Americans warm to real estate, shun stocks as a long-term investment, Bankrate says

Americans appear to be turning away from stocks as long term investments, and looking at real estate instead, new research suggests.

Despite stocks hitting record highs, many Americans are still cautious when it comes to Wall Street. It’s leading them to look at other asset classes as better bets, according to Bankrate data.

“People have never warmed to the stock market, despite the ten-year bull market,” Greg McBride, Bankrate’s chief financial analyst, told Yahoo Finance.

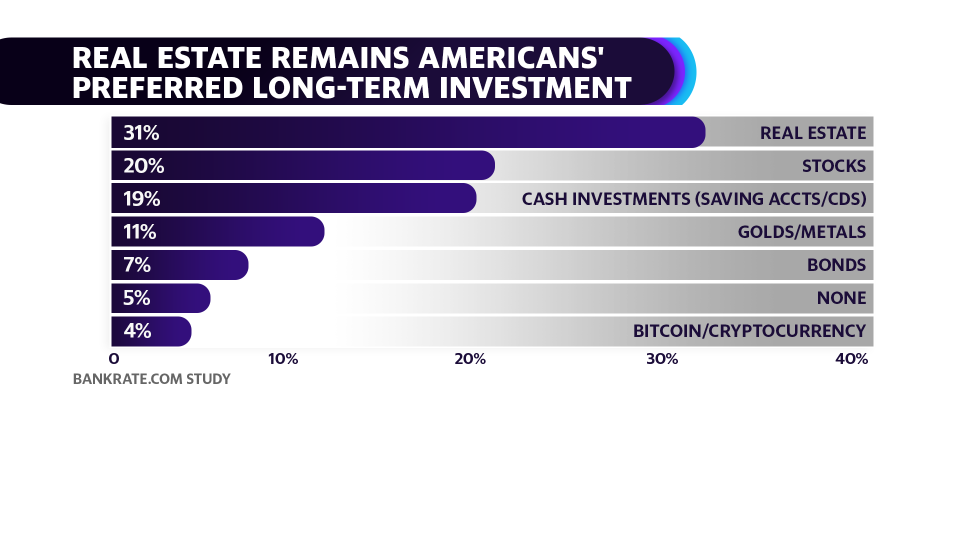

According to a recent Bankrate study, 31 percent of respondents would chose real estate for investing money they won't need for the next 10 years.

Stocks, which were the most popular investment in 2018, are now trailing behind real estate—which is the sector’s “best showing” in the seven years that Bankrate’s conducted the study.

“People grasp onto the tangible nature of real estate and the fact that they feel a little bit more insulated from loss, particularly if it’s a use asset,” said McBride.

The U.S. real estate market, valued at over $27 trillions dollars, has caught the attention of one group in particular.

At 36%, millennials scored the highest among all other age groups in Bankrate’s survey for favoring real estate as a long-term investment strategy.

“Millennials...have the lowest preference for the stock market of any age group,” McBride said, “which I think is troubling from the standpoint of accumulating retirement savings.”

He added: “Millennials are going to have the biggest retirement savings burden in history.”

While a potential interest rate cut from the Federal Reserve seemingly in the offing, Bankrate’s survey found that declining rates would not impact their decision of how to invest their money.

Roughly 1-in-4 Americans asked would be more likely to borrow more money due to falling interest rates. “It makes you question why the Fed is going to cut rates,” McBride said.

Sarah Smith is a Segment Producer/Booker at Yahoo Finance. Follow her on Twitter: @sarahasmith

Read more:

Why a real estate investor says 'the housing market is done in America'

Away, Instagram's favorite suitcase brand, is now worth $1.4 billion

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.