Biopharmaceutical Stock Could Be Headed Towards Fresh Highs

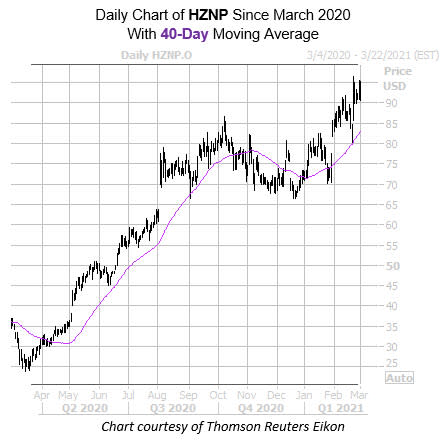

The shares of Horizon Therapeutics PLC (NASDAQ:HZNP) are down 3.4% at $91.29 at last check. Traders shouldn't worry just yet, though, as the equity isn't too far off from its Feb. 24, all-time high of $96.54. Plus, HZNP still sports an impressive 165.9% year-over-year lead with some underlying support at its 40-day moving average. Plus, a historically bullish signal now flashing on the charts suggests more records could be in store for HZNP.

More specifically, the equity's recent peak comes amid historically low implied volatility (IV), which has been a bullish combination for the security in the past. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been three other times in the past five years when HZNP was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower. This is currently the case with the security's SVI of 48%, which at the 13th percentile of its 12-month range.

White's data shows that a month after these signals, Horizon Therapeutics stock was higher, averaging an 8.4% return. From its current perch, a similar move would put HZNP just shy of the the $99 mark -- well above its February peak.

Tailwinds could also come in the form of a shift in the stock's options pits. This is per the equity's Schaeffer's put/call ratio (SOIR), which stands in the 76th percentile of its 12-month range, suggesting short-term options traders have rarely been more put-biased.