3 Companies Carrying a Minimal Debt Burden

When scouting for investments, the extensive list of options out there can sometimes make the task challenging and overwhelming.

However, targeting companies carrying little to no debt can be a great initial filter when searching, as these companies can use their excess cash to fuel other areas of business, including growth opportunities.

Three companies that fit the criteria – Monster Beverage Corp. MNST, SEI Investments SEIC, and Paychex PAYX – could all be considered.

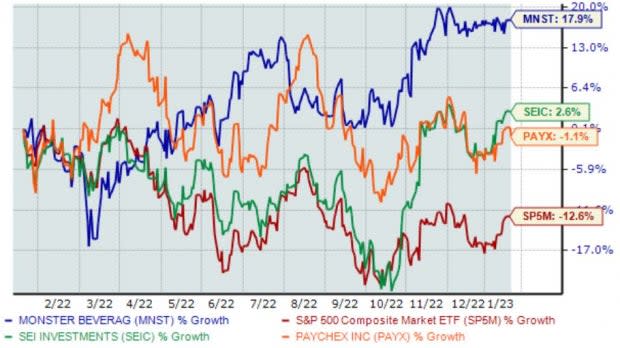

Below is a chart illustrating the performance of all three stocks over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Monster Beverage Corp.

Monster Beverage is a marketer and distributor of energy drinks and other alternative beverages. Currently, the company sports a Zacks Rank #2 (Buy).

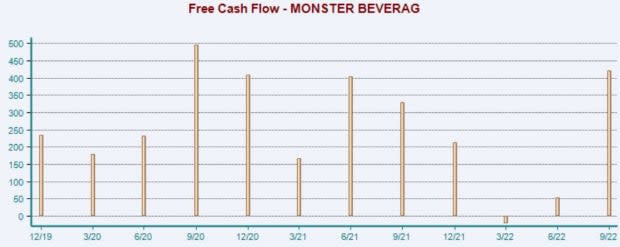

In its latest quarter, MNST generated $422 million in free cash flow, good enough for a solid 28% Y/Y increase. As we can see in the chart below, the company’s free cash flow has recovered from 2022 lows.

Image Source: Zacks Investment Research

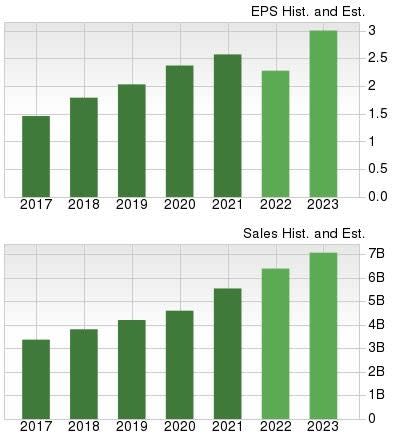

Monster’s earnings are forecasted to take a hit in its current fiscal year (FY22), with estimates indicating an 11% Y/Y decrease. Still, growth resumes in FY23, with estimates calling for 30% Y/Y earnings growth.

Image Source: Zacks Investment Research

SEI Investments

SEI Investments is a leading global provider of asset management, investment processing, and investment operations solutions. SEIC is a Zacks Rank #3 (Hold).

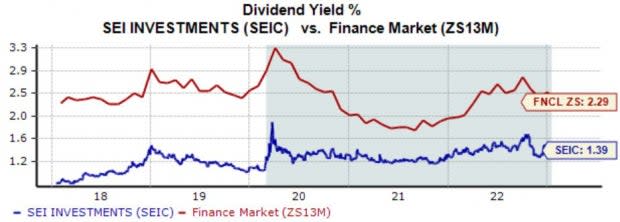

For those with an appetite for income, SEIC has that covered; the company’s annual dividend currently yields 1.4%.

While the current yield is below its Zacks Finance sector average, SEIC’s 7% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

The company snapped a streak of mixed earnings results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 11% and penciling in a 2.6% sales surprise.

Image Source: Zacks Investment Research

Paychex Inc.

Paychex is a recognized leader in the payroll, human resource, and benefits outsourcing industry. PAYX’s earnings outlook has drifted higher over the last several months, pushing it into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

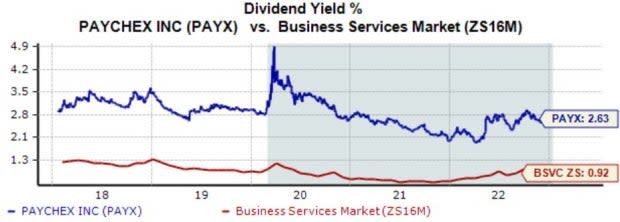

Like SEIC, Paychex rewards its shareholders; its annual dividend currently yields a solid 2.6%, well above its Zacks Business Services sector average of 0.9%.

Impressively, the company’s payout has grown by nearly 8% over the last five years.

Image Source: Zacks Investment Research

And to top it off, PAYX carries a favorable growth profile, with earnings forecasted to climb 13% in FY23 and a further 8% in FY24.

The projected earnings growth comes on top of estimated Y/Y revenue upticks of 8.2% and 6% in FY23 and FY24, respectively.

Image Source: Zacks Investment Research

Bottom Line

For those with a more conservative approach, targeting companies with little to no debt is an excellent initial screen when searching for potential investments.

After all, nobody wants to see a company they own become bogged down with obligations, negatively impacting other business areas.

And all three stocks above – Monster Beverage Corp. MNST, SEI Investments SEIC, and Paychex PAYX – fit the criteria, carrying little to no debt.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report