Beauty and Fashion Sites That Popped Over Black Friday, Cyber Monday

As experts continue dissecting post-Thanksgiving Day sales data, some notable insights are starting to emerge. The latest comes from analytics firm Similarweb, which posted its list of popular beauty and apparel sites based on online traffic growth over Black Friday and Cyber Monday.

According to the AI-based market intelligence platform, which tracks web and mobile app visits, it analyzed the top 100 beauty sites to learn which ones showed the greatest increase during this time, compared to their lead-up in November.

More from WWD

SkinStore vaulted to top of the charts on Black Friday, the firm said, with 895 percent growth outperforming the rest of the beauty list by a wide margin. The traction may be due to scheduled promotions, such as a SkinStore 30 percent discount that dropped to 25 percent on Monday.

Estee Lauder took second place with 590 percent growth, followed by Glossier (506 percent), Kiehl’s (472 percent), Clinique (389 percent), Dossier (365 percent), MAC (345 percent), IT Cosmetics (321 percent), Lancome USA (308 percent) and Olaplex (284 percent).

On Cyber Monday, the script flipped to some degree, with SkinStore ranked at number 4, with 342 percent growth, and IT Cosmetics seated in first place, with a 587-percent jump. A number of legacy brands — such as Estee Lauder, Clinique and MAC — fell off the list entirely, though Kiehl’s (459 percent) and Lancome USA (253 percent) remained. They nestled in alongside edgier fare, buzzworthy newcomers and multi-branded e-commerce sites, including Beverly Hills MD (357 percent), Inkbox (302 percent), Tarte (287 percent), Dossier (261 percent), Esalon (232 percent) and Glossier (222 percent).

The distinctions among fashion websites weren’t so glaring. Abercrombie & Fitch’s teen purveyor Hollister won apparel on Black Friday with 401 percent growth, followed by Rack Room Shoes (358 percent), Lululemon (348 percent), American Eagle (332 percent), Ralph Lauren (324 percent), H&M (319 percent), Asos (316 percent), Abercrombie & Fitch (303 percent), Express (301 percent) and Journeys (282 percent).

Cyber Monday put Reebok, which didn’t place at all on Friday, in the lead with 224 percent growth, edging out American Eagle’s 214 percent. Rack Room Shoes maintained popularity, slotting into third place with 188 percent, followed by Under Armour (187 percent), Madewell (181 percent), Ralph Lauren (174 percent), J. Crew (173 percent), Adidas (171 percent), Express (162 percent) and Urban Outfitters (159 percent).

Based on which brands popped and when, it looks like younger consumers may have focused more on apparel on Friday and scoured the web for beauty on Monday.

Either way, their buying muscle this year is not entirely surprising. Usage has spiked in “buy now, pay later” services, which have become popular with Gen Z. Adobe reported that BNPL ballooned with 21 percent in revenue year over year on Cyber Monday. Business climbed at installment payments companies, with Klarna tracking Black Friday/Cyber Monday sales growth of 129 percent and Afterpay noting a 34 percent increase in orders compared to 2020, across both online and in-store.

While shopping behaviors may be changing, there are still some things that stay the same. Like bargain hunting.

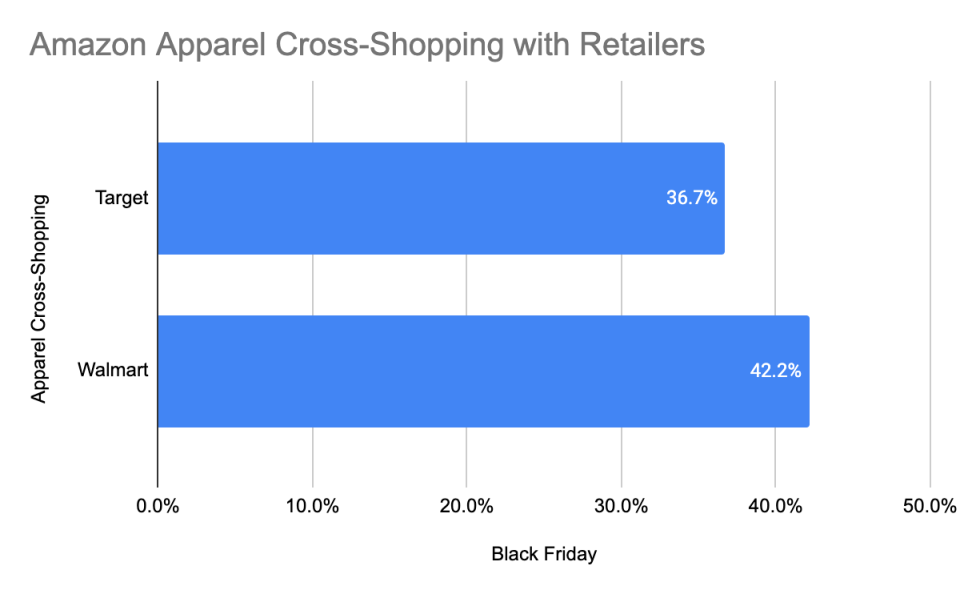

Similarweb saw clothes shoppers, in particular, hunting for deals across sites, and it pointed out a deep level of cross-shopping between the e-commerce behemoths. Out of all consumers who searched for apparel on Amazon, it said, more than a third (37 percent) also checked out Target on Black Friday. Even more, at 42 percent, visited Walmart.

As far as charts go, this one may perfectly explain the competitive intensity between the retail giants.

Courtesy image

Of course, there are caveats to reading too much into holiday 2021 metrics. This year was unlike any other, including last year. Supply chain constraints, labor issues and other pressures — which crucially include the ongoing pandemic and new variants — had retailers spreading out more modest deals instead of hyping blow-out, doorbuster promotions.

Also, with vaccines and boosters available now, people delivered more foot traffic in physical stores than last year, though it’s still not to the degree of pre-pandemic levels. All of that impacts e-commerce-related figures.

It’s worth noting that Similarweb’s data doesn’t reflect actual sales or revenue, only web traffic growth. But knowing where the online momentum is can speak volumes about consumer interest and how it shifts, shedding light on valuable, but all-too-elusive factors, like intention. That offers at least a little clarity within this uncertain and constantly changing retail landscape.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.