Bull Signal Says TWLO Tumble Could Be Short-Lived

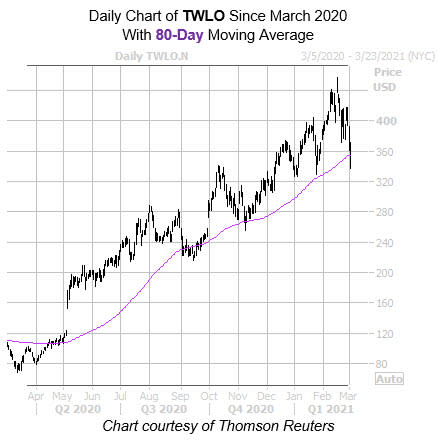

The shares of cloud communications name Twilio Inc (NYSE:TWLO) are plummeting today, down 7% at $339.17 at last check. The security has been pulling back from a Feb. 18 all-time high of $457.30 over the past few weeks, though it still carries an impressive 222.4% year-over-year lead. This pullback may be a short-lived one, too, as this recent drop has placed the security near a historically bullish trendline.

Specifically, Twilio stock just came within one standard deviation of its 80-day moving average, after spending several months above this key trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, no fewer than seven similar signals have occurred in the past three years. The security enjoyed a positive return one month later in 71% of those cases, averaging an 8.7% gain for that period. From its current perch, a move of similar magnitude would put TWLO over the $368 mark.

Additional tailwinds could come from a shift in the options pits. This is per the Twilio stock's 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands higher than all other readings from the past year. In other words, puts are being picked up their fastest rate in 12 months.

Now also seems like an affordable time to buy TWLO options, too. The stock's Schaeffer's Volatility Index (SVI) of 60% sits higher than just 20% of all other readings in its annual range. This means options players are pricing in relatively low volatility expectations at the moment. Lastly, the equity's Schaeffer's Volatility Scorecard (SVS) sits at a high 97 out of 100, meaning TWLO has exceeded these volatility expectations during the past year.