Arctos Hits $950 Million After Latest Fundraising Round

Private equity firm Arctos Sports Partners has closed on its third round of fundraising, bringing its total raise to about $950 million, Sportico has learned.

Arctos’ latest round has added $150 million to $200 million to the fund’s capital and comes from a diverse base of institutional investors, according to people familiar with the matter who asked not to identified because they aren’t authorized to speak publicly. The investors include endowments, pension funds, insurance companies and other large financial institutions. This investment comes about three months after the fund closed a round that vaulted assets to around $800 million, and seven months after Arctos disclosed $421 million in assets to the Securities and Exchange Commission. Arctos Partners declined to comment on the latest round of fundraising.

Arctos is one of a group of emerging sports investment funds that seek to invest in limited partner stakes of major league sports franchises in North America and Europe. Minority stakes in franchises are typically a tough sell for a variety of reasons, the primary one being the surge in team values that has put pro team stakes out of the reach of most wealthy individual investors. Team values across the four major North American sports leagues have grown at a 12% annualized rate since 1991, compared to about 8% for the stock market.

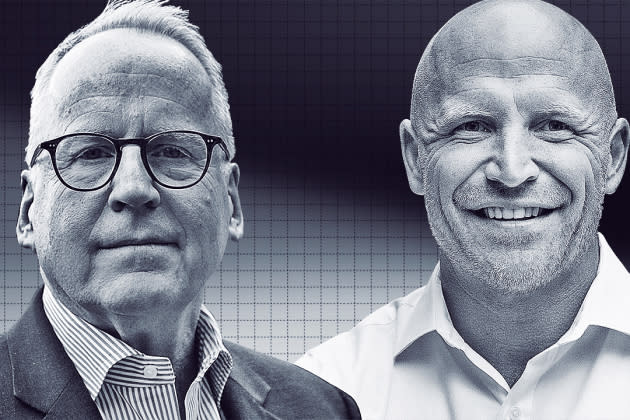

Arctos is led by Ian Charles, who helped lead a similar, non-sports strategy at Landmark Partners, and David “Doc” O’Connor, former CEO of Madison Square Garden, owner of the New York Knicks and Rangers.

More from Sportico.com