Adobe: Buy the Moat?

- By Nicholas Kitonyi

Shares of creative software giant Adobe Inc. (ADBE) are up 30% since Dec. 24, as the stock continues to mirror the general market trend while also presenting investors with a unique value proposition.

Adobe is the world's largest creative software company dominating the market from the individual and SMBs levels all the way to multinational enterprises. The company manages to maintain its strong business moat in creative software by offering different products that attract different customers.

The company's creative cloud is quickly becoming one of the main growth drivers because of its subscription-based revenue model and the adaptability to different businesses. This platform attracts customers of all levels offering flexible packages ranging from $9.99 per month all the way to $49.99.

Adobe's most popular product, Photoshop, continues to maintain market-leading standards and together with Lightroom, Dimension, Animate and Illustrator are quickly becoming growth products because of their adoption and integration into the digital advertising marketplace.

And last year, Adobe bought e-commerce software company Magento for a reported $1.7 billion, which essentially will serve to strengthen the company's footprint in the digital marketing software space. According to Adobe's Experience Cloud senior vice president for strategic marketing, Aseem Chandra, the company wants to "make every digital experience shoppable," and Magento will be central to realizing this goal.

Warning! GuruFocus has detected 3 Warning Sign with FTCH. Click here to check it out.

The intrinsic value of ADBE

You will hardly come across a business entity that does not use at least one of Adobe's flagship products when formulating a market strategy, and this gives the company an edge over its competitors in a market whose impact across other industries is growing every year.

In addition, Adobe hardly has any direct competition in the industry. Most of its rivals compete only with one or a few of its products but essentially, Adobe can be considered to be a potential monopoly in its craft. It enjoys unique synergies gained from integrating the different products it offers to customers, something none of the other players in the market can boast to have.

Nonetheless, with the digital marketing space seen as the main top-line growth catalyst for Adobe, there are several technology giants that could hold back its perceived growth. Adobe has moved from being just a creative content software company where the likes of Slidemodel.com compete with it in presentation graphics, to a more diverse enterprise in the e-commerce space.

In this new and exciting market opportunity, the challenge is bigger. Adobe will battle it out with the likes of Oracle Corp. (ORCL), SAP SE (SAP), Salesforce.com (CRM) and Shopify (SHOP) among other emerging players for a share of the digital marketing software market.

While Adobe might seem to be arriving late to the party, the three tech giants -- Oracle, SAP, and Salesforce -- made the move to strengthen their grip on the rapidly growing digital marketing software market not long ago.

Oracle was first among the trio to make the giant leap when it bought e-commerce software maker ATG for roughly $1 billion in 2011. Two years later, SAP followed by paying $1.5 billion for Hybris, a B2B software company, while in 2016, Salesforce.com beat Adobe in the race to buy Demandware (B2C software company) after bidding $2.8 billion.

Clearly, the digital marketing software space, from which Adobe looks to derive its next growth phase, is becoming highly competitive. But, with its great portfolio of products that could help to harness some operational synergies in the space, this could help to claw some market share from its rivals.

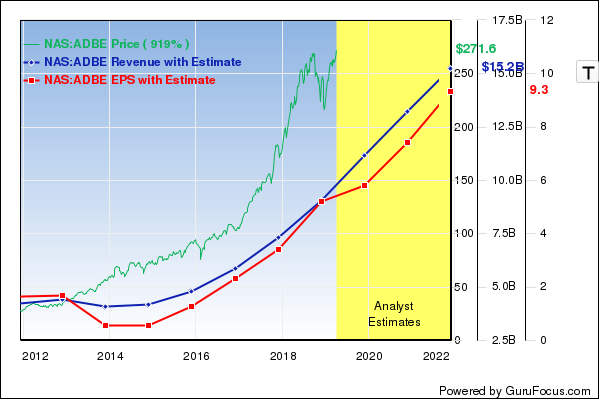

Therefore, while Adobe's growth outlook might seem a little dim because of the competitive nature of the digital marketing software market, its strong business moat could be what helps it to weather the storm with its strong profit margin providing it with the required flexibility. The company's new revenue model also helps it to generate more predictable revenue and income estimates and this will assist in planning and strategy. Adobe has enjoyed double-digit revenue growth over the last three years, and this is expected to continue through 2021.

The company's bottom line is also expected to keep up with this growth as it continues to integrate recent acquisitions to its business model. Magento, which is yet to break the $200 million top line barrier, is one of the products that the company is yet to integrate fully into its business and once it weaves its expansive portfolio of creative content in its remodeled subscription-based cloud platform, it will be able to harness more synergies, thus boosting its revenue potential.

From a valuation perspective, Adobe's current price-earnings ratio of about 50.34x is typical of any technology stock that is perceived to have great potential for growth in a rapidly developing market. Its projected five-year PEG ratio of 1.47x shows that there is great expectation for growth in Adobe's earnings, and this should continue to boost the value of the company.

Disclosure: I have no positions in the stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with FTCH. Click here to check it out.

The intrinsic value of ADBE