Ariel Investment Exits Generac Holdings, Cuts Microsoft, Nokia

- By Tiziano Frateschi

John Rogers (Trades, Portfolio)' Ariel Investment LLC sold shares of the following stocks during the fourth quarter, which ended on Dec. 31.

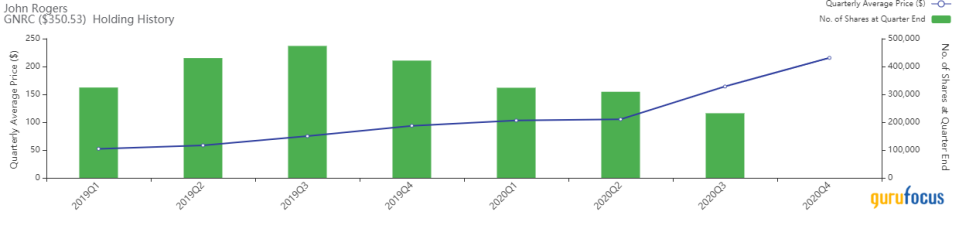

Generac Holdings

The firm exited its position in Generac Holdings Inc. (NYSE:GNRC). The trade had an impact of -0.65% on the portfolio.

The company, which manufactures power generation equipment and other engine-powered products, has a market cap of $22.03 billion and an enterprise value of $22.44 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 30.16% and return on assets of 12.26% are outperforming 94% of companies in the industrial products industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.62.

The largest guru shareholders of the company are Pioneer Investments (Trades, Portfolio) with 0.85% of outstanding shares, Steven Cohen (Trades, Portfolio) with 0.32% and Mairs and Power (Trades, Portfolio) with 0.17%.

Microsoft

The Microsoft Corp. (NASDAQ:MSFT) holding was reduced by 9.66%, impacting the portfolio by -0.46%.

The company, which develops and licenses consumer and enterprise software, has a market cap of $1.84 trillion and an enterprise value of $1.78 trillion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 43.01% and return on assets of 17.4% are outperforming 95% of companies in the software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.9 is below the industry median of 2.4.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 0.31% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.29% and PRIMECAP Management (Trades, Portfolio) with 0.27%.

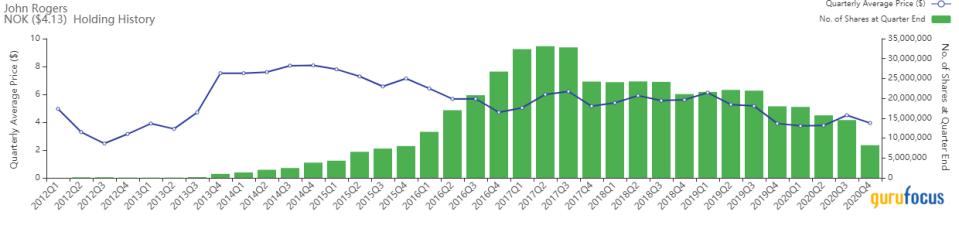

Nokia

The firm trimmed its Nokia Oyj (NYSE:NOK) stake by 43.51%. The portfolio was impacted by -0.36%.

The company, which operates in the telecommunications equipment industry, has a market cap of $23.44 billion and an enterprise value of $21.37 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -16.39% and return on assets of -6.28% are underperforming 84% of companies in the industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 1.28.

The largest guru shareholder of the company is Rogers with 0.14% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.14% and PRIMECAP Management (Trades, Portfolio) with 0.12%.

Charles River

The firm cut its Charles River Laboratories International Inc. (NYSE:CRL) stake by 15.8%. The portfolio was impacted by -0.25%.

The company, which provides drug discovery and development services, has a market cap of $14.26 billion and an enterprise value of $16.21 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 17.8% and return on assets of 6.05% are outperforming 70% of companies in the medical diagnostics and research industry. Its financial strength is rated 5 out of 10 with the cash-debt ratio of 0.11.

The largest guru shareholder of the company is Simons' firm with 0.87% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.74%, Fisher with 0.49% and Murray Stahl (Trades, Portfolio) with 0.22%.

China Mobile

The firm exited its position in China Mobile Ltd. (NYSE:CHL). The portfolio was impacted by -0.25%.

The Chinese telecom operator has a market cap of $112.66 billion and an enterprise value of $55.97 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 9.55% and return on assets of 6.32% are outperforming 61% of companies in the in the telecommunication services industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 6.77 is above the industry median of 0.34.

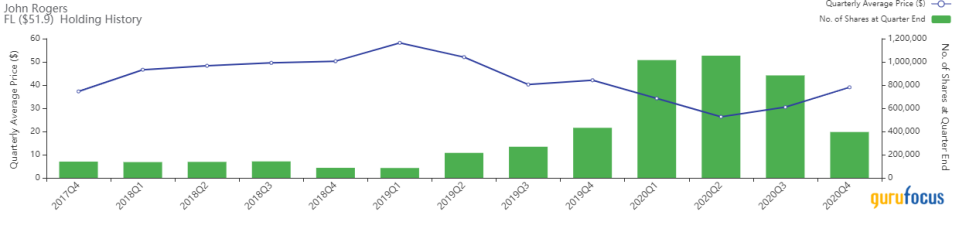

Foot Locker

The Foot Locker Inc. (NYSE:FL) position was trimmed by 55.24%, impacting the portfolio by -0.23%.

The company, which operates retail stores specializing in athletic apparel, has a market cap of $5.41 billion and an enterprise value of $7.24 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 13.62% and return on assets of 4.92% are outperforming 80% of companies in the manufacturing, apparel and accessories industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.43 is below the industry median of 0.45.

The largest guru shareholders of the company include Pioneer Investments (Trades, Portfolio) with 0.49% of outstanding shares, Rogers with 0.38%, Hotchkis & Wiley with 0.08% and Joel Greenblatt (Trades, Portfolio) with 0.03%.

Disclosure: I do not own any stocks mentioned.

Read more here:

GMO Exits Philip Morris, Starbucks, Trims Apple

Davis Selected Advisers Cuts Facebook, Alphabet, Amazon

Hillman Capital Exits Nike, Cuts Simon Property

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.