AR Could Soar with Help from Flashing Bull Signal

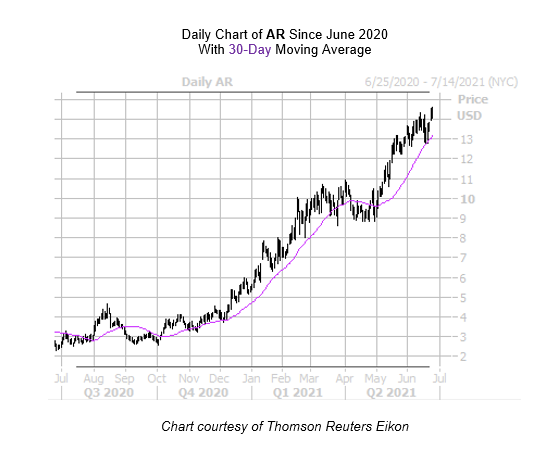

The shares of Antero Resources Corporation (NYSE:AR) are up 2.8% to trade at $14.54 at last check, after earlier hitting a two-year high of $14.60. The equity is pacing for its fifth straight day of gains, guided higher by the 30-day moving average, which put pressure on shares in April. Shares are now up an astounding 458.3% year-over-year, and there's reason to believe AR could continue to climb higher in the coming weeks.

Specifically, today's peak comes amid historically low implied volatility (IV), which has been a bullish combination for Antero stock before. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been three other times in the past five years when the stock was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) stood in the 10th percentile of its annual range or lower. This is now the case with AR's SVI of 8%, which sits in the low 3rd percentile of its12-month range.

White's data shows that one month after these signals, the security was higher, averaging an impressive 22.4% return for that time period. From its current perch, a move of similar magnitude would put AR just shy of $19, an area the equity has not crossed since October 2018.

A short squeeze could also keep the wind at AR's back. Short interest fell 12.8% in the last two reporting periods, yet the 24.74 million shares sold short still account for 9.5% of AR's available float.

What's more, the equity's Schaeffer's Volatility Scorecard (SVS) sits at 92 out of a possible 100. This means Antero Resources stock has managed to exceed volatility expectations during the past year -- a boon for option buyers.