Asana's (NYSE:ASAN) Unprofitability is Hardly a Concern

This article first appeared on Simply Wall St News.

Flying on the headwind of remote work and increasingly important online work management, Asana (NYSE: ASAN) has been doing great in 2021, almost tripling up before the latest earnings caused a parabolic rally.

In the wake of these events, we will look at the numbers and examine the current cash burn of this exciting yet unprofitable company.

View our latest analysis for Asana

Earnings Results

Non-GAAP EPS: -US$0.23 (beat by US$0.03)

GAAP EPS: -US$0.40 (in line) Revenue: US$89.6m (beat by US$7.24m)

FY2022 Revenue: US$357m-359m (+57-58% y/y) vs US$338.88m consensus

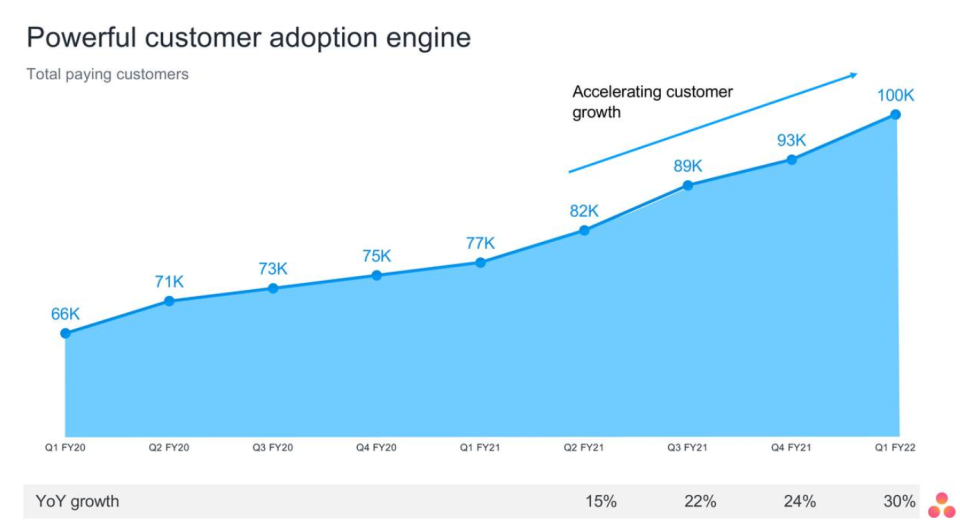

The company's outlook is improving, with data showing that the customers who spend US$50,000 per year grew by 111%. The following graph shows the strong positive paying customers growth.

CEO Dustin Moskovitz reflected that the company is helping society through one of history's most significant workplace transformations. He named some of the latest partnerships, especially a deep integration with Zoom Video Communications (NASDAQ: ZM).

Meanwhile, Asana became one of the first companies to list on the Long-Term Stock Exchange (LTSE). This exchange was founded 2 years ago to list the companies that focus on long-term value creation and accountability regarding executive compensation.

Outlining the Cash Burn

For this article, we'll define cash burn as the amount of cash the company spends each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash relative to its cash burn.

Does Asana Have A Long Cash Runway?

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. Asana has such a small amount of debt that we'll set it aside and focus on the US$374m in cash it held in July 2021.

Looking at the last twelve months, the cash burn was US$144m. That means it had a cash runway of about 2.6 years as of July 2021. Notably, analysts forecast that Asana will break even (at a free cash flow level) in about 3 years.

While it doesn't have much breathing room - it shouldn't need more cash, considering that cash burn should be continually reducing.

You can see how its cash balance has changed over time in the image below.

How Well Is Asana Growing?

Asana boosted investment sharply in the last year, with cash burn ramping by 66%. While that certainly gives us pause for thought, we take a lot of comfort in the strong annual revenue growth of 62%.

Considering the factors above, the company doesn't fare badly when assessing how it is changing over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Asana Raise Cash?

While Asana seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business.

One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalization, we understand how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalization of US$22b, Asana's US$144m in cash burn equates to about 0.7% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Asana's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Asana is burning through its cash. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending.

After considering the various metrics mentioned in this report, we're pretty comfortable that the company will meet its needs over the medium term.

It is important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 2 warning signs for Asana that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com