Analysts, Options Traders Target TJX Before Earnings

The shares of TJX Companies Inc (NYSE:TJX) are down 1.1% to trade at $71.26 at last check, despite a pre-earnings price-target hike from Wedbush to $75 from $66. The stock has seen a slew of bullish price-target adjustments this past month, including one yesterday from J.P. Morgan Securities to $81 from $78, all ahead of the company's earnings. TJX's first-quarter report is due out tomorrow, May 19, ahead of the open.

Looking back at the last two years, five of the company's last eight post-earnings sessions were higher, including a 7.2% pop in February of 2020. The security has averaged a post-earnings swing of 3%, regardless of direction. This time around, the options market is pricing in a much bigger move of 6.8%.

Options traders have been quick to chime in ahead of the event, with options running at 3.1 times the usual daily volume already today. Puts and calls are relatively even, with 8,550 calls and 8,015 puts across the tape so far. The May 70 and 67.50 puts are the most popular, with new positions being opened at both, followed by the May 75 call.

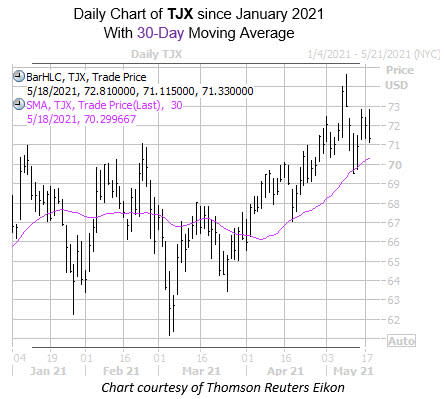

On the charts, TJX isn't too far off from its May 10 all-time high of $74.65. The equity has support from its 30-day moving average as well, which have helped catch the stock's farthest pullbacks since mid-April. Year-to-date, the security is up 4.3%.