Buy the Dip on This Struggling Solar Stock

Enphase Energy Inc (NASDAQ:ENPH) was last seen down 2.3% at $255.51, extending yesterday's 9.3% drop after short-seller Carson Block set his sights on the solar sector, specifically Sunrun (RUN) and Hannon Armstrong (HASI). According to the interview published by the Financial Times, Block accused the sector of "an obsession with rapid growth at the expense of standards."

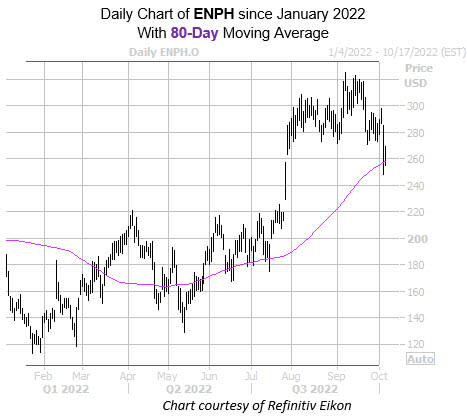

Enphase stock has the potential to stage a rebound, though. This pullback has ENPH within one standard deviation of its 80-day moving average -- a trendline with historically bullish implications according to Schaeffer's Senior Quantitative Analyst Rocky White. The equity has seen six similar signals in the last three years, and was higher one month later half of the time, averaging a 10.7% gain.

A move of similar magnitude would place ENPH above $282 and closer to its Sept. 8 record high of $324.83. The stock's 14-day relative strength index (RSI) of 23.1 sits firmly in "oversold" territory, which also points the equity toward a short-term bounce.

The stock is seeing attractively priced premiums at the moment, per ENPH's Schaeffer's Volatility Index (SVI) of 72%, which sits in the 26th percentile of its annual range. Furthermore, the security's Schaeffer's Volatility Scorecard (SVS) sits at a high 99 out of 100, meaning ENPH has exceeded option traders' volatility expectations during the past year.