Bear of the Day: Hilton Grand Vacations (HGV)

The resilience of COVID variants is beginning to put a damper on things. While vaccination rates vary from state to state and country to country, the threat of shutdowns looms. Already there has been a lot of chatter about mask mandates coming back. This uncertainty is putting the reopening trade at risk. Stocks which were the hardest hit, in industries like cruise lines and hotels, are coming under pressure yet again.

One of the stocks coming under pressure recently is today’s Bear of the Day, Hilton Grand Vacations HGV. Hilton Grand Vacations Inc., a timeshare company, develops, markets, sells, and manages vacation ownership resorts primarily under the Hilton Grand Vacations brand. The company operates in two segments, Real Estate Sales and Financing; and Resort Operations and Club Management.

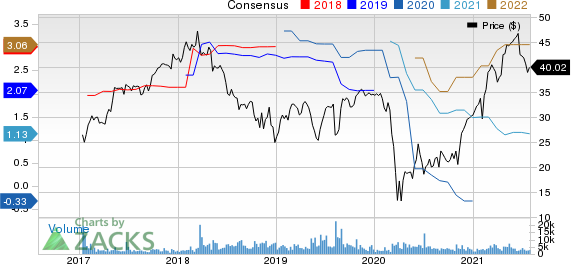

Hilton Grand Vacations is a Zacks Rank #5 (Strong Sell) in the Hotels and Motels industry which ranks in the Bottom 23% of our Zacks Industry Rank. The company is coming off two consecutive quarterly earnings disappointments. Last quarter, the company reported 10 cents EPS versus expectations calling for 21 cents. That was a 52% disappointment for the stock. Recently, analysts have cut their expectations for the current year. The bearish moves have cut our Zacks Consensus Estimate for the current year down to $1.13.

Hilton Grand Vacations Inc. Price and Consensus

Hilton Grand Vacations Inc. price-consensus-chart | Hilton Grand Vacations Inc. Quote

The good news for the long-term bulls out there is that next year’s number is still strong. Next year’s Zacks Consensus Estimate calls for $3.06. That would represent growth of 170% over the current year. The current year number is also much better than last year. That $1.13 is up 147% year-over-year.

Investors looking for other stocks within the same industry have a couple of stocks to investigate further which are in the good graces of our Zacks Rank. Civeo CVEO is a Zacks Rank #1 (Strong Buy) while Playa Hotels PLYA is a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Civeo Corporation (CVEO) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report

Playa Hotels & Resorts N.V. (PLYA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research