2 Dividend Kings Outperforming the S&P 500 Index

The Dividend King index is a collection of just 45 companies with at least 50 consecutive years of dividend growth. These companies have raised payments to shareholders through multiple recessions, showing the strength of their respective business models.

This safety is attractive when the market enters a downturn.

For example, the S&P 500 Index has declined slightly more than 13% in the last year. There are names within the index, however, that have had an excellent return over that period of time and still trade at a discount to intrinsic value.

Warning! GuruFocus has detected 5 Warning Signs with BDX. Click here to check it out.

NYSE:BDX), or BD, a leading medical device company. The company is valued at $66 billion and generates annual revenue of $20 billion.

BDs operates through three segments, including Medical, Life Sciences and Intervention. Between these segments, the company address most major areas of health care. Among the devices in its portfolio are drug delivery systems, surgical blades, diagnostic testing devices, devices used for specimen collections and systems that detect a range of infectious disease and cancers. BD purchased C. R. Bard for $24 billion in late-2017 to give the company more of a footprint in the areas of peripheral vascular disease, urology and hernias.

The stock has outperformed the S&P 500 Index by 13% over the last 12 months. The health care sector typically does well in difficult market conditions as the products produced by these companies are usually in demand throughout all phases of the economic cycle.

This has been the case for BD throughout multiple economic cycles, enabling the company to raise its dividend for 50 consecutive years. The dividend has a 10-year compound annual growth rate of 7%, accordingly to Value Line, though that has slowed to just over 3% for the past five years. Shares yield 1.5%, which compares to the five-year average yield of 1.4%.

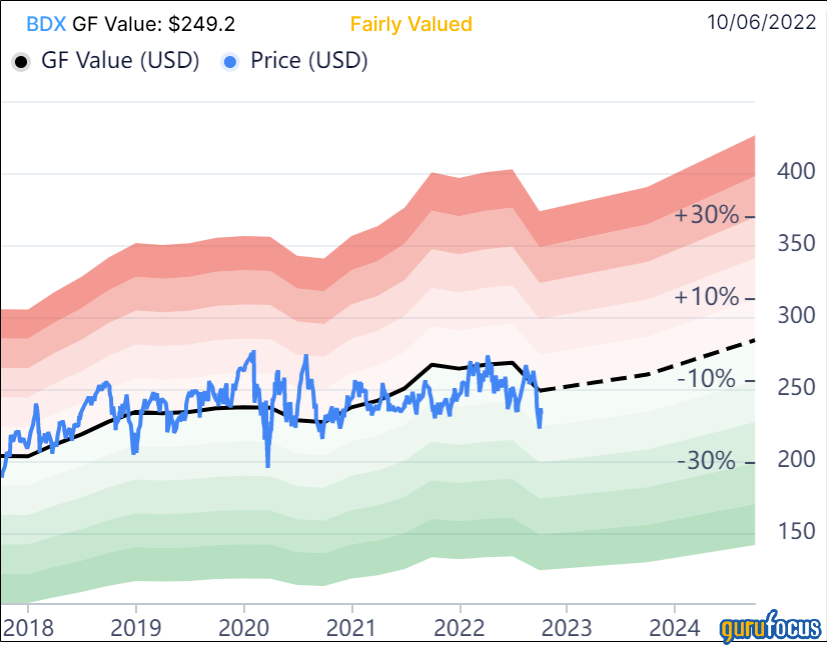

BD shares trade around their fair value based on the GF Value Line, which takes historical ratios, past financial performance and analysts' earnings projections into account.

2 Dividend Kings Outperforming the S&P 500 Index BD has a price-to-GF Value ratio of 0.93, implying shares would return 7% were they to reach the GF Value.

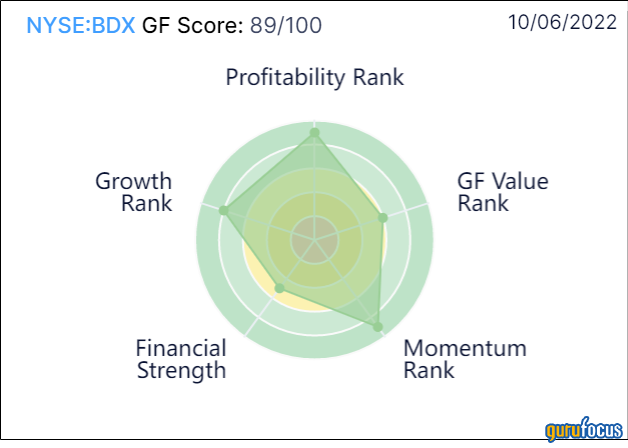

The company has a solid GF Score of 89 out of 100, meaning it has good performance potential.

2 Dividend Kings Outperforming the S&P 500 Index The GF Score is driven by a 9 out of 10 on profitability rank, where BD is well ahead of peers on metrics such as operating margin, return on assets and return on invested capital. The company has been profitable every year for the last decade as well, topping more than 99.8% of peers in the medical device industry on this metric.

The companys weakest area is financial strength, where it has a middling score of 5 out of 10. Much of this is driven by the explosion of debt over the last decade, going from $3.8 billion in 2012 to $17.1 billion last year. Much of this debt is due to acquisitions that have been made over this period. As a result, interest coverage is very low compared to peers, but above the median of BDs last decade. On the plus side, ROIC of 6.2% is ahead of the weighted average cost of capital of 4.5%.

Hormel Foods

The second Dividend King to consider is Hormel Foods Corp. (NYSE:HRL), a leading packaged foods company. The company has a market capitalization approaching $25 billion and annual sales of $11.4 billion.

Hormels core business is processed meat, something the company has been involved in since its founding in 1891. The company has made significant strides in expanding its products to appeal to a larger pool of customers. In addition to Hormel brand meats, SPAM and Jennie-O product lines, the company has acquired Skippy peanut butter and Planters nuts. In total, the company has the top or second market share in 40 separate food categories.

Consumer packaged food stocks are another area of the market that tends to hold its ground during downturns, but shares of Hormel have done very well over the last year as the stock has outperformed the market by 26.3% for the period. Even higher inflationary costs, plant shutdowns and limited supplies of certain meats have not slowed the stock.

Hormel has raised its dividend for the past 56 years. The CAGR since 2012 is 14%, which is a fairly high growth rate for a consumer packaged staples company. The CAGR has slowed somewhat recently, but is still close to 10% for the past five years. Hormel offers a 2.3% dividend yield, which is above the 1.7% average yield for the S&P 500. I find the dividend is also very safe.

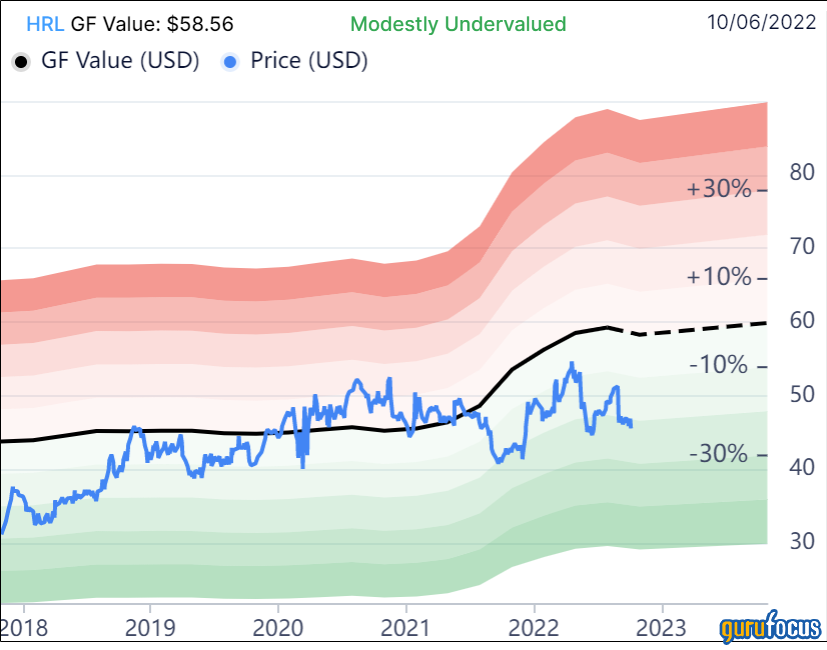

The stock appears to be mispriced by the market looking at the GF Value chart.

2 Dividend Kings Outperforming the S&P 500 Index Hormel has a price-to-GF Value ratio of 0.78. Investors buying today could see a return of more than 28% if the stock were to reach its GF Value. Shares are rated as modestly undervalued.

Hormels GF Score is just average at 78 out of 100.

2 Dividend Kings Outperforming the S&P 500 Index The company has a solid 8 out of 10 score on its profitability rank, as it leads many of its peers in a number of areas. Return on capital as defined by Joel Greenblatt (Trades, Portfolio) is above 88% of the competition. Return on assets and return on equity is also very strong. Hormel has produced a profitable year for the past decade, separating itself from the vast majority of its industry.

Hormels financial strength rank is 7 out of 10. The company has middle-of-the-pack scores on most debt-related metrics as acquisitions have caused debt to go from $250 million in 2012 to $3.3 billion last year. Still, the company has a good showing on interest coverage. Hormel has proven skillful at using invested capital to further growth. The companys ROIC of 9.1% is considerably higher than its WACC of 2.4%.

Final thoughts

While the market as a whole has been trending down for the last year, there are number of names that have outperformed the index. BD and Hormel are two examples of this as both have outperformed the S&P 500 by at least 10% for the period.

Each stock is also trading below its GF Value and both companies have at least five decades of dividend growth.

Investors looking for stocks that have beaten the market, have a proven commitment to raising dividend payments and offer upside potential might want to consider adding BD and Hormel to their watchlist.

This article first appeared on GuruFocus.