The biggest differences between Apple's new credit card and most other cards

The Apple Card is officially available to consumers across the U.S., which means you can finally get your hands on one of your own. I’ve had the digital version of Apple’s (AAPL) card for a few weeks, and recently began using the physical card, and I’ve found it has a number of features of that make it more appealing than your average credit card.

There’s the fantastic interface, the gorgeous physical card, and the fact that the card itself is easy to apply for, set up, and start using. Serious travelers and those looking for high-end card benefits might scoff at the Apple Card’s cash back rewards, but the average consumer is certain to find good use for Apple’s latest major product release.

Signing up is incredibly fast and easy

I recently upgraded two of my credit cards and began using them more often after having an aversion to cards in general for some time. That’s mostly due to the fact that I’ve always been convinced that I would end up using the card like free money and going into severe debt.

But I’ve gotten over that fear, and now have three cards, one of which I use as my primary form of payment. The biggest difference between the Apple Card and most other cards is that the Apple Card is a digital experience first and a physical experience second. That much is clear from the moment you sign up for the card.

To do so, you need to open the Apple Wallet app and tap on the plus sign at the top of the screen, and select Apple Card. From here you’ll be able to sign up for the card in less than five minutes. The credit check is equally fast, and you’ll either be approved or denied in short order.

It’s important to note that applying for the Apple Card, like all credit cards, will ding your credit slightly, since such an application causes a hard credit inquiry. Such inquiries usually only take a few points off of your credit score, but if you’re applying for a housing or automotive loan at the same time, it’s worth keeping in mind, as multiple hard inquiries can have a greater impact on your credit score.

I signed up for my Apple Card through the app and started using the digital version of the card in less than 15 minutes.

Pushing digital first

Yes, the Apple Card is meant to be a gateway for more users, especially in the U.S., to adopt Apple’s Apple Pay contactless payment system. That’s why the Apple Card even exists, and why you’ll be able to use the digital Apple Card instantly.

In the U.S., contactless payment offerings like Apple Pay, Google Pay, and Samsung Pay still make up a small part of the card payment market. Regions like Europe and Asia, however, have made the transition from traditional plastic cards to digital cards far faster.

Adoption has been so slow in the U.S. that Chase recently announced that it was shutting down its own Chase Pay contactless payment service.

With the Apple Card, Apple is hoping to push more users to contactless payments via Apple Pay, which serves as a source of revenue for the company. The Apple Card is specifically designed to do that by giving users greater rewards when using the card.

The Apple Card’s rewards are cash back rather than, say, frequent flier miles. I’m a fan of cash back, because I only travel once a year, and it gives me a nice pool of money to use on things like Christmas gifts at the end of the year.

Apple’s rewards include 3% cash back on purchases made at the Apple Store or via the Apple App Store and on Uber and Uber Eats purchases when using the digital card. You’ll get 2% cash back on contactless payments using the Apple Card at physical payment terminals in stores or online, and 1% cash back when using the physical Apple Card either online by entering your card number, or at stores where the checkout counters don’t yet offer contactless payment functionality.

Apple says that 70% of merchants in the U.S. have some form of contactless payment functionality. I spend a lot of my money using Seamless or Grubhub, at the grocery store, and at bars. Seamless and Grubhub purchases are easily covered with Apple Pay, so I’m always getting 2% cash back there. My grocery store also accepts Apple Pay, so that gets me 2% cash back on my weekly allotment of peanut butter and diet Sunkist.

But bars and restaurants aren’t exactly at the forefront of payment technologies, which means I end up using my physical Apple Card to pay for drinks and food. And if you’re throwing down your card to get the benefits from a large purchase like a group dinner, the difference between 1% and 2% cash back can be meaningful enough to make you think about pulling out a different card.

I, for example, have a Capital One Quicksilver Card, which gets me 1.5% cash back on all purchases. So naturally, I pull that out rather than my Apple Card to get that extra cash back.

It’s all about the app and security

That physical card is as elegant as a credit card can be. It’s made of titanium and doesn’t have display your card number, expiration date, or security code. I have absolutely pulled the card out of my wallet at least a half dozen times to show people and dropped it on a table or desk or tapped it on my palm to show them that it’s a metal card.

The way that people ask to see it reminds me of how they react when I tell them I’m using a new iPhone. They instantly want to see it and feel it. Of course, after that, there’s not much to show. After all, it’s a credit card. They can’t exactly use it without my permission.

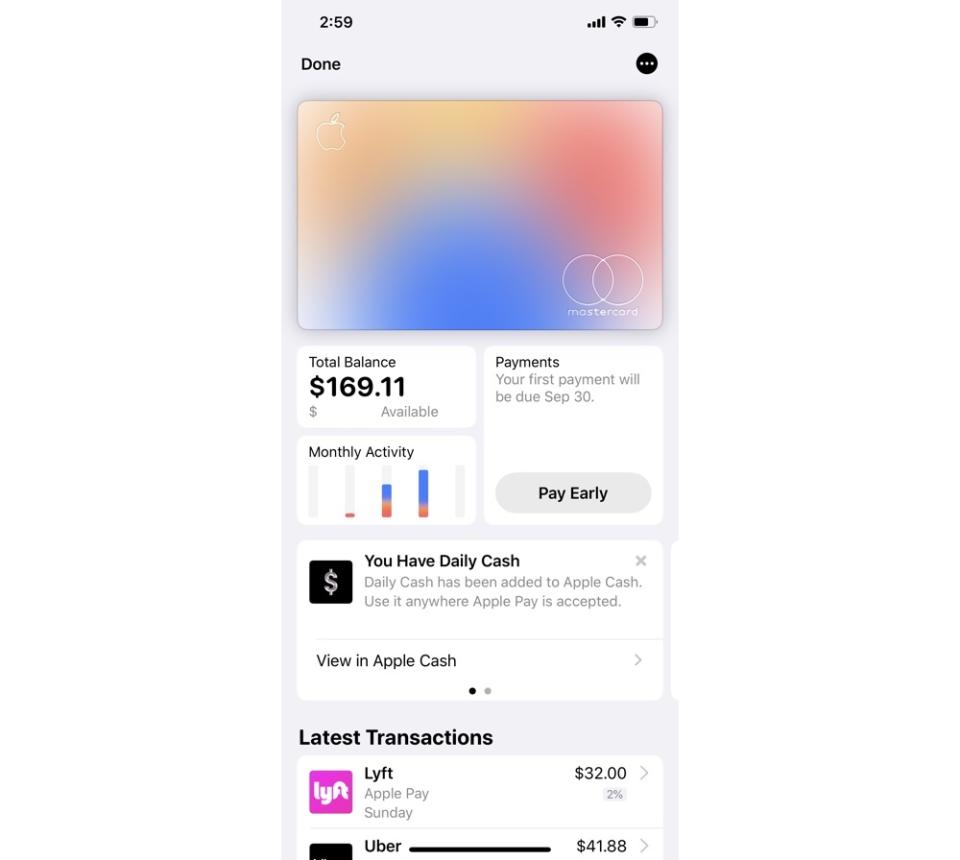

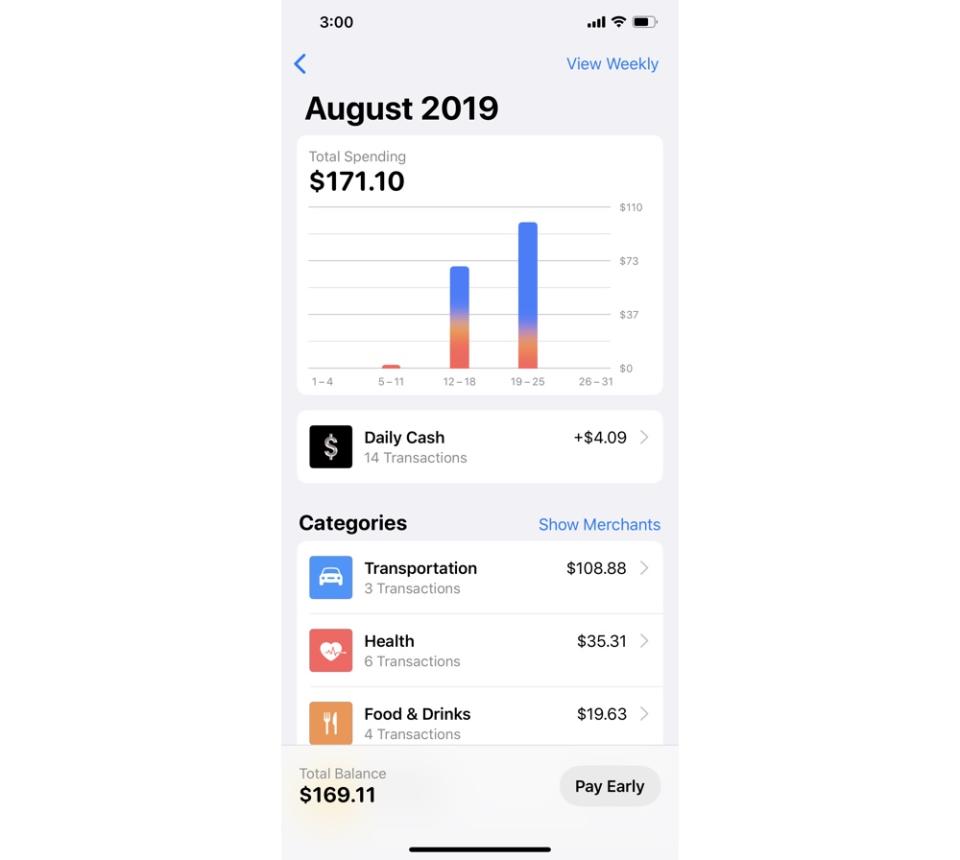

While the physical card is a nice touch, it’s the digital card and app that really sell the Apple Card. The app screen, which is accessible via the Apple Wallet app, shows you everything from your recent purchases, to where you’ve purchased items, to how much you’ll get back for each transaction. Sure, most credit card apps do all of that, but Apple’s solution is elegant in that it breaks down your transactions to help you understand where you’re spending the most.

Each purchase you make with the card falls into one of a number of categories, whether that be health, transportation, shopping, or food and drink. Each category is color coded, and presented to you as a bar chart so you can see where your money is going. In a typical demonstration of Apple’s attention to detail, the digital card in the app also changes color based on your spending habits. Mine is mostly blue since I spend a lot on transportation.

Transactions are also shown on a map, so you know exactly where you spent your money. That should come in handy if you head out to the bar for a few drinks, wake up in the morning, and see that there’s a $150 charge on your card.

Making payments on the card is helpful in that you’ll see exactly how much interest you’ll accrue if you don’t pay off your balance. It’s typically best not to carry a balance, since that interest is just free money you’re handing over to your creditor, but if you need to in an emergency, it’s good to see how much you’ll be hit with.

Security and privacy

Apple is pushing the Apple Card for its impressive security and privacy features. Each card has three distinct numbers, one for your digital card, one for online transactions, and one for your physical card.

The card number for your digital card is stored in a part of your iOS device called the secure element, locked away from potential thieves. And to even put a charge on the card, the Apple Card sends out a unique transaction number that has to match up with your account, or it won’t go through.

What’s more, authorizing transactions via your iOS device requires that you use biometric authentication via either Touch ID or Face ID.

The physical card can also only be activated using your specific iOS device, so if it’s lost in the mail, it can’t be turned on by another user. I’m on my second Apple Card, because someone stole the shipping bag that mine came in from my front door.

After the card never showed, I reached out to Apple’s customer support, and they took the card off of my account and sent out another one. Since then, I’ve been using it no problem.

If, somehow, your digital card is compromised, you can order a new number from within the Apple Card app, and start using that right away.

As for privacy, Apple says that it doesn’t receive any information about your transactions. Goldman Sachs (GS), the creditor behind the card, has also agreed not to use your information for any marketing or sell it to third-party vendors. MasterCard (MA), which processes the transactions globally, however, can use anonymized aggregated data from users.

Should you get it?

When all is said and done, the Apple Card is a credit card. It’s not a new iPhone that will blow you away, but rather something you’ll use to buy that new iPhone. The app is truly helpful, and the security behind the card gives you an extra sense of peace of mind if something were to go wrong.

Whether you get the Apple Card depends on what you’re looking for in a card. If you want cash back, then the Apple card is a great option. Its benefits aren’t above and beyond other cards, but its interface and privacy are fantastic. If you’re a frequent traveller, you’ll likely skip Apple’s option for card that gets airline miles.

Regardless of the card you choose, just remember to pay off that bill at the end of the month.

More from Dan:

Fitbit debuts premium fitness and health tracking service as part of turnaround

Samsung’s Galaxy Note10+ is a big-screen powerhouse with a big price tag

Email Daniel Howley at dhowley@yahoofinance.com; follow him on Twitter at @DanielHowley.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.