Berkshire Holding Merck Dips on Covid-19 Vaccine Program Termination

- By James Li

Shares of Merck & Co. Inc. (NYSE:MRK) dipped approximately 1% on Monday following the company's announcement that it discontinued its Covid-19 vaccine program and is focusing more on therapy treatments.

The Kenilworth, New Jersey-based drug manufacturer announced that it terminated its development of its two Covid-19 vaccine candidates, V590 and V591, citing inferior immune responses compared to other Covid-19 vaccines. The termination of the vaccine program is subject to a charge in Merck's fourth-quarter 2020 earnings results based on generally accepted accounting principles.

Company switches attention to therapeutic treatments

Dr. Dean Li, president of Merck Research Laboratories, said that despite the termination of the vaccine program, the company remains committed to help "relieve the burden" of the pandemic on patients, health care systems and communities. The company discussed two candidate therapeutic treatments: MK-7110 and Molnupiravir (MK-4482). The former treatment aims to target a novel immune pathway checkpoint to modulate the inflammatory response to the virus.

Stock dips as broad market starts new week sour

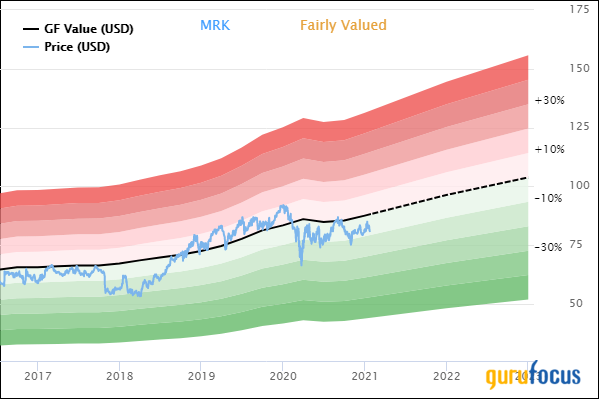

Shares of Merck traded at an intraday low of $80.06, down approximately 1.13% from last Friday's close of $80.98. The stock is fairly valued based on Monday's price-to-GF Value ratio of 0.92.

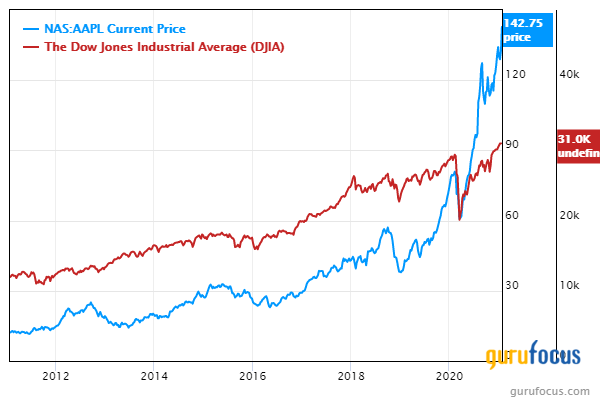

The Dow Jones Industrial Average hit an intraday low of 30,564.06, down 432.92 points from the previous close of 30,996.98, as investors prepare for a busy week of earnings reports.

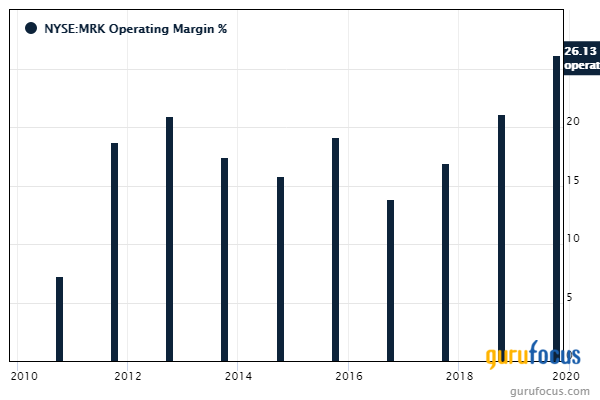

GuruFocus ranks Merck's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and an operating margin that has increased approximately 9% per year on average over the past five years and is outperforming over 92% of global competitors.

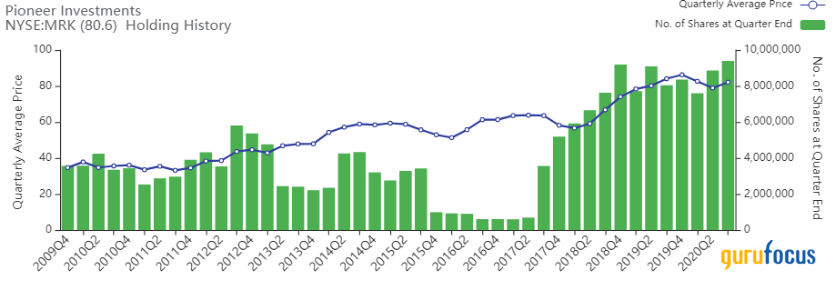

Gurus with large holdings in Merck include Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B), Pioneer Investments (Trades, Portfolio), Ken Fisher (Trades, Portfolio)'s Fisher Investments and the Vanguard Health Care Fund (Trades, Portfolio).

Disclosure: No positions.

Read more here:

5 European Companies With Historical Low Price-Sales Ratios

Schlumberger Dips Despite 4th-Quarter Revenue Beat

5 Oceania Companies With Good Financial Strength and Profitability

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.