BHP boss: US-China trade war and nationalism threaten global economy

The world’s largest mining company has warned that increased nationalism, interference by governments in global supply chains, and the US-China trade war threaten global economic growth.

BHP (BHP.L) CEO Andrew Mackenzie said that the trade standoff between the US and China was a consideration for the company, warning that there was “no doubt” that it would “put a dampener on world economic growth.”

“Ultimately it will impact demand for our products,” he said, noting that the effect would be limited in the short to medium term thanks to stimulus measures in China and strong demand in Australia.

Mackenzie similarly warned that “increased nationalism” and the “increased assertion by governments to interfere in global supply chains and capitalism” were considerations for his company and the global economy.

READ MORE: A US recession is probably coming so investors should just deal with it

The comments serve as a riposte to the brand of economic nationalism embraced by US president Donald Trump, who has started a global trade war by imposing tariffs and quotas on imports.

BHP on Tuesday reported a 2% jump in underlying profits, to $9.12bn ($7.54bn), for the year to the end of June, slightly below analyst expectations due to weaker-than-forecast revenue.

The mining giant — the world’s biggest by market capitalisation — nevertheless announced a record dividend of 78 cents per share, which comes on top of the $17bn paid out to shareholders last year.

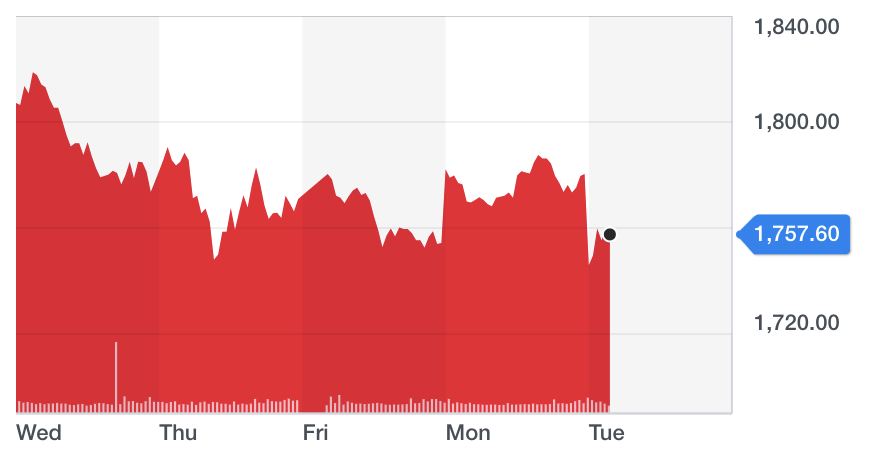

Shares in the company fell by nearly 2% in early trading:

The company has benefitted hugely from the rise of China, with its iron ore, coal, and copper helping fuel the country’s dramatic economic expansion.

But the company was jolted by a collapse in commodity prices in 2014, forcing it to introduce a series of cost-cutting measures.

Demand from China has not yet been significantly affected by the trade war, Mackenzie said.

“There’s obviously been a slight cooling in appetite based on some of the concerns we have seen in the short term for the global economy,” he said.

Mackenzie said the company was in a good position for the current financial year, pointing to a strong outlook for volume and costs.

Yahoo Finance

Yahoo Finance