Bullish Signal Flashing for Walmart Stock Ahead of Earnings

Walmart Inc (NASDAQ:WMT) is getting ready to release its first-quarter earnings report ahead of the open tomorrow, May 17. The security was last seen down 0.5% to trade at $147.36, and it has seen a dramatic drop from its April 21, record high of $160.77, but it is still clinging to a 6.3% year-over-year lead. What's more, this pullback put it back near a historically bullish trendline that could bode well for WMT in the coming month.

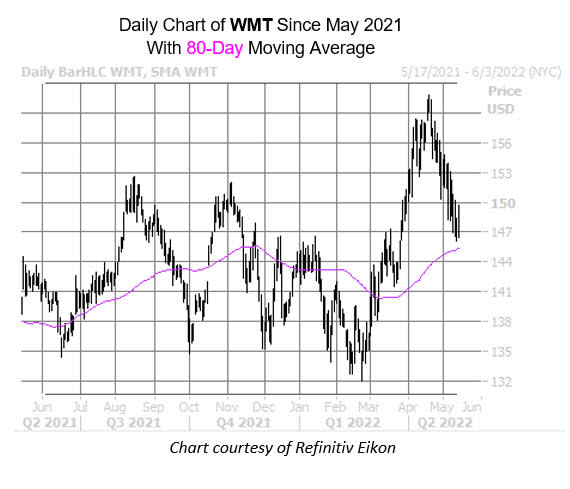

Per a study from Schaeffer's Senior Quantitative Analyst Rocky White, WMT just came within one standard deviation of its 80-day moving average, following a lengthy period above the trendline. The stock has seen eight similar signals over the past five months, and was higher one month later 63% of the time, averaging a 2.2% return during that time period. A similar move would put the blue-chip stock just below the $151 level.

While WMT has enjoyed a post-earnings pops after just two of its last eight earnings reports, the losses it has suffered have been relatively tame, with the largest next-day plummet of 6.5% happening in February 2021. This time around, options players are pricing in a 6.1% swing, regardless of direction, which is much bigger than the 2.5% move WMT averaged over the past two years.

An unwinding of pessimism among short-term options traders could also put wind in WMT's sails, as its Schaeffer's put/call open interest ratio (SOIR) of 0.84, which sits higher than 99% of readings from the past year, indicates these players have rarely been more put-biased.

It's also worth noting WMT sits just on the cusp of "oversold," per its 14-day Relative Strength Index (RSI) of 32. This implies a short-term bounce could already be in the cards for Walmart stock.