4th-Quarter Update on the Oakmark International Small Cap Fund

- By Margaret Moran

The Oakmark International Small Cap Fund recently disclosed its portfolio updates for the fourth quarter of 2020, which ended on Dec.31.

Founded in 1995 and managed by portfolio managers David Herro (Trades, Portfolio), Michael Manelli and Justin Hance, the Oakmark International Small Cap Fund invests in a relatively small number of non-U.S. small cap stocks (approximately 50 to 60). The fund aims to invest in securities that are trading at a discount to intrinsic value and show strong potential to increase value for shareholders.

Based on these criteria, the fund's top buys for the quarter were Kimberly - Clark de Mexico SAB de CV (MEX:KIMBERA) and Software AG (XTER:SOW), while its top sells were Fluidra SA (XMAD:FDR) and BlackBerry Ltd. (TSX:BB).

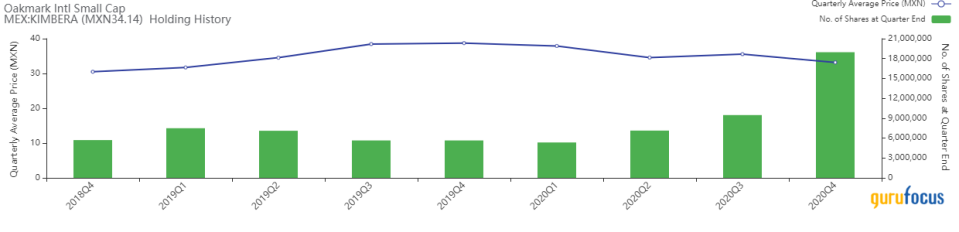

Kimberly - Clark de Mexico

The fund added 9,484,000 shares to its investment in Kimberly - Clark de Mexico (MEX:KIMBERA), increasing the position by 100.12% for a total of 18,957,000 shares and impacting the equity portfolio by 1.19%. During the quarter, shares traded for an average price of 33.18 Mexican pesos ($1.58).

Headquartered in Mexico City, Kimberly-Clark de Mexico is a subsidiary of American company Kimberly-Clark Corp. (NYSE:KMB). It manufactures, markets and distributes consumer, industrial and institutional hygiene products under the Kimberly-Clark label in Mexico.

On March 3, shares of Kimberly-Clark de Mexico traded around 34.14 pesos for a market cap of 105.33 billion pesos. According to the GuruFocus Value chart, the stock is modestly undervalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. The interest coverage ratio of 4.47 is lower than 67% of industry peers, but the Altman Z-Score of 3.34 indicates the company is not in financial distress. The three-year revenue growth rate is 7.3% while the three-year Ebitda growth rate is 14.2%.

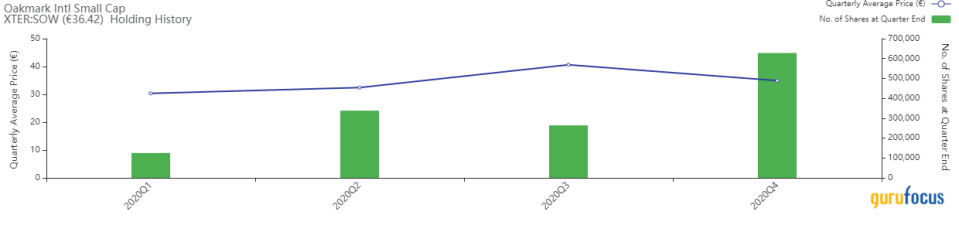

Software

The fund also upped its stake in Software (XTER:SOW) by 364,000 shares, or 137.88%, for a total of 628,000 shares. The trade had a 1.08% impact on the equity portfolio. Shares traded for an average price of 34.91 euros ($42.14) during the quarter.

Software is the second-largest software vendor in Germany. It is a leader in platform integration and internet of things applications for enterprises, connecting applications on the ground and in the cloud.

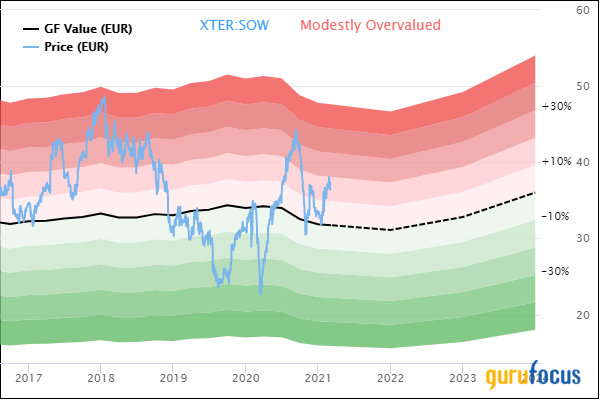

On March 3, shares of Software traded around 36.42 euros for a market cap of 2.80 billion euros. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 8 out of 10 and a profitability rating of 7 out of 10. It has no debt and a strong Piotroski F-Score of 6 out of 9. The operating margin of 24.12% and net margin of 17.40% are outperforming 81% of other companies in the industry.

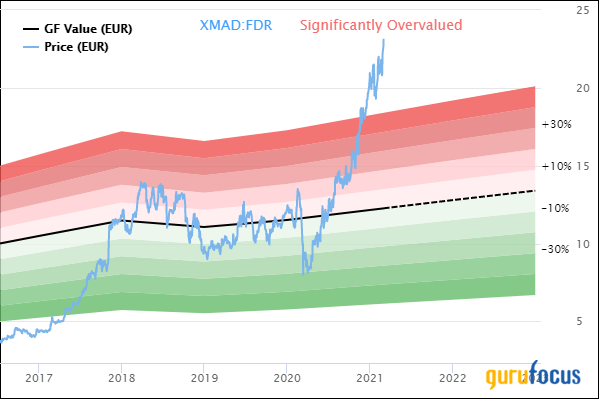

Fluidra

The fund sold out of its 613,000-share holding in Fluidra (XMAD:FDR), impacting the equity portfolio by -0.93%. During the quarter, shares traded for an average price of 17.15 euros.

Fluidra is a Spanish company that operates in the "global pool and wellness" industry. Through more than 140 sales offices and 34 production centers around the world, the company designs, sells and builds various different types of swimming pools.

On March 3, shares of Fluidra traded around 23.10 euros for a market cap of 4.43 billion euros. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 6 out of 10. The cash-debt ratio of 0.19 is lower than 85% of industry peers, but the Piotroski F-Score of 6 out of 9 is typical of a financially stable company. The return on invested capital surpassed the weighted average cost of capital in the most recent year, indicating a turn to profitability, though this has not normally been the case for the company over the past decade.

BlackBerry

The fund cut its BlackBerry (TSX:BB) position by 1,963,000 shares, or 37.96%, for a remaining holding of 3,208,000 shares. The trade had a -0.80% impact on the equity portfolio. Shares traded for an average price of 7.74 Canadian dollars ($6.13) during the quarter.

The Canada-based enterprise software company was once famous for its smartphones, but it now primarily focuses on cybersecurity, communications software and IoT applications.

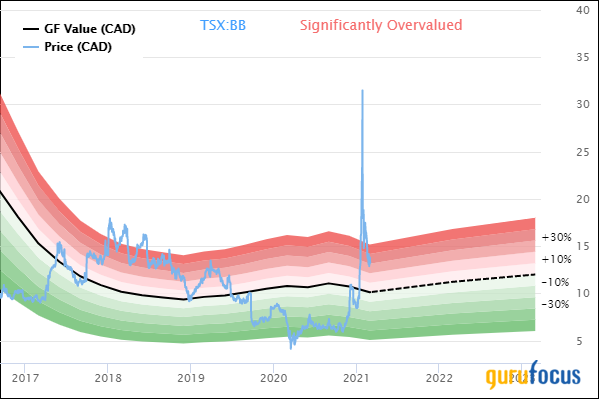

On March 3, shares of BlackBerry traded around CA$13.22 for a market cap of CA$7.44 billion. According to the GuruFocus Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 3 out of 10. The Piotroski F-Score of 4 out of 9 and Altman Z-Score of 2.4 indicate the company may not have the best financials but is still in a stable situation. The operating margin of -17.60% and net margin of -14.62% indicate that operations are not profitable.

Portfolio overview

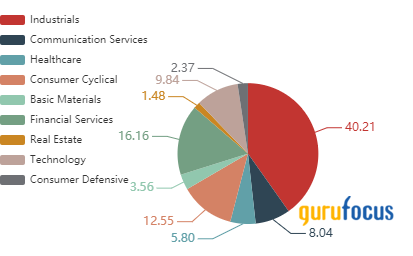

As of the quarter's end, the fund held shares in 59 common stocks valued at a total of $1.37 billion. The top holdings were Konecranes Oyj (OHEL:KCR) with 3.99% of the equity portfolio, Duerr AG (XTER:DUE) with 3.89% and Julius Baer Gruppe AG (XSWX:BAER) with 3.87%.

In terms of sector weighting, the fund was most invested in industrials, followed distantly by financial services and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Buffett on Market Mood Swings: A Look at Berkshire's 2020 Results

Causeway International Value Fund Buys Rolls-Royce, Dumps Aviva

Top 4th-Quarter Buys of Frank Sands' Firm

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.