2 Stocks in Mason Hawkins' Longleaf Partners Fund Approach 52-Week Lows

The markets are not even a month into the new year and a few stocks in Mason Hawkins (Trades, Portfolio) equity portfolio are already trading near their 52-week lows.

As the market continues to contend with inflation and rising interest rates, two stocks in the gurus equity portfolio have dived.

In contrast, after posting a -19.44% total return for 2022, the S&P 500 Index has gained around 5% so far this month.

Southeastern Asset Management, the investment firm founded by Mason Hawkins (Trades, Portfolio) in 1975, manages the Longleaf Partners Funds. To achieve long-term capital growth, the Memphis, Tennessee-based firm invests in a somewhat concentrated number of undervalued companies that have strong balance sheets and good management teams.

The third-quarter 13F filing showed Longleafs equity portfolio consisted of 40 stocks as of the three months ended Sept. 30, 2022, which was valued at $3.97 billion. The holdings have posted mostly positive performances so far in 2023, with only three of the top 20 positions declining.

As of Thursday, the two stocks that have collapsed to near their lowest prices in a year were Douglas Emmett Inc. (NYSE:DEI) and Lumen Technologies Inc. (NYSE:LUMN).

Investors should be aware 13F filings do not give a complete picture of a firms holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

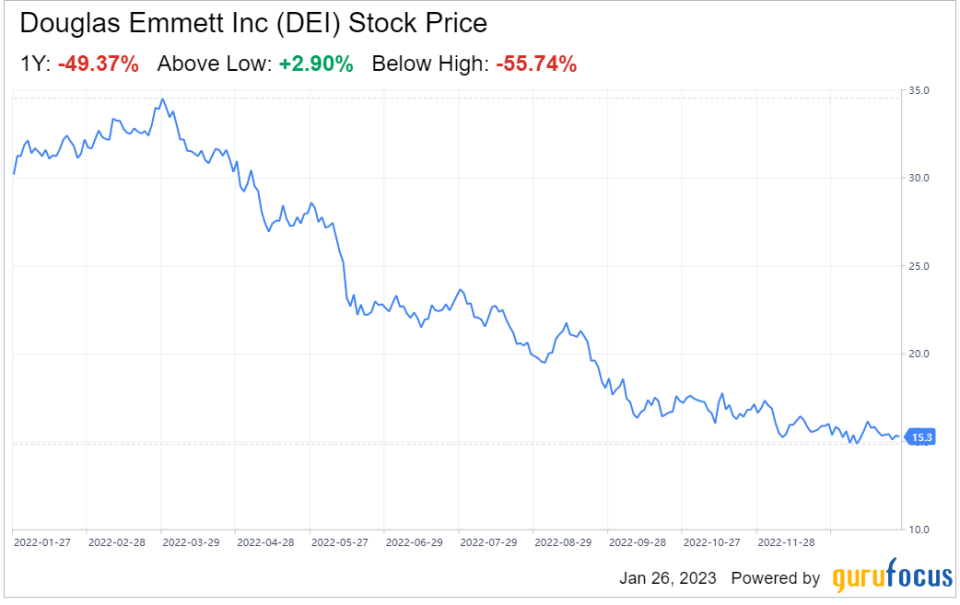

Douglas Emmett

Douglas Emmetts (NYSE:DEI) shares have tumbled nearly 50% over the past year. The stock is currently 3.74% above its annual low of $14.72.

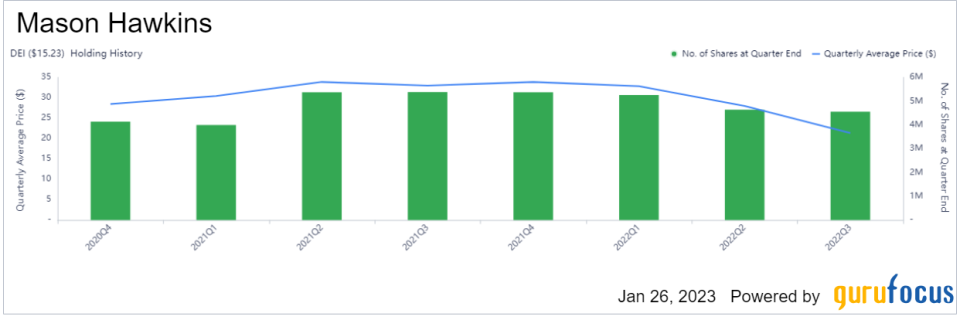

The fund currently holds 4.5 million shares of the company, which represent 2.05% of the equity portfolio. GuruFocus estimates it has lost 41.05% on the investment, which was established in the fourth quarter of 2020.

The Santa Monica, California-based real estate investment trust, which owns office buildings and apartment complexes, has a $2.68 billion market cap; its shares were trading around $15.24 on Thursday with a price-earnings ratio of 29.31, a price-book ratio of 1.04 and a price-sales ratio of 2.74.

In its commentary for the fourth quarter of 2022, Longleaf noted that while the stock declined in a challenging year for office real estate, there has been meaningful insider buying of the deeply discounted shares. Additionally, Douglas Emmetts board approved a $300 million share buyback plan to take advantage of the steep price disconnect.

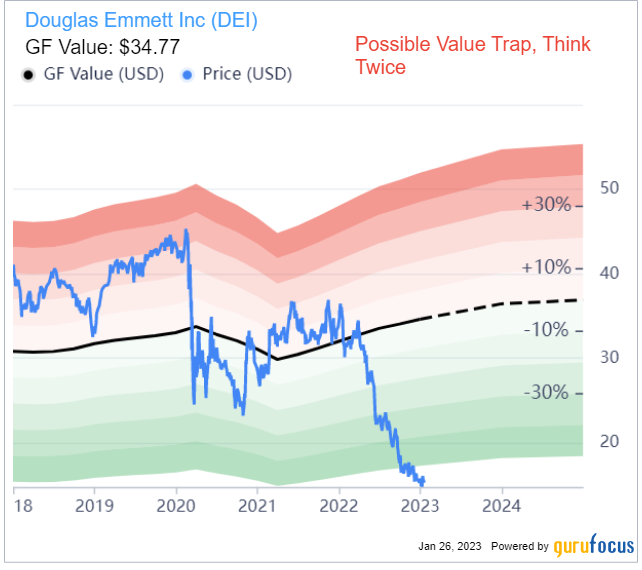

Unsurprisingly, the GF Value Line suggests the stock, while undervalued, is a possible value trap due to the poor business environment. The value metric, which is based on historical ratios, past financial performance and analysts future earnings projections, cautions potential investors to do thorough research before making a decision.

Further, the GF Score of 66 out of 100 suggests the company has poor future performance potential. While Douglas Emmett received a high profitability rating, the growth and GF Value ranks were more moderate and the ranks for financial strength and momentum were low.

Of the gurus invested in Douglas Emmett, First Eagle Investment (Trades, Portfolio) has the largest stake with 6.84% of its outstanding shares. Ron Baron (Trades, Portfolio) and Diamond Hill Capital (Trades, Portfolio) also have significant positions in the stock. Additional guru shareholders are Chris Davis (Trades, Portfolio), Jim Simons (Trades, Portfolio) Renaissance Technologies, Caxton Associates (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio).

Lumen Technologies

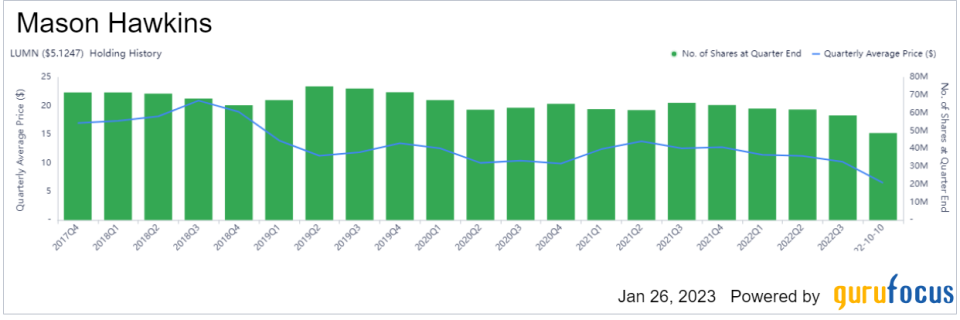

Shares of Lumen Technologies (NYSE:LUMN) have declined more than 55% over the last 12 months. The stock is currently 4.33% above its yearly low of $4.96.

The fund owns 58.63 million shares of the company, making it the largest holding with a weight of 10.75%. GuruFocus data shows Longleaf has lost an estimated 48.76% on the long-held investment.

Known as CenturyLink prior to September of 2020, the telecommunications company headquartered in Monroe, Louisiana has a market cap of $5.30 billion; its shares were trading around $5.13 on Friday with a price-earnings ratio of 2.56, a price-book ratio of 2.23 and a price-sales ratio of 4.39.

In its fourth-quarter commentary, Longleaf noted that Lumen was a top detractor for the period. While the company had a history of managing costs and producing steady free cash flow under its previous CEO, organic revenue and cash flow have been disappointing in recent years. Along with new CEO Kate Johnson, the announcement of its planned sale of its European business and a new stock repurchase program, the fund said, The recent moves are creating a clearer business mix and stronger balance sheet.

According to the GF Value Line, the stock is a possible value trap currently.

Further, the GF Score of 60 indicates the company has poor future performance potential. Although the ratings for profitability and GF Value were moderate, the growth, financial strength and momentum ranks were low.

With 4.71% of outstanding shares, Hawkins firm is the companys largest guru shareholder. Other top guru investors of Lumen include Jeremy Grantham (Trades, Portfolio), Arnold Van Den Berg (Trades, Portfolio), Greenblatt, Mario Gabelli (Trades, Portfolio), John Hussman (Trades, Portfolio), Jeff Auxier (Trades, Portfolio) and Mairs and Power (Trades, Portfolio).

This article first appeared on GuruFocus.