Just 18 First-Time Homebuyer Tips You Should Probably Know, Since I Personally Did Most Of These Very, Very Wrong

When purchasing your first home, I can basically guarantee that you will experience more "wow, literally no one prepared me for this" moments than you could possibly imagine. I know I did.

I bought my first home earlier this year, and y'all. When I tell you there's no way to truly prepare yourself for the never-ending stream of WTF moments you will encounter, I mean it with every fiber of my being. (I know I look happy here, but just remember this was the tail end of a VERY very stressful process!!)

Whether you're a soon-to-be first-time homeowner, beginning to think about making the plunge, or you're simply addicted to scrolling through real estate listings and daydreaming about your future homeowner life, I made this list of helpful tips and advice for you. For what it's worth, the home-buying experience can vary pretty wildly depending on a variety of factors — the state of the housing market, type of sale, even time of year — so let me just say that your experience might differ from my experience in every way! Regardless, I want your first home-buying experience to be more enjoyable than mine was, so this is basically my way of channeling all of my stress and frustration into something that makes all that chaos *worth it*... Right?!

Disney / Via giphy.com

(And, you're welcome.)

1.Take the time to find a real estate agent that you'll love working with, and don't be afraid to ask questions.

Many first-time homebuyers will want to go full-out DIY on their first home to cut costs, which includes buying their home without a real estate agent. I'm sending all the good vibes your way when it's time to DIY that new kitchen sink post-closing, but when it comes to actually buying your home, this is something you don't want to do alone — especially as a first-timer. Fun fact: it won't cost you any additional money to use an agent since buyers aren't responsible for paying their agents directly, so you owe it to yourself to work with a buyer's agent that'll offer their advice and expertise every step of the way.

When you search for a home through online databases (like Zillow), filling out their online form to visit a property will automatically "pair" you with a buyer's agent in that area. You might get lucky...but you also might not. Do your own research! I highly recommend choosing an agent that folks have vouched for, whether that's through a friend or family member's recommendation or through trustworthy online reviews, like those from Zillow, Google, or Yelp.

When deciding on a realtor, remember that you're quite literally designating the person that's going to advocate for you every step of the way — from the initial offer to closing day. For that reason, here are some buyer's agent red flags that should prompt you to run far, far away as quickly as humanly possible:

🚩 They take a long time to respond to your initial inquiry (thank you, next!)

🚩 They attempt to show you listings that are unreasonably outside your budget (see ya!)

🚩 They don't take the time to adequately answer your "first time homebuyer" questions (nope.)

2.Familiarize yourself with the differences between getting pre-approved and pre-qualified — and aim for the latter if your resources allow.

The Mortgage Monk / Via giphy.com

I stumbled upon the listing for my current house on an ~actual~ whim and went into the process with only a pre-qualification, so...this is a classic instance of do as I say, not as I do. In hindsight, I majorly lucked out.

Long story short: a pre-qualification is essentially like that friend that offers to be your reference for a job you're applying for, and you coach them through every single thing they should and should not say on your behalf. You're giving a potential lender the SparkNotes version of your financial situation, and they're telling you how much money you'd potentially be approved to borrow. Definitely better than nothing, but not necessarily 100% convincing for the seller.

A pre-approval, however, will involve a very in-depth application, including a hard credit check — essentially the beginning of your lengthy loan process — and for your efforts, you'll be rewarded with definitive approval (up to a specific amount) from your future lender.

Just remember — pre-approvals take significantly longer than pre-qualifications, so set aside some time for pre-approval before you even begin looking at homes, and you'll save yourself from some serious stress later.

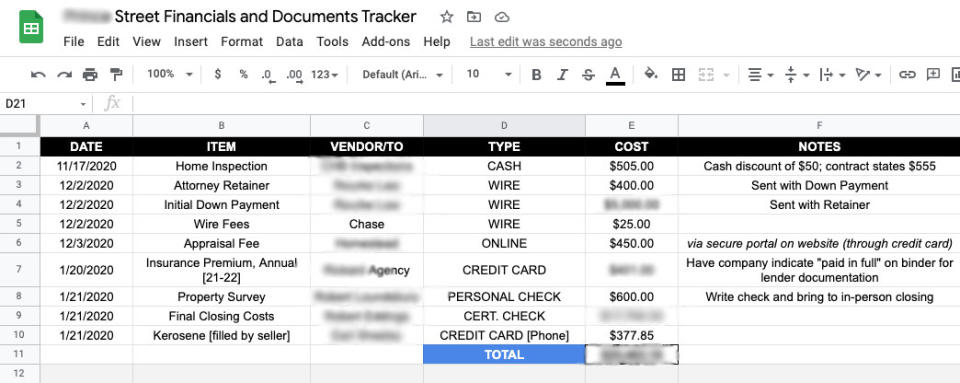

3.Throughout your home-buying process, you'll write checks for a LOT more than just your down payment, so factor these additional costs into your budgeting process well in advance.

We get lost in the down-payment of it all, but in reality, you'll need extra cash for the many expenses and closing costs that you'll get hit with along the way. I nearly passed out when I realized that I had to pay a year's worth of homeowner's insurance premiums before I made it to the closing table, so I promise, it won't hurt to take a look at some common costs associated with the home-buying process so you don't accidentally drain your bank account before closing day. I promise you: it's more than you think.

4.Be realistic with your home-hunting — if a listing looks too good to be true, it probably is.

Whether the listing fails to show specific rooms in the home, or the house has been on the market for an unusually long period of time for the area you're searching in, proceed with caution. I'm not saying this to deter you from touring a listing, just *managing expectations* is all.

Selling a home at a fair value is actually a very important element of a successful home-buying process, since things can go majorly wrong when appraisals — which are required for any mortgage — come back too far outside the purchase price. So yes, run away from that shiny, newly-renovated home that's $100K less than other comparable listings in the area. Unless you have the cash to remedy the hidden defects, it's probably not worth it.

5.Don't rush the initial visit to your future home.

As someone who would literally rather DIE than "overstay my welcome," I can't stress this one enough. You're touring your future home for the first time, so you're 100% allowed to stay as long as it takes to do a thorough tour of the home, even if you get the impression that it's "annoying" people. No door should go unopened and not a single corner should be left unexamined! Remember: if the inspection uncovers obvious, deal-breaking issues that you missed in the tour, you won't get the inspection fee back, and you'll theoretically throw hundreds of dollars down the drain if you can't re-negotiate with the seller.

When it comes time to tour your potential new home, come prepared with a list of questions and ask every single one of them. Walk on every square inch of that property. Check basements and attics for water damage or obvious signs of mold...and for god's sake, run every faucet and flush 👏 every 👏 last 👏 toilet.

6.Consider the pros and cons of large vs. small lenders.

This one will vary depending on your financial situation, but it's incredibly important to consider who you're borrowing money from — and your options are seemingly limitless.

The most important thing here is to do what's right for you, and to have an idea of who you'd like to borrow money from before you even think about touring potential homes. (If you're planning on getting pre-approved for a mortgage, you're all set on this front.) Just because your friends obtained their mortgage through a massive bank or mortgage lender doesn't mean you should — maybe you'd be better served by a smaller credit union. Do your own research, and make a decision that you're comfortable with.

For example: I decided to use a smaller lender since my home was on the cheaper side, and I knew many larger banks would be less likely to offer a loan at the price I was looking for...which in hindsight was an A+ decision.

7.When applying for a loan, don't include any info that you can't back up.

FOX / Via giphy.com

It won't help you...actually, it will hurt you...and I know because it happened to me. 😒

When I first applied for my loan, I was a W-2 employee with some every-now-and-then income on the side from freelance work. I included my estimated self-employment income with my yearly salary, and that's when shit totally hit the fan. My self-employment income came in slightly under what I had estimated, and it nearly cost me my loan (and house). Luckily, we were able to resolve this issue...but let me assure you, it was incredibly not fun.

Take it from me: don't over-inflate anything in hopes that you'll get a lower interest rate or seem like a "more attractive" buyer. And if you derive your income entirely from freelance work, it's incredibly important to understand the realities of applying for a mortgage as someone who is self-employed.

8.Even if you're getting the "deal of the century" through the lender that granted you pre-qualification or pre-approval, you'd be wise to shop around.

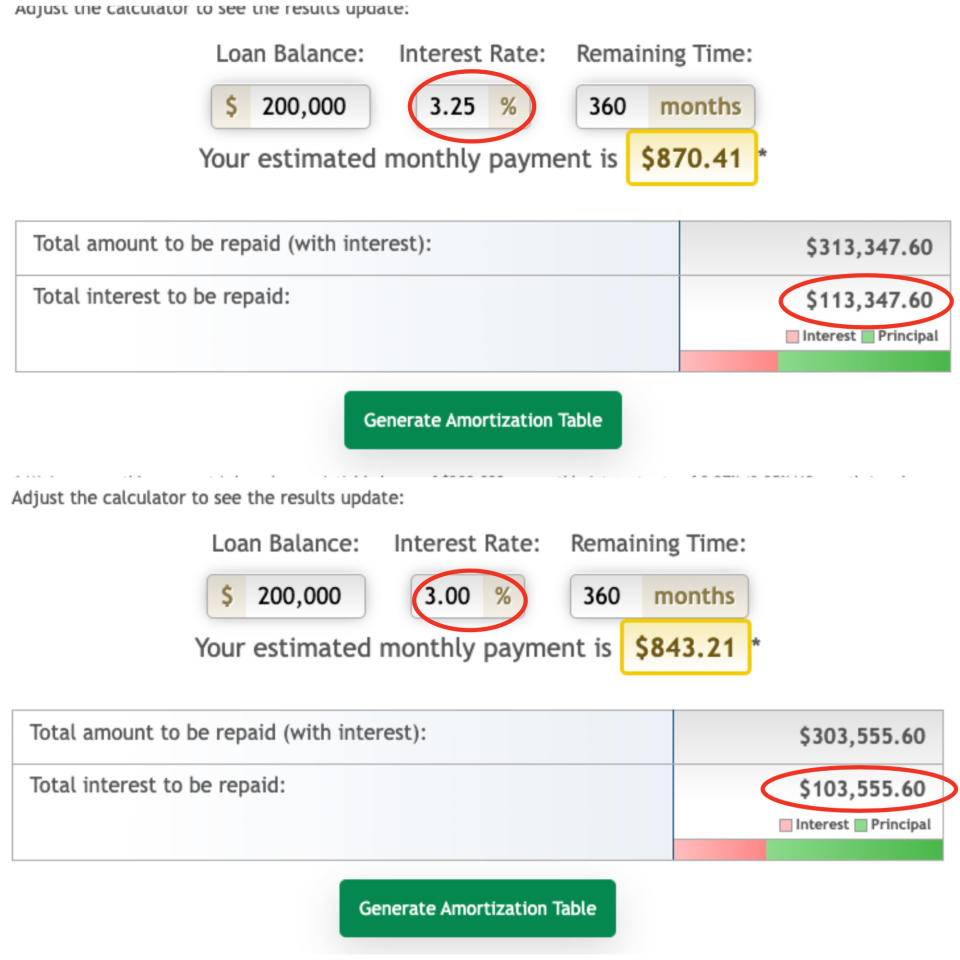

If you have solid credit (meaning, your credit score can take the hit from a few additional hard pulls), meeting with additional lenders to secure the best rate or deal you can get might end up saving you thousands over the life of your mortgage (see repayment calculator above with modified figures). But if you're at all worried about your credit score dipping into not-so-great territory, exercise caution here.

My credit score at the time didn't allow me to shop around as much as I would have liked to, and as a first-time homebuyer, yours might not either...which is totally OK! But if you can, you probably should. Why? Remember that the lender you eventually choose is going to make money off of the interest you pay them, so in many cases, they'll lower your interest rate a bit to ensure that you'll enter into a mortgage with them, not a competing lender — especially if you can cite other (better) quotes that you've obtained. If your first lender option gives you a hard time for shopping around, just remember that shopping for the best rate you can find is totally normal, and in most cases, you'll save a pretty significant amount of money. You might even find a lender that you vibe with more, which ultimately can only help, so ~you do you~ and don't let anyone sway you.

9.Don't purchase anything major (or open any new accounts) until after closing.

This will come as news to literally no one, but credit scores are undeniably complicated. Since your score will be checked before mortgage pre-approval and again just before closing, making a major purchase that could increase your debt-to-income ratio (and consequently lower your credit score) just isn't worth it. Lenders want to make sure you're a trustworthy, responsible borrower, so don't give them a reason to ding your application. Here's my rule of thumb: if it can wait until after you close on your new home, buy it then. Yes, that includes the brand-new mattress and bedroom furniture set that you're looking to finance (which you TOTALLY deserve...just not in this exact moment).

10.There's a 99% chance that the purchase process will take longer than you think, so make sure you're prepared for worst-case scenarios.

Waiting is, without a doubt, the worst part of purchasing a home. I spent an embarrassing amount of time daydreaming of the first night in my new home as soon as my initial offer was accepted...and then two months later, I finally had my keys. 🙃

The fact is, there's a massive amount of variables that can affect the amount of time it takes to finally get to the closing table: from the time of year you're looking to purchase to how long it takes to get an appraiser to the property. Since I bought my home in the height of the pandemic (read: everyone was getting their homes refinanced due to low interest rates), it took over a month to get the home appraised, and that was totally out of my control.

The best thing you can do to combat the always-shifting timeline is to prepare for the worst-case scenario as far in advance as you can — especially if you're approaching the end of a current lease and have a move-out date selected. Describe your situation to your landlord and ask if your move-out day can be flexible, depending on when you close, or see if you have any friends or family members you can crash with (and a storage unit to store your items in) in case closing day comes later than expected. You'll be happy that you made those plans ahead of time in the event that things go awry.

11.Get as much information as you can from the seller ahead of time.

Do you know when various appliances were installed? When they were repaired? How old is the HVAC system? Does the house use septic or public sewer? If the former, how long has it been in place and when was it last pumped?

The joy (intense sarcasm) of being a first-time homeowner is: you're about to deal with a slew of problems that would have literally never crossed your mind before — from broken appliances to faulty power outlets to flooded basements. Even the most proactive first-time home buyers aren't going to foresee every single issue on the horizon, but you owe it to yourself to poke around the good ol' internet and figure out the types of preventative questions you should be asking along the way. After all, as soon as closing day is over, it'll be much harder to ask the seller all those burning questions you'll wish you had asked sooner. Believe it or not, it's *highly* unlikely that your new home will come with an instruction manual. Ask those big questions ASAP to prevent the need to troubleshoot the ancient boiler you inherited that won't kick on in the middle of a blizzard. I say this from experience.

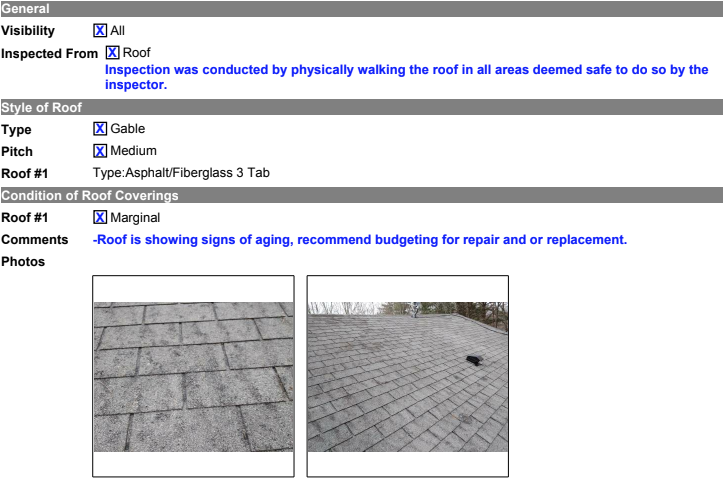

12.Apply the same diligence to choosing your home inspector as you did to choosing your real estate agent and lender.

The home inspection is one of the most crucial parts of the home-buying process, as it can make or break a sale — or leave you stuck with a defective home and countless out-of-pocket expenses. The inspection is all about you, the future owner, which means you need to hire someone with your best interests at heart. That said, you'd be wise to conduct some research beyond asking your real estate agent for their recommendations.

When operating off of your agent's recommendation, there's a slight conflict of interest issue at the heart of this matter: While the vast majority of inspectors are probably going to give you the full scoop on your future home, regardless of their professional relationship to your agent, there's always a risk that you'll hire an inspector that prioritizes their future business with your agent over providing an accurate report. If you have the bandwidth to do so, do your own research on reputable, trustworthy home inspectors in your area — Yelp, Google, and asking homeowners you know are all great places to start. Backing up an inspector recommendation (and any recommendations, really!) with reputable reviews from non-biased parties is never a bad idea.

13.If you can swing it, plan on being present for the inspection and any other in-person events that are scheduled prior to closing.

CBC / Via giphy.com

So long as you're not moving cross-country or anywhere outside a reasonable driving distance, you should absolutely plan on being present for any major in-person events, like inspections, or even property surveys, should they need to be updated prior to closing. (Since I never met my surveyor on-site, I literally paid $600 for a "new" property survey that was...fully the outdated one with a new date on it. Dead serious.)

Not only is it a great opportunity to actually meet the people you're paying to perform various tasks for you, but it's the perfect chance to become better acquainted with your future home and voice any of your burning questions to a legitimate professional that can/will help you. Clueless about the big scary tank that's somehow providing your home with heat and hot water, or maybe you want some answers about how well (or...not well) your future home is insulated? Ask away! You might not get an answer to every single one of your questions, but it's certainly a great start.

14.Depending on where you live and the specifics of your sale, you might consider working with a real estate attorney.

When my real estate agent asked me who I wanted "to represent me in the sale," I literally drew the biggest of all blanks. Like...I need a LAWYER to buy a house?!

Here's the scoop: depending on where you live, you might legally need an attorney to represent you in your sale and handle everything as it relates to closing — since I live in New York, that was a requirement for me. That said, depending on your geography, you might not be legally required to obtain an attorney.

In my case (regardless of my state's legal requirement to hire one), I found working with my real estate attorney to be absolutely worth the money, since they performed some incredibly useful functions and ultimately made things a lot smoother. As a first-time homebuyer, I had an endless list of questions, and appreciated having my attorney (and their team) available to break things down for me in a super digestible way, and when it came to closing, I felt extremely prepared.

If you're budget-conscious and your state doesn't require you to use an attorney, you might be totally fine without one — but either way, I'd encourage you to do your research and figure out if working with a real estate attorney might be right for you. Depending on the specifics of your purchase, it might save you a whole lot of stress and anxiety.

15.Block out some "paperwork time" and get organized, since filling out documents of all kinds will basically become a full-time job.

Disney / Via giphy.com

So...be prepared to spend an unfathomable amount of time in front of your computer, proving basically every single detail about yourself and your finances!

If you don't have the flexibility to work from home, now is a great moment to let your boss know that you're in the process of buying a home, and it's possible that last-minute, time-sensitive documents might come along that need to be properly filled out. When your realtor inevitably passes along that one document that needs to be signed ASAP in the middle of your work day, you'll feel better knowing that you were prepared ahead of time and don't have to annoy your manager in order to get it done.

For those of you who struggle with organization, trust me: this is the perfect time to overcome that hurdle and make sure all your information is stored in one easy-to-navigate place. I found Google Drive to be an invaluable resource, where I could keep secure copies of bank statements, employment verification forms, and other important documents in organized folders and access them whenever I needed to, even from my phone. If you prefer to keep things on physical paper, start a new file folder so you can access any important documents easily, without having to dig through a zillion statements or outdated pieces of paperwork. You're about to go on some pretty hefty scavenger hunts to find the information you'll need to prove yourself worthy, so organize your life ahead of time.

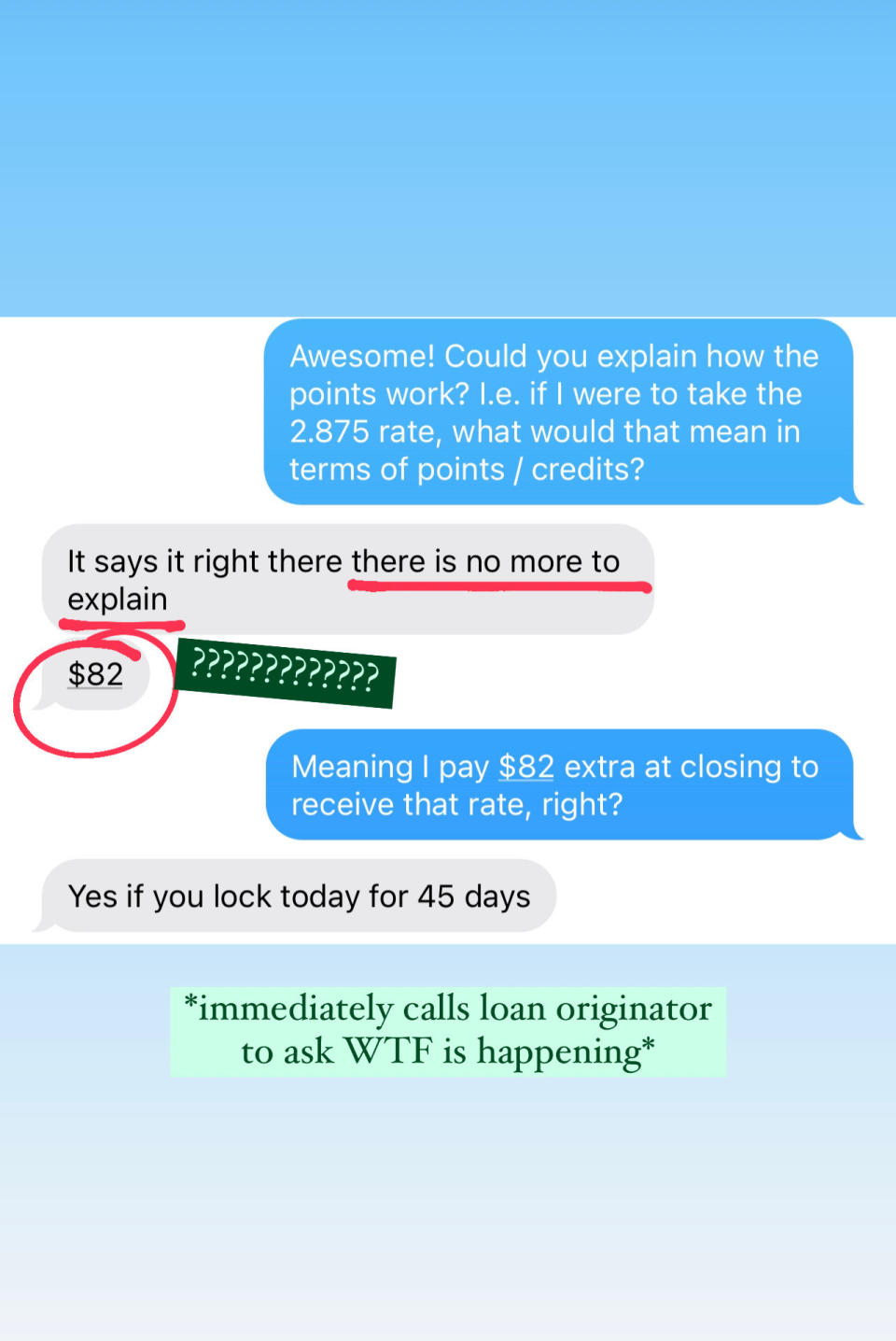

16.If any terminology comes up that you're unfamiliar with, ask a professional to clear things up (and don't feel weird about it).

Yes, I forced my loan originator to explain mortgage points to me for probably 15–20 minutes, and I don't regret it even one bit. Buying a home is no small-commitment — you're literally in charge of *actual property* that you will *own*, so no, don't sign your life away on any forms or documents if you don't 100% understand each and every word. The professionals you work with can/should take the time to walk you through the entire process. It's literally their job!

17.Your final walkthrough is anything but a throw-away, so come prepared.

I surely did not know this was a thing until it happened, and in my case, we walked into a completely cold house on a freezing January day. Had I skipped that walkthrough, I would've had to pay that hefty plumber's invoice for something that was entirely not my fault.

The importance of completing that final walkthrough ahead of closing can't be overstated — essentially, you're making sure that your soon-to-be home is in the condition that the seller stated it was in, and that any requested repairs or improvements were completed to your satisfaction. For all the care and attention you gave the home during your first walkthrough — even before starting the home-buying process — you should be even more detailed with this one. Bring this checklist with you to the final walkthrough, and don't leave until you're 100% sure everything is in working order.

Also, pro-tip: this is the time to ask how to turn off gas, electricity, water, or any other utilities that could potentially become dangerous in an emergency situation. (See note above about "home not coming with an instruction manual.")

18.Post-closing, your credit score is going to go on a rollercoaster ride. This is 100% normal — but it doesn't hurt to be prepared for it.

You have the keys, you're living your new homeowner dreams, and...your credit score went down 40 POINTS?! Don't panic. A lot of variables contribute to your credit score taking a big dip post-closing, but let me assure you that this is perfectly normal. Just be careful about excessive hard credit pulls or opening any new accounts in the months following your closing date. The odds are already stacked against you in terms of your credit score, so give it a little time to recover before you fill your home with all the big purchases you've been dreaming of, or open up that new account to finance that DIY renovation you've been anxiously waiting to tackle. Your new home is a long-term commitment, so if the purchase can wait until your credit score comes back to a normal-ish figure, wait.

Though the (occasionally excruciating) process of buying your first home can, quite literally, feel like the sky is falling at all times...it was worth it in more ways than I could have ever imagined. 10 months in, and I can happily report that any stress or anxiety I experienced was nothing compared to the joy of having a little place 👇 that's 100% mine.