcoin ETF holdings have reached an all-time high of 19,692.149 BTC despite the current bitcoin market decline.

The dip in the bitcoin market has not scared off Canadian investors. By considering the Purpose Bitcoin ETF re-accumulation, there is an indication that investors are buying the dip. Over the last month, Purpose’s holdings have increased by 963 BTC.

BTC is currently sitting at $36,028, a steep drop from its all-time high of $63,000. However, despite the flash crash, which brought the price down to around $30,000, the ETF has been steadily gaining over time.

Its holdings at the current price amount to around $709 million.

Purpose Bitcoin ETF success

The Purpose Bitcoin ETF launched in February 2021. It is hosted by the Canadian investment company Purpose Investments.

The company won approval for the ETF from Canada’s regulators and continues to be successful. Two days after its launch, the ETF grew its assets under management (AUM) to over $400 million.

It’s not the only ETF Canada has or the only groundbreaking move coming out of the country. In April, Purpose Investments marked another first, with the world’s first direct custody Ether ETF.

This ETF offer investors the chance to invest directly into physically settled ether.

No signs of ETF approval from U.S.

Not only was the bitcoin ETF a first for Canada, but it was also a first for North America. It was hoped that this bold move would encourage its southern neighbor, the United States. However, this was not the case.

The U.S. is still to approve an ETF, despite the multiple applications from various parties. In addition, it appears even the success of the Canadian ETF hasn’t been able to sway regulators.

Most recently, the SEC delayed its decision on VanEck’s latest filing just hours before the deadline. This keeps it in the pile of over a dozen applications that are still in limbo.