America’s favorite Mexican fast-food restaurants: survey

Though many would argue that Mexican fast-food in America is not authentic, that doesn’t mean Americans aren’t crazy about their tacos and burritos. But, which restaurant chain is America’s favorite?

Market Force Information, a customer experience management company, conducted a survey of over 7,600 American adults to find out their favorite fast-food restaurants — and when it comes to Mexican food, one took the top spot by a narrow margin.

Despite its previous woes, Chipotle (CMG), was voted America’s favorite fast-casual Mexican restaurant for the third year in a row.

Participants were asked about their satisfaction levels with their most recent visit and their likelihood to recommend the restaurant to others. The results were then averaged to establish the Composite Loyalty Index (CLI) score. Only chains that received at least 100 customer responses were analyzed. Participants were also asked about their dining experiences, including delivery services, visit frequency, brand engagement, customer experience and problem experience.

While Chipotle took the crown, Moe’s Southwest Grill was a close second, and El Pollo Loco (LOCO) was only a hair behind in third place. Del Taco (TACO) and Taco Bell (YUM) came in at the bottom of the list. Qdoba, another big taco chain, ranked third place in last year’s study, but did not receive enough votes in this year’s survey to make the list.

Though there has been a bit of a decline in visits to fast-food Mexican restaurants, about 59% of customers visited at least once a month in the past 90 days. The study showed that 46% of customers dine in at the restaurant, while 30% prefer to go through the drive through. Twenty-two percent opt to take out directly from the restaurant and only 2% get their food delivered directly from the store or through a third-party delivery service.

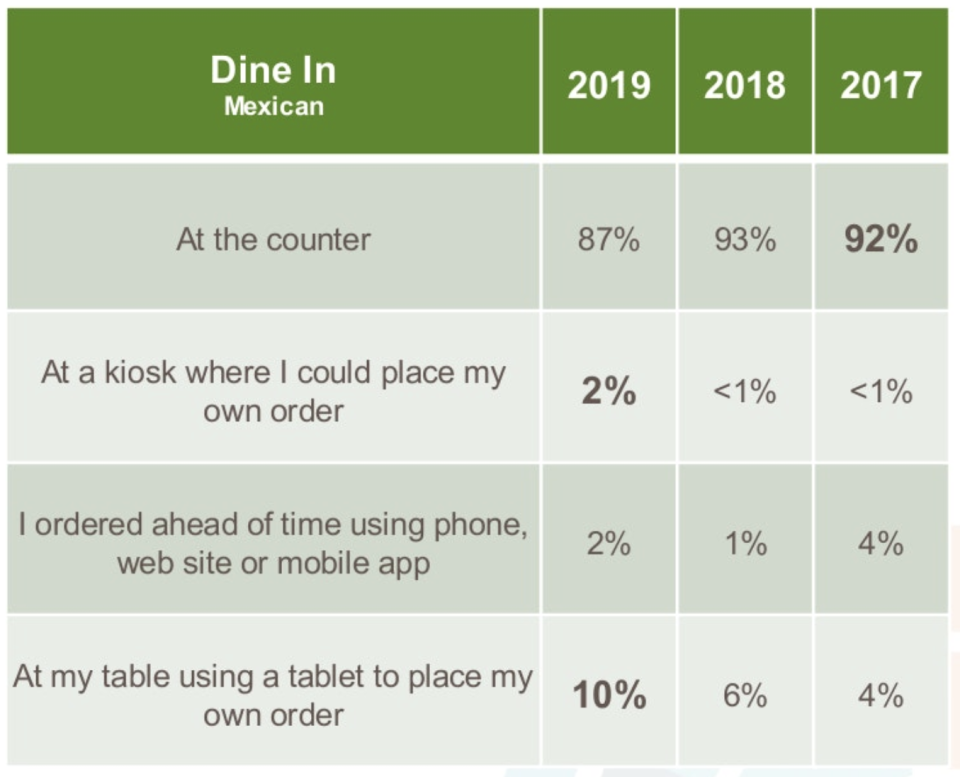

Of those who choose to dine in, more are placing their orders using tech. In the study, 87% said that they order at the counter, which is down from 93% last year and 92% in 2017. Whereas, 2% now order at a kiosk, which is an increase from the two previous years. The use of tablets to place orders has skyrocketed this year to 10%. Only about 6% ordered via tabled in 2018 and 4% in 2017.

Nearly 43% of customers complained that orders were inaccurate, and one in every four customers said the wait times were too long. Poor food and beverage quality ranked the third biggest complaint among customers. El Pollo Loco actually had the lowest problem experience and is the best at resolving problems. Meanwhile, Chipotle received the second most problem experiences and Taco Bell saw the highest amount of issues among the restaurants.

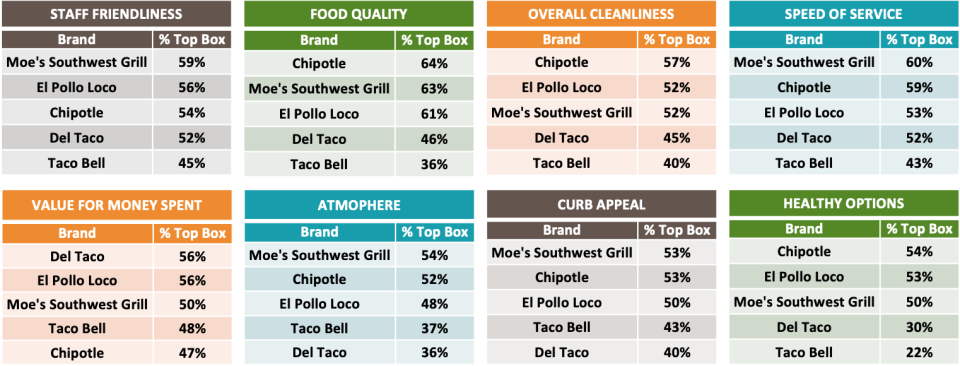

Nevertheless, Moe’s gave Chipotle a serious run for its money in eight key experience categories. Moe’s led four of the eight including staff friendliness, speed of service, atmosphere, and curb appeal. While Chipotle topped food quality, overall cleanliness and healthy options.

One of Chipotle’s newest initiatives is the introduction of its loyalty program. While it is in its early stages, awareness among survey participants was low and ranked third with only 45% of customers responding that they knew a loyalty program existed. El Pollo Loco had the highest loyalty incentive awareness with 61%, and 53% of customers knew of Moe’s loyalty program.

It seems as if Chipotle’s turnaround plan has worked, and its brand image is finally recovering meaningfully among customers after E. Coli outbreaks shook the company to its core in 2017. Chipotle now offers different healthy options for those on the Keto, Paleo and Whole30 diets and is constantly testing out new products. The burrito chain also has been focusing on tech initiatives and delivery for its customers. Under new management, Chipotle’s stock is back near record highs, and same-store sales, a key industry metric, continues to see strong growth. Nevertheless, Wall Street analysts have questioned whether or not the strong sales momentum can continue long term. Shares have rallied a stunning 82% this year and have outperformed the broader market, which has risen 15% in the same time period.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

LeBron James–backed pizza chain is America’s favorite: survey

America’s favorite and least favorite fast-food burgers: survey

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.