Amigo: This Fintech Is Poised to Rebound

Founded in 2005, Amigo Holdings PLC (LSE:AMGO) is a fintech company that specializes in guarantor loans. These are the types of loans issued to someone with a poor credit score who can use a trusted friend or family member to secure it.

Amigo secured 80% of the guarantor loan market in the U.K. The company went public in 2018 on the London Stock Exchange at a 1.3 billion pounds ($1.6 billion) valuation. However, In November 2020 the business model was halted by regulators on a number of concerns and the company faced bankruptcy.

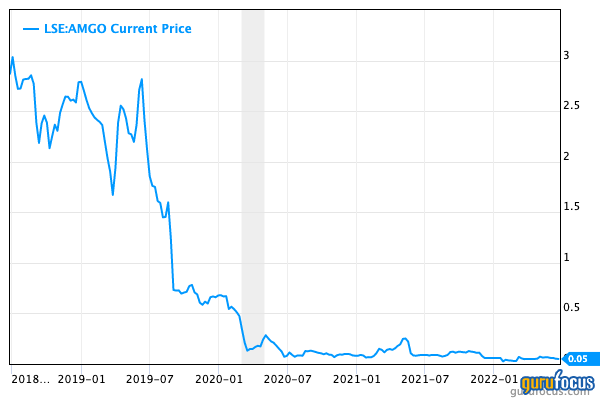

As a result, the share price has tumbled by over 98% since 2019. However, a high court approved its new business model in May, so it is set to be able to continue business very soon (subject to regulatory approval). The stock popped by 15% in the last 48 hours on the news.

Lets dive into the story so far, looking at the financials and valuation to see if this bloody stock is poised to rebound.

The bad - business model halted

Amigo is the U.K.s largest guarantor loan company. The idea is to offer loans up to 10,000 pounds ($12,300) to those people who are locked out of the financial system and cannot borrow due to a poor credit history. They can do this by asking a friend or family member to back the loan. Their loans are classed as mid cost loans with a 49.9% annual percentage rate and no extra fees. This is significantly higher than mainstream banks, but cheaper than payday loans. However, in July 2020, Amigo received a swath of complaints regarding lack of affordability checks and had to pay out approximately 35 million pounds to address them. Its business was halted in November 2020 and the company was teetering on the edge of bankruptcy.

The good - approval

In May, a high court approved the company's new business model. As such, Amigo is set to be able to continue business very soon if the Financial Conduct Authority approves as well.

Under the new scheme, Amigos total net new lending cannot be more than 35 million pounds and it must have at least 112 million pounds in the scheme. The idea is to make the new loans more customer-friendly with annual interest-free payment holidays offered and methods to allow customers to reduce monthly payments.

Source: Amigo presentation.

The ugly - shareholder dilution

If the FCA approves the scheme, then the company will need to raise more money from investors. Amgo will need 15 million pounds raised from investors and 97 million pounds from its strong internal cash balance of 110 million pounds in unrestricted cash. By raising capital, the company will be issuing 19 new shares for each existing share, which will result in vast dilution for existing shareholders. As a fallback solution, the company will wind down the business into bankruptcy.

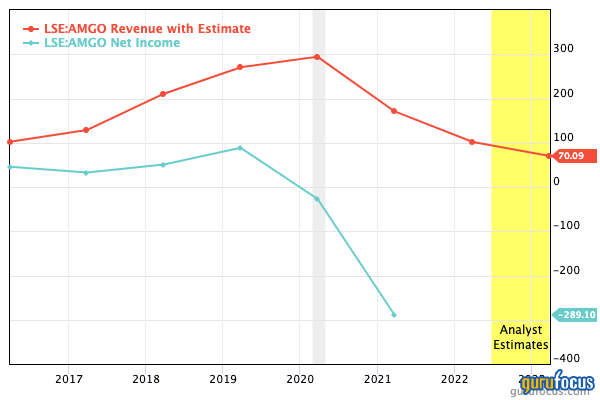

Shaky financials

As of the end of December 2021, the company announced a strong unrestricted cash position of over 110 million pounds excluding debt. Amigo has a net loan book of 180.7 million pounds, which is down 56.2% year over year. The number of its customers in arrears (struggling to pay back loans) has increased its impairment coverage ratio to 22.4% from 18% in the third quarter of 2021. It has a vast complaints provision of 347.5 million pounds. Amigos profit before tax was 1.6 million pounds, up from a vast 81.3 million pounds loss in the third quarter. Positive profitability is a good sign as the company ruthlessly cuts costs.

Valuation

In terms of valuation, the stock has a market capitalization of just 25 million pounds, making it truly a small-cap stock. However, the 110 million pounds in net unrestricted cash means it is in a strong cash position. If we exclude the 97 million pounds for the new scheme, we have 13 million pounds left over, which means the company is currently trading at approximately two times its future cash position. But remember this is not taking into account future dilution, which could skew the numbers even more.

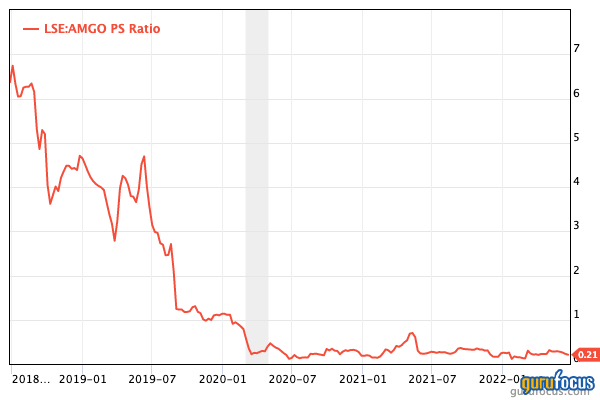

The company is trading at a price-sales ratio of 0.21, which is much lower than historic levels of 6.

The GF Value Line indicates the stock is modestly undervalued relative to historic multiples, past financial performance and future earnings projections.

Final thoughts

Amigo is a battered and bloody fintech, which has recently been given a glimmer of hope after the positive ruling. Its brand and in-house office team looks to have a fun and friendly style of borrow to your Amigo, but the current situation is still on shaky ground.

The company's new scheme is awaiting regulatory approval, after which it should be poised to rebound. The future shareholder dilution adds another element of danger to the investment and makes it difficult to value. Thus, I believe the stock is likely to rebound, but an investment today would definitely be a speculative bet and this would be one of those trades where I would assume any investment has the possibility of going to zero. Thus an assessment of the risk-reward ratio should be made.

This article first appeared on GuruFocus.