3 Fast Growers With Strong Financials

- By Margaret Moran

One of the many preset screeners that GuruFocus offers is the "Fast Growers." This screener identifies stocks that have been growing both their revenue per share and Ebitda per share significantly over the past five-year and 10-year periods, which can provide a good starting point for further research on these companies whose business activities are producing clear results.

In order to filter out companies whose growth has come at the expense of their balance sheets, I further narrowed the results of the Fast Growers screener to only include stocks that have a financial strength rating of at least 5 out of 10. Below are three stocks that meet all of the above criteria and also have positive estimates of future earnings from analysts surveyed by Morningstar.

Ulta Beauty

Ulta Beauty Inc. (NASDAQ:ULTA) is a beauty salon retailer headquartered in Illinois. It offers both prestige and mass-market cosmetics, makeup, fragrances, hair and skin care products, among others, through its brick-and-mortar stores and online.

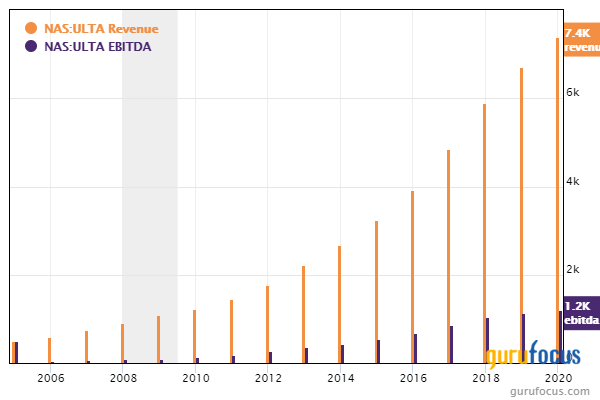

Ulta's revenue per share has grown approximately 21% per year over the past five-year and 10-year periods, while Ebitda grew an average of 20.30% per year over the past five years and 25.30% per year over the past 10 years. Analysts estimate a three to five-year earnings per share growth rate of 5.68% for the company.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. The interest coverage ratio of 72.88 is stronger than 80% of industry peers, while the Altman Z-Score of 5.4 indicates the company is not in danger of bankruptcy. The return on invested capital has been consistently higher than the weighted average cost of capital in recent years, indicating the company is creating value as it grows.

Ulta's strong growth over the years has given it a strong name in the beauty retail industry. The fact that it carries a wide variety of products for almost every beauty style and spending group helps make it a go-to name, and with its market share having increased from 3% to 8% between 2010 and 2019, the company could still have room to grow if it plays its cards right. Its strong balance sheet will help play a part in this, as the company is in a good position to weather the pandemic without suffering as many losses as its more debt-ridden competitors.

Notably, the company only reported an earnings loss in the second quarter of 2020, losing $1.39 per share before reporting earnings per share of 14 cents in the third quarter and $1.32 in the third quarter. The company's strong recovery was attributed to strong online sales and a relatively low pre-existing debt burden, which allowed it to increase liquidity at rock-bottom rates as a precaution.

Alibaba Group Holding

Alibaba Group Holding Ltd. (NYSE:BABA) is a Chinese multinational conglomerate with holdings in e-commerce, retail, internet and technology assets, among many others. By volume, Alibaba is the largest e-commerce company in the world, with millions of merchants and hundreds of millions of users.

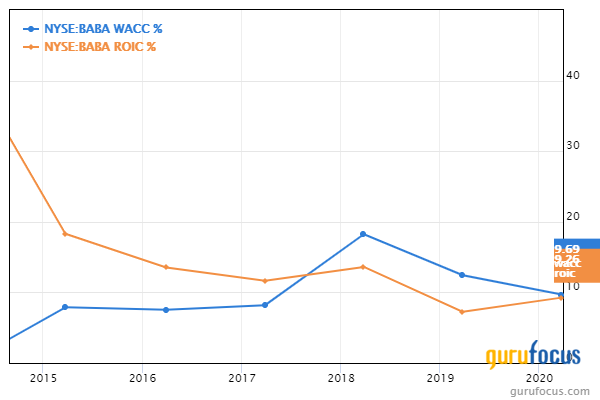

Alibaba's revenue per share has grown at an annual rate of 44.60% over the past five years and 64.40% over the past 10 years, while Ebitda grew an average of 30.10% per year over the past five years and 71.80% per year over the past 10 years. Analysts estimate a three to five-year earnings per share growth rate of 22.14% for the company.

The company has a financial strength rating of 7 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 3.37 and Piotroski F-Score of 5 out of 9 outperform 80% of industry peers and are typical of a financially stable company. The ROIC has fallen below the WACC in recent years as the company focused on growth over profitability, though the fortress-like balance sheet seems to be in a good position to endure this kind of strategy for the time being.

Alibaba's stock prices have taken a few hits recently due to concerns that the Chinese government could take action to control its Amazon (AMZN) style monopoly over the Chinese e-commerce sector. On Dec. 24, 2020, regulators launched an anti-monopoly probe into the company as a follow-up to founder Jack Ma's public criticism of the regulatory system. Regulators also cited such comments as their reason for derailing Alibaba's fintech arm Ant Group from going public.

Ant Group's hopes of going public now lie in restructuring itself as a financial holding company, and separating this arm from the main company could help Alibaba lessen the regulatory pressures it faces. From its prevalence as China's largest e-commerce company to its booming cloud computing business, there's a lot to like about Alibaba's growth potential.

Ubiquiti

Ubiquiti Inc. (NYSE:UI) is a New York-based manufacturer of enterprise-grade wireless data communication products and wireless broadband providers. Its products include mesh wi-fi systems, software-defined networking solutions and an array of security cameras, gateways and switches.

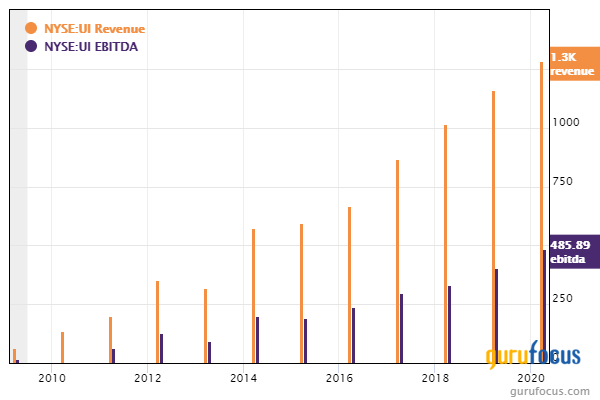

Ubiquiti's revenue per share has grown approximately 25.10% per year over the past five-year period and 23.50% over the past 10-year period, while Ebitda grew an annual rate of 27.50% over the past five years and 38.20% over the past 10 years. Analysts estimate that earnings per share will increase to $7.80 in fiscal 2021, up from $5.80 in fiscal 2020.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 10 out of 10. While the interest coverage ratio of 20.08 is mediocre for the industry, the Piotroski F-Score of 7 out of 9 indicates a very healthy financial situation. With the ROIC consistently surpassing the WACC, Ubiquiti is creating value as it grows.

Ubiquiti's networking technology offers a kind of middle ground between more expensive enterprise networking options and lower-quality mass market options. Customers often refer to it as "enterprise lite" for this reason. As the world becomes more connected, there is still a long runway for growth estimated for the kind of products that the company offers. The company has also gained fame for its being shareholder-friendly, as it has a three-year average share buyback ratio of 7.4%.

On the other hand, Ubiquiti is facing problems in the form of increasing debt, which might be due more to the correction of misrepresentation than any actual change in the company's financial conditions. In 2018, shareholders sued the company for allegedly misrepresenting its financials, causing artificially higher prices, though the questionable accounting practices should be fixed by now. Additionally, Wall Street isn't fond of the company because it is rather unconventional. Unlike competitors, it does not hire a direct salesforce, choosing instead to rely on reviews and the online community so that customers can interface directly with research and development, marketing and support.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

3 Buffett-Munger Stocks Expected to Show Strong Growth

Intel Shares Rise on Strong 4th-Quarter Results

Strategies to Stay Ahead in a Market Bubble

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.