Bitcoin surges above 7% to $11,700 as US-China trade tensions soar

Bitcoin is rising sharply against the pound and dollar on Monday amid continued trade tensions between the US and China.

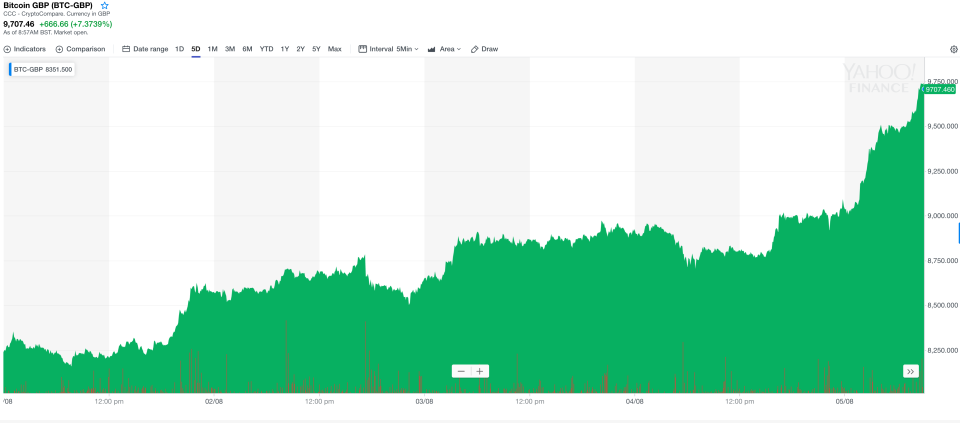

Bitcoin was up 6.7% against the pound to £9,647.83 (BTC-GBP) at 1.20pm and up 7.2% against the dollar to $11,770.98 (BTC-USD). The surge extends a rally that began last week and means the cryptocurrency has now risen 16% since Thursday evening.

The backdrop to bitcoin’s price rise is escalating trade tensions between the US and China, which have sent stock markets and the Chinese yuan diving.

US President Donald Trump hit $300bn-worth of Chinese imports with additional 10% tariffs on Friday. China has responded by allowing the yuan to slide against the dollar, rather than stepping in to maintain exchange rates. The Chinese yuan fell to a seven-year-low against the dollar on Monday morning.

Simon Peters, an analyst at trading platform eToro, said: “The yuan has fallen against the dollar to levels not seen since the 2008 financial crisis, and Chinese investors are casting around for alternative assets for their wealth.”

China outlawed cryptocurrency exchanges in 2017 but trading may still be possible through over-the-counter dealers rather than centralised exchanges.

The escalating tensions could also be driving investors outside of China to pick-up bitcoin.

“For a lot of currency holders, bitcoin is seen as a safe haven,” Tom Maxon, head of U.S. operations at CoolBitX, said.

The escalating tensions have provoked sell-offs in global stock markets as investors move into safer assets to preserve wealth. The FTSE 100 (^FTSE) was down by 1.4% on Monday morning and the Hong Kong Hang Seng (^HSI) closed 2.8% lower overnight.

Bitcoin’s price rising while traditional markets falter extends a pattern seen earlier this year when trade tensions were flaring.

“Even though correlation does not equal causation and we still don't have enough data, it's difficult to ignore the coincidence that bitcoin rose sharply in May and June while the US and China trade tensions were at their height,” Mati Greenspan, a senior market analyst at eToro, said in a note on Friday.

Some analysts and bitcoin investors believe that bitcoin can be used as a safe-haven store on value in the same way as gold. Bitcoin’s rise over the last few days has mirrored a similar rally in the price of gold, although gold has not risen as fast. The precious metal was up 0.7% against the dollar to $1,468.90 (GC=F) on Monday morning.