Analyzing Micron's Prospects After Earnings

Micron Technology (NASDAQ:MU) recorded record revenue for its third quarter of fiscal 2022. The semiconductor company posted revenue of $8.64 billion versus $7.79 billion for the prior quarter and produced a stellar earnings per share result of $2.59, beating analyst estimates by 15 cents. Furthermore, the company produced net income of $2.63 billion and $3.84 billion in free cash flow.

Although Micron delivered stunning earnings results, its stock remains weighed down by the combination of disappointing guidance and a general market downturn for the semiconductor industry. Could that mean Micron is now a value stock?

Assessing the market

When valuing Micron, I'd like to take a look at something that many investors often overlook: market segmentation.

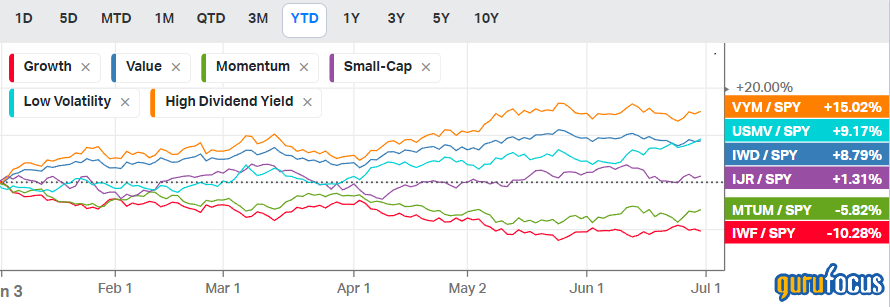

All market participants can benefit from understanding how market segmentation works. Market segmentation divides stocks into a few factors: growth, value, size, momentum, quality and dividend yield. These segments are inextricably linked to the economy and exhibit independent correlations to economic cycles.

Micron exhibits a few characteristics that align with value and quality factors. According to modern financial literature related to market segmentation, quality and value stocks tend to outperform the broader market whenever the market's risk profile is high, which is affirmed by the chart below measuring segment performance relative to the S&P 500.

Source: KoyFin

Micron's business verticals

Micron is in a secular growth phase, conveyed by its year-over-year Ebitda growth of 76.49% and its normalized net income growth rate of 1.83. Whether this will continue in the near future is another question entirely, but at least as of its third quarter, it was still growing.

Much of the company's revenue stems from DRAM (dynamic random access memory) sales, of which it owns 22% of the market. The DRAM space is set to grow at a CAGR of 8% until the year 2030 according to estimates from Market Research Future, which allows Micron to capitalize on an industry that's likely to grow faster than GDP, supporting Micron's claim that even if the near-term is painful, the long-term is promising.

Also, Micron owns approximately 11% of the NAND landscape, which Market Research Future expects to surge by 11.27% through 2030, once again providing a secular growth opportunity.

Lastly, Micron's exposure to artificial neural networks could be rife with potential. The ANN industry is growing quickly and could be pivotal to semiconductor stocks' growth trajectory.

Valuation

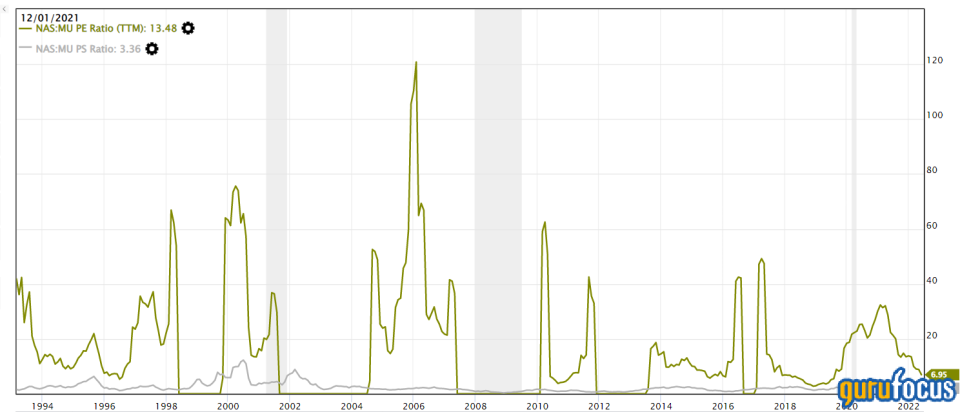

At a price-earnings ratio of only 6.95, it can be surmised that Micron is significantly undervalued for a technology stock, especially considering the sector median price-earnings ratio is 61.71% higher. In addition, Micron's price-sales ratio is meager for a technology stock, as it is just 2.02, which is lower than its five-year average by 21.03%.

Concluding thoughts

Micron's stock is clearly undervalued in my view after its more than 40% year-to-date drop. Although management expects a soft back end of 2022, the company delivered robust results in its latest financial quarter and calls for solid long-term growth.

This article first appeared on GuruFocus.