2 Companies Handing Out Double-Digit Dividend Increases

Dividend growth investors are often fond of saying a raise is a raise. For those focused on generating a higher source of income, every dividend increase is appreciated.

While some may gripe about the size of the raise relative to the historical average, the average dividend growth investor doesnt liquidate a position simply because the raise isnt up to their expectations.

A double-digit increase, however, is often viewed favorably. Leadership teams that come through with a raise of this magnitude often expect that business will improve significantly going forward, hence the sizeable increase in dividend.

Warning! GuruFocus has detected 3 Warning Signs with AMGN. Click here to check it out.

NASDAQ:AMGN) is the largest name in biotech in the world. Amgens product portfolio includes medicine used to treat aliments in the aeras of bone health, cardiovascular disease, inflammation and oncology, among others. The $114 billion company has annual revenue of more than $25 billion.

On Dec. 3, Amgen announced a 10.2% dividend increase for the March 8, 2022 payment date, extending the companys dividend growth streak to 11 years. The dividend has a compound annual growth rate of 19% since 2012, the first year the company distributed four quarterly payments. The most recent raise is below the long-term average, but above the five-year CAGR of 9%.

The new annualized dividend amounts to $7.76, giving the stock a forward yield of 3.8% based off of the most recent closing price of $202.44. This compares favorably to the stocks 10-year average yield of 2.3%, according to Value Line. Part of the reason for the high yield is that Amgens stock is lower by almost 11% over the last year.

According to Wall Street analysts surveyed by Yahoo Finance, Amgen is expected to earn $16.88 per share in 2021. With shareholders receiving $7.04 of dividends per share this year, the projected payout ratio is 42%. Using the new annualized dividend and next years estimates, the payout ratio inches higher to 43%. This is above the five-year average payout ratio of 37%, but not to a point where future dividend growth appears to be in question.

Amgen trades with a forward price-earnings ratio of 12, which is lower than the 13.4 times earnings multiple that the stock has averaged since 2011.

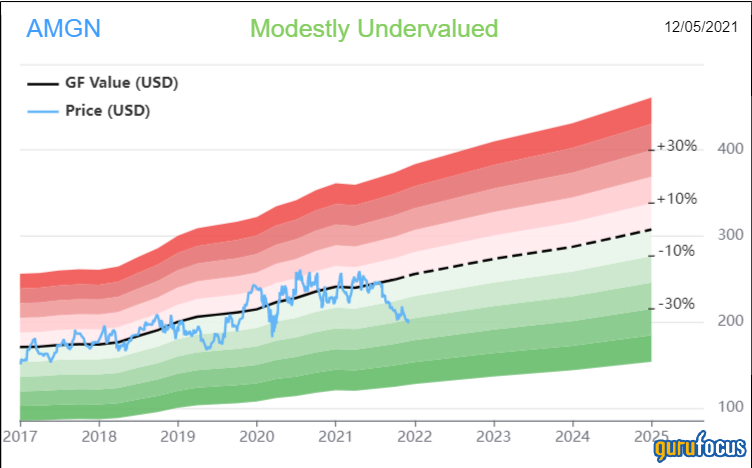

Shares also appear to offer good value looking at the GF Value chart.

2 Companies Handing Out Double-Digit Dividend Increases Amgen has a GF Value of $253.93, implying a price-to-GF Value of 0.80. Reaching the GF Value would mean a 25% gain in the share price. Factoring in the dividend yield would push total returns into the high 20% range. Amgen earns a rating of modestly undervalued from GuruFocus.

Nike

Nike Inc. (NYSE:NKE) is one of the best-known footwear and apparel companies in the world. The company sells basketball, football and running shoes in addition to training and sportswear, among other products. Nike has a market capitalization of $249 billion and generated revenue of $44.5 billion in its most recent fiscal year.

On Nov. 18, management declared a 10.9% dividend increase for the Dec. 28 payment date. This latest raise gives the company 20 consecutive years of dividend growth. Shareholders have seen dividends grow with a CAGR of 15.2% over the past decade, so this latest raise isnt too far off the long-term average.

Nikes new annualized dividend of $1.22 equates to a forward dividend yield of just 0.7% based on Fridays closing price of $170.24. This is half of the 10-year average yield of 1.4%. This is low yield is largely the result of a 76% improvement in share price over the last two years, a trade-off most investors are likely to live with.

Analysts expect that Nike will earn $3.60 per share in fiscal year 2022, which ends May 31. With shareholders expected to see dividends of $1.16 for the year, the payout ratio is projected to be just 32%. This is nearly in line with the decade-long average payout ratio of 33%. The estimated payout ratio drops to 26% using estimates for fiscal year 2023, meaning shareholders will likely be the beneficiary of another double-digit increase this time next year.

Nike trades at more than 47 times earnings estimates for fiscal year 2022. The stock has often traded with a premium valuation, with an average price-earnings ratio of 33 and 30 over the last five- and 10-year periods. Still, the current multiple is rich even compared to Nikes historical average.

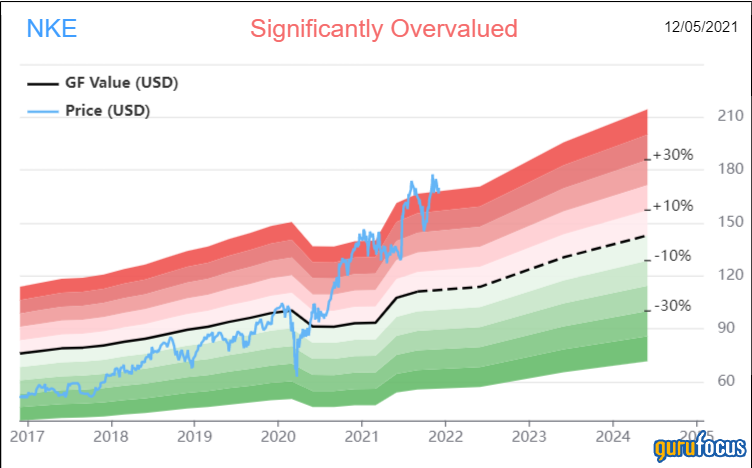

Shares look expensive looking at the GF Value chart as well.

2 Companies Handing Out Double-Digit Dividend Increases With a GF Value of $112, Nike is trading with a price-to-GF Value of 1.52. Reverting to the GF Value would result in a share price decline of more than 34%. GuruFocus rates shares as significantly overvalued.

Final thoughts

Amgen and Nike both delivered a recent dividend increase of more than 10%. Amgens dividend growth has slowed since the company initiated its dividend, but the latest raise was above the medium-term average. Shares also yield near 4% today. Nikes dividend growth has remained strong over the long haul, is approaching Dividend Champion status and has been able to maintain an extremely low payout ratio over the last decade.

At the current price, Amgens valuation, both against its historical average and GF Value, suggests the stock is undervalued. On the other hand, Nike is trading at a steep premium to both its long-term average multiple and GF Value, suggesting investors consider waiting for a better entry point.

This article first appeared on GuruFocus.