6 Guru Stocks Boosting Book Value

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, a Premium feature, the following guru-owned financial stocks have grown their book value per share over the past decade through Dec. 2.

Book value per share is calculated as total equity minus preferred stock, divided by shares outstanding. Theoretically, it is what shareholders will receive if a company is liquidated. Total equity is a balance sheet item and is equal to total assets minus total liabilities.

Since the book value per share may not reflect the company's true value, some investors check the tangible book value to confirm their investment ideas.

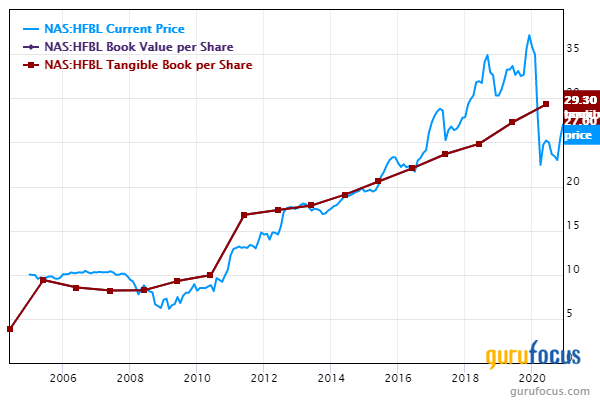

Home Federal Bancorp

The book value per share of Home Federal Bancorp Inc. of Louisiana (NASDAQ:HFBL) has risen 8.60% over the past 10 years. The price-book ratio and the price-tangible book ratio are 0.91.

The bank holding company has a market cap of $45.45 million.

According to the discounted cash flow calculator, the stock is undervalued and is trading with a 56.23% margin of safety at $27. The share price has been as high as $37.99 and as low as $20 in the last 52 weeks. As of Wednesday, the stock was trading 28.93% below its 52-week high and 35% above its 52-week low. The price-earnings ratio is 12.22.

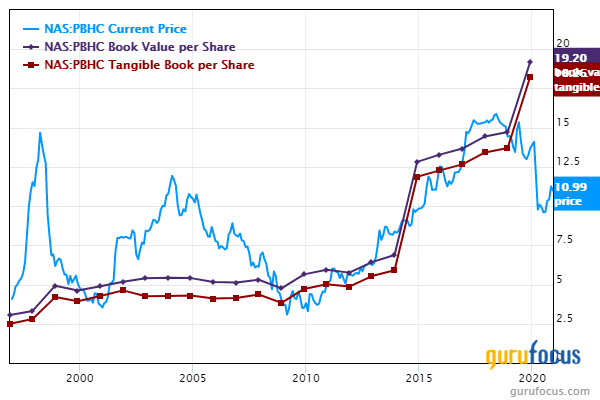

Pathfinder Bancorp

Pathfinder Bancorp Inc.'s (NASDAQ:PBHC) book value per share has grown 14.30% over the past decade. The price-book ratio is 0.54 and the price-tangible book ratio is 0.57.

The holding company for Pathfinder Bank has a market cap of $49.77 million and an enterprise value of $109 million.

According to the DCF calculator, the stock is undervalued and is trading with a 35.09% margin of safety at $10.99. The share price has been as high as $14.5 and as low as $9.08 in the last 52 weeks. As of Wednesday, the stock was trading 24.21% below its 52-week high and 21.04% above its 52-week low.

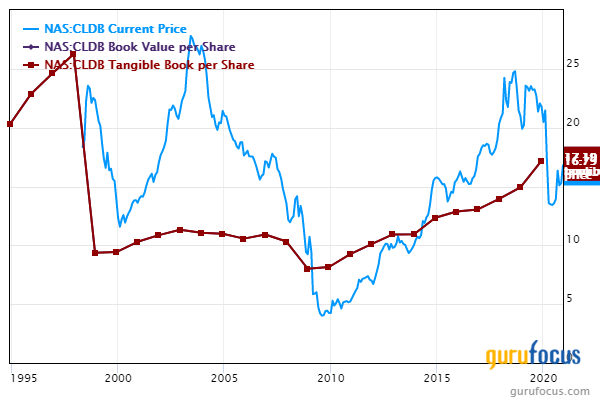

Cortland Bancorp

Cortland Bancorp's (NASDAQ:CLDB) book value per share has grown 6.70% over the past decade. The price-book ratio and the price-tangible book ratio are both 0.91.

The company, which owns, manages and supervises Cortland bank, has a market cap of $70.91 million and an enterprise value of $58.43 million.

According to the DCF calculator, the stock is undervalued and is trading with a 9.83% margin of safety at $16.79. The share price has been as high as $23.99 and as low as $11.1 in the last 52 weeks. As of Wednesday, the stock was trading 30% below its 52-week high and 51.26% above its 52-week low.

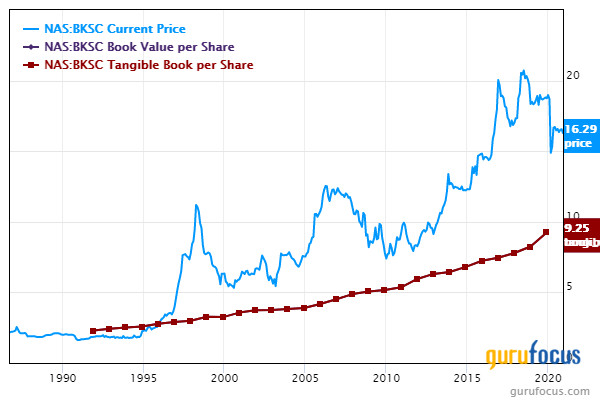

Bank of South Carolina

The book value per share of Bank of South Carolina Corp. (NASDAQ:BKSC) has grown 5.50% over the past 10 years. The price-book ratio and the price-tangible book ratio are both 1.65.

The bank holding company has a market cap of $89.93 million and an enterprise value of $58.28 million.

According to the DCF calculator, the stock is undervalued and is trading with a 10.59% margin of safety at $16.29. The share price has been as high as $19.45 and as low as $11.43 in the last 52 weeks. As of Wednesday, the stock was trading 16.25% below its 52-week high and 42.52% above its 52-week low. The price-earnings ratio is 14.17.

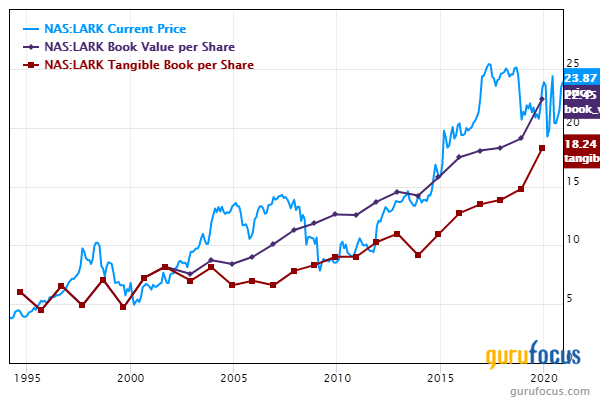

Landmark Bancorp

Landmark Bancorp Inc.'s (NASDAQ:LARK) book value per share has grown 5.70% over the past decade. The price-book ratio is 0.93% and the price-tangible book ratio is 1.12%.

The bank holding company has a market cap of $113 million and an enterprise value of $138 million.

According to the DCF calculator, the stock is undervalued and is trading with a 59.91% margin of safety at $23.87. The share price has been as high as $26.46 and as low as $14.24 in the last 52 weeks. As of Wednesday, the stock was trading 9.79% below its 52-week high and 67.63% above its 52-week low.

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the largest guru shareholder of the company with 2.39% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.94%.

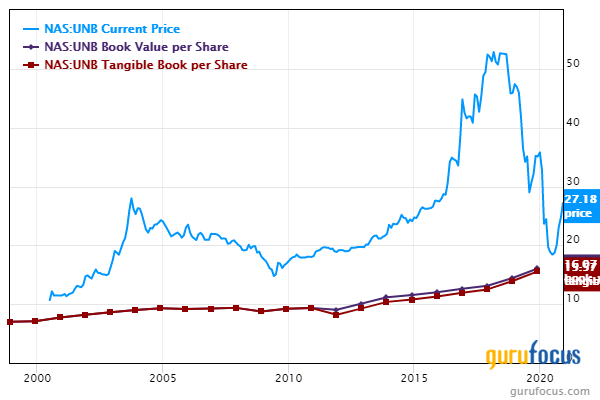

Union Bankshares

The book value per share of Union Bankshares Inc. (NASDAQ:UNB) has grown 5.70% over the past 10 years. The price-book ratio is 1.65 and the price to tangible book ratio is 1.60.

The community bank has a market cap of $121.64 million and an enterprise value of $117 million.

According to the DCF calculator, the stock is undervalued and is trading with a 9.61% margin of safety at $27.18. The share price has been as high as $38.79 and as low as $16.5 in the last 52 weeks. As of Wednesday, the stock was trading 29.93% below its 52-week high and 64.72% above its 52-week low. The price-earnings ratio is 10.37.

With 0.82% of outstanding shares, Simons' firm is the company's largest guru shareholder.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Stocks Trading Below Peter Lynch Value

5 Guru Stocks Expected to Boost Earnings

5 Guru Stocks With Strong Dividend Yields

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.