5 Historical Low Price-Book Companies for 2021

- By James Li

According to the Historical Low Price-Book Screen, a Premium feature of GuruFocus, the following five stocks have good financial strength and are trading near historical low price-book as of Wednesday: 51job Inc. (NASDAQ:JOBS), Centene Corp. (NYSE:CNC), Clorox Co. (NYSE:CLX), City Holding Co. (NASDAQ:CHCO) and Cass Information Systems Inc. (NASDAQ:CASS).

The Historical Low Price-Book Screen seeks companies that have consistent revenue and earnings growth over the past 10 years and a current price-book ratio that is at most 30% above the 10-year-low price-book ratio.

According to the GuruFocus Model Portfolio pages, the Historical Low Price-Book model portfolio returned 28.88% in 2019, on par with the Standard & Poor's 500 index benchmark. The model portfolio returned an annualized 15.42% per year during the past five years and an annualized 12.45% per year during the past 10 years, outperforming the respective benchmark returns of 14.9% and 11.28%.

51job

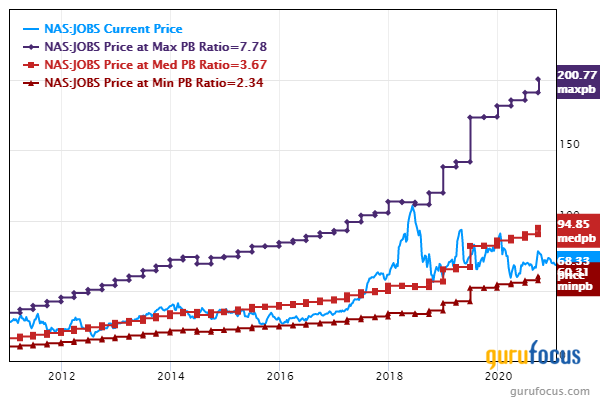

Shares of 51job (NASDAQ:JOBS) traded around $69.27 on Wednesday. The stock's price-book ratio of 2.69 is approximately 12.5% above the 10-year-median ratio of 2.39.

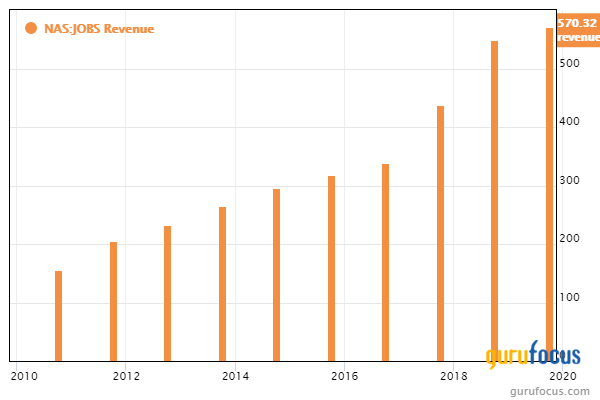

The Shanghai-based company offers online recruitment advertising and other complementary human resource services. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include a four-star business predictability rank and an operating margin that has increased approximately 2% per year over the past five years and is outperforming over 93% of global competitors.

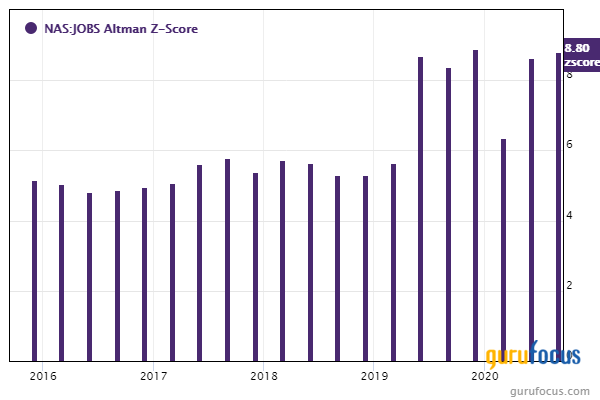

GuruFocus ranks 51job's financial strength 7 out of 10 driven on a strong Altman Z-score of 7.83 and debt ratios that outperform over 90% of global competitors despite a weak Piotroski F-score of 3.

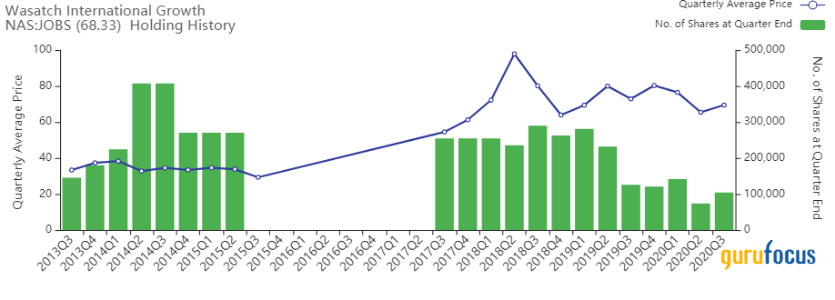

Gurus with holdings in 51job include the Wasatch International Growth (Trades, Portfolio) Fund, Ken Fisher (Trades, Portfolio)'s Fisher Investments and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates.

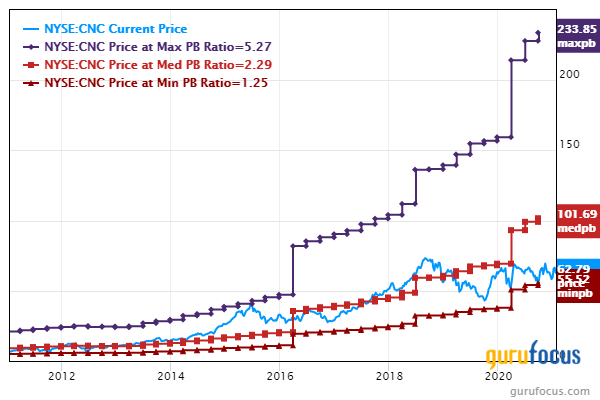

Centene

Shares of Centene (NYSE:CNC) traded around $62.87. The company's price-book ratio of 1.42 is 18.33% above the 10-year low of 1.2 and outperforming over 78% of global competitors.

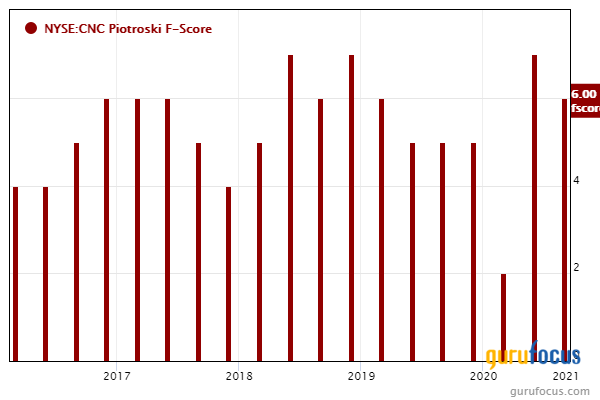

The St. Louis-based company offers government-sponsored health care plans, including Medicare and Medicaid. GuruFocus ranks the company's financial strength 6 out of 10 on the heels of a moderately-high Piotroski F-score of 6 despite interest coverage and debt ratios underperforming over 65% of global competitors.

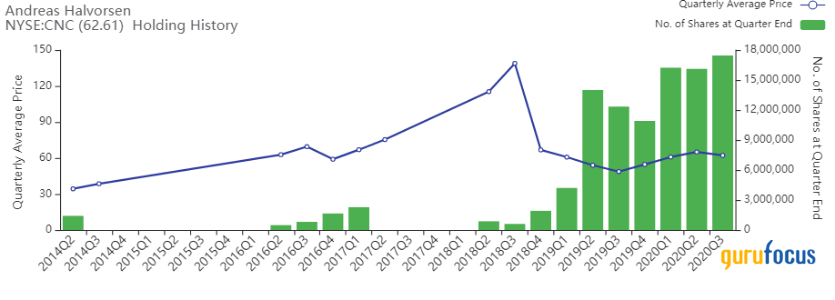

Gurus with large holdings in Centene include Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors and the Vanguard Health Care Fund (Trades, Portfolio).

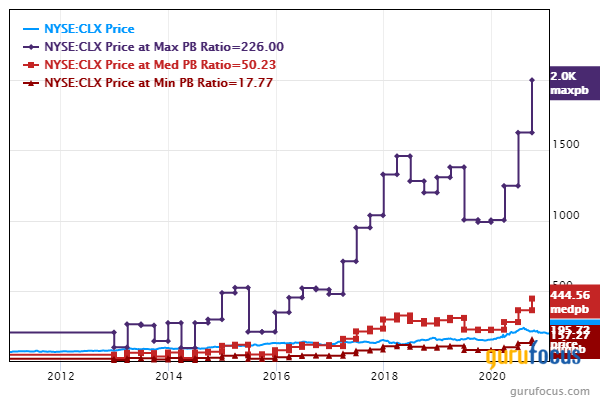

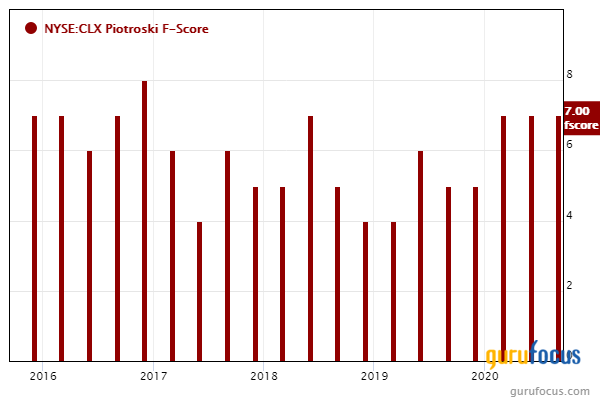

Clorox

Shares of Clorox (NYSE:CLX) traded around $195.85. Even though the stock's price-book ratio of 22.09 underperforms over 90% of global competitors, the ratio is just 24.39% above the 10-year low of 17.77%.

The Oakland, California-based company sells a wide range of consumer products, including cleaning supplies, laundry care and toilet bags. GuruFocus ranks the company's financial strength 5 out of 10. Even though debt ratios underperform more than half of competitors, Clorox has a high Piotroski F-score of 7 and a strong Altman Z-score of 5.43.

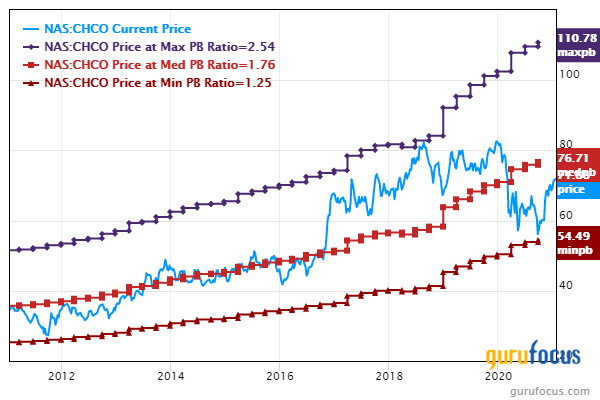

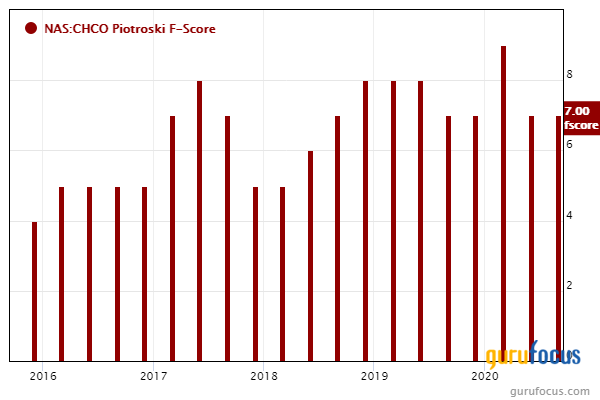

City Holding

Shares of City Holding (NASDAQ:CHCO) traded around $71.86. The stock's price-book ratio of 1.65 is approximately 28% higher than the 10-year low ratio of 1.29.

According to GuruFocus, the Charleston, West Virginia-based financial holding company has a high Piotroski F-score of 7 and an equity-to-asset ratio that outperforms over 80% of global competitors, suggesting high financial strength.

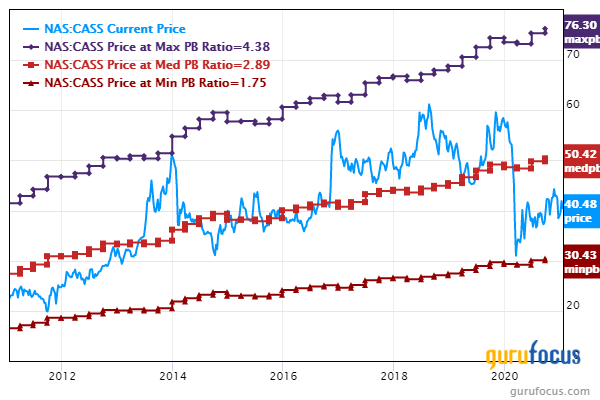

Cass Information Systems

Shares of Cass Information Systems (NASDAQ:CASS) traded around $40.48. The stock's price-book ratio of 2.31 is approximately 28.33% higher than the 10-year low of 1.80.

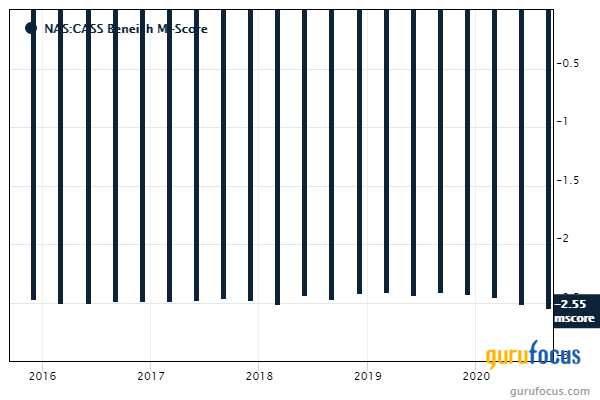

The St. Louis-based company provides payment and information processing services to large manufacturing, distribution and retail enterprises. According to GuruFocus, the company has a safe Beneish M-score of -2.55 and no long-term debt, suggesting good financial strength.

Disclosure: No positions.

Read more here:

Royce International Premier Fund's Top 4th-Quarter Trades

Yacktman Fund's Top 5 4th-Quarter Trades

4 Peter Lynch Growth Stocks With Good Financial Strength

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.