3 Stocks Trading With a Margin of Safety

When screening the market for bargains, investors may want to consider the following stocks since their share prices are trading below the intrinsic value calculated by GuruFocus' free cash flow-based discounted cash flow calculator.

Additionally, Wall Street has issued positive recommendation ratings for these companies, which means they expect higher share prices over the coming months.

APA

The first stock investors could be interested in is APA Corp. (NASDAQ:APA), a Houston-based oil and gas explorer and producer.

The stock closed at $25.58 per share on Friday, which is below the intrinsic value of $74.56 calculated from the DCF model, yielding a margin safety of 65.69%.

The share price has risen by 75% over the past year, determining a market capitalization of $9.29 billion and a 52-week range of $13.97 to $31.14.

GuruFocus has assigned a score of 3 out of 10 to the company's financial strength and a 5 out of 10 rating to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $34.17 per share.

U.S. Steel

The second stock investors could be interested in is U.S. Steel Corp. (NYSE:X), a Pittsburgh-based producer and seller of flat-rolled and tubular steel products primarily in the United States, Canada and Europe.

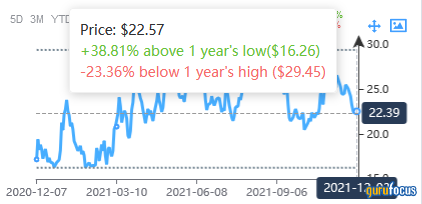

The stock closed at $22.57 per share on Friday, which is below the intrinsic value of $120.44 calculated by the DCF model, yielding a margin safety of 81.26%.

The share price has risen by 31.3% over the past year, determining a market capitalization of $6.10 billion and a 52-week range of $15.88 to $30.57.

GuruFocus has assigned a score of 5 out of 10 to the company's financial strength and 3 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of hold with an average target price of $32.40 per share.

Murphy Oil

The third stock investors could be interested in is Murphy Oil Corp. (NYSE:MUR), a Dorado, Arkansas-based petroleum and natural gas production and exploration company.

The stock closed at $26.51 per share on Friday, below the intrinsic value calculated from the DCF model of $55.57. The margin of safety stands at 52.29%.

The share price has increased by 126.58% over the past year for a market capitalization of $4.09 billion and a 52-week range of $11.15 to $31.

GuruFocus has assigned a score of 4 out of 10 to the company's financial strength and 5 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of hold and an average target price of $32.38 per share.

This article first appeared on GuruFocus.