Barrick Gold Is Performing Well Despite a Tough Climate

Gold and silver haven't had the chance to shine this year. Gold prices have been struggling to break new highs while cryptocurrencies continue to lose value. Inflation continues to be a huge pressure point.

To be sure, there are various factors at play here beyond just inflation. Gold often struggles when real rates rise, and that's been the case this year as U.S. Treasury yields have moved higher on expectations that the Federal Reserve will continue to raise rates. Gold is also weighed down by a stronger dollar, which makes it more expensive for foreign buyers. Ultimately, it boils down to supply and demand dynamics. Gold has failed to attract enough buying interest to push prices meaningfully higher. Gold bulls hope the situation will change later this year as the predict central banks around the world will turn dovish again as global growth slows. But for now, at least, investors are content to sit on the sidelines regarding gold.

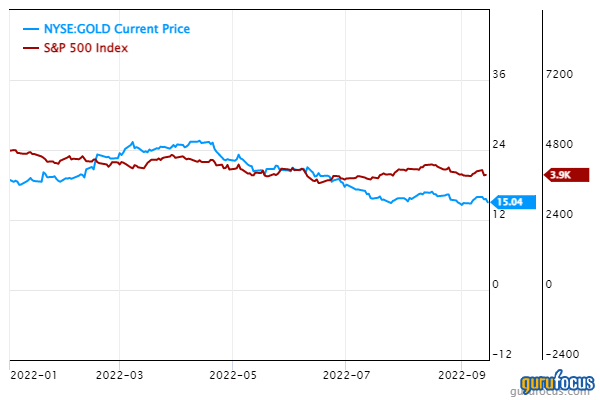

Still, one gold producer has managed to do well despite the unfavorable market trend, and that is Barrick Gold (NYSE:GOLD). Even though Barrick Gold faces headwinds such as inflation, the pandemic and other troubles of the gold mining industry, this company has still done better than expected, roughly keeping pace with the S&P 500 year-to-date. This makes Barrick Gold an ideal choice for gold bulls, in my opinion.

The Reko Diq settlement will boost the company

One interesting thing to note is that Barrick had a legal battle with Pakistan's federal government after the country's courts suspended a project work on Reko Diq, which is one of the world's largest undeveloped copper-gold deposits. The two parties finally came to terms earlier this year, with Barrick taking a 50% stake while the remaining half is co-owned by several local stakeholders.

The company is working on the finer details with the government of Pakistan. The production from the project will begin in 2027 or 2028, with 40 million tons of iron ore processed yearly. The production can be expected to double within five years. The project has been estimated to last for 40 years. The company will also benefit from gold extracted from the copper mines. Although it is present in smaller amounts, it still adds significant value.

The mining industry is growing

There are a lot of positives in Barrick's favor at the moment. One of these includes the healthy growth of the mining industry. A recent study from The Business Research Company forecasts the mining industry to reach $2 trillion by 2022 with a further 12.9% compound annual growth rate that will help the industry reach approximately $3.4 trillion by 2026.

The gold mining industry is not moving at the same pace, but its still moving strong. A report from Research and Markets states that from $214.1 billion in 2021, the gold mining market should be worth $249.6 billion by 2026, growing at a 3.1% compound annual growth rate for the period running from 2021 to 2026. Gold prices have been volatile recently, driven by several factors, including interest rate hikes. The high costs of mining equipment also hamper the industrys growth. With continuous technological improvement, more efficient equipment should lower the overall mining costs.

Uncertainties loom

No one is immune to the inflation or the effects of the Covid-19 pandemic, the Russian-Ukraine War and the skyrocketing freight prices. Barrick Gold certainly has challenges, and these issues may impact its production levels and financial health. CEO Mark Bristow expects inflation to stay for a considerable period. All these factors can indeed affect the company and the industry in the short to medium term.

Takeaway

Barrick's stock has recently been volatile due to many factors, including declining gold prices. Barrick has responded to business challenges by reducing costs and increasing efficiency across its operations. It focuses on reducing debt and generating free cash flow as it seeks to create long-term shareholder value. Thus, I believe the share price decline could offer a value opportunity.

This article first appeared on GuruFocus.