11 Money Mistakes That Can Wreck Your Finances in Your 20s, 30s, 40s

As we grow, we gain a fuller understanding of the importance of money in our lives, from learning what it means to save for a goal to understanding the value of investing and everything else money can do. But along the way, everyone is bound to make a mistake or two that could have huge implications if not addressed.

We asked experts about the most common money mistakes people make throughout the different stages of life—and how to fix them.

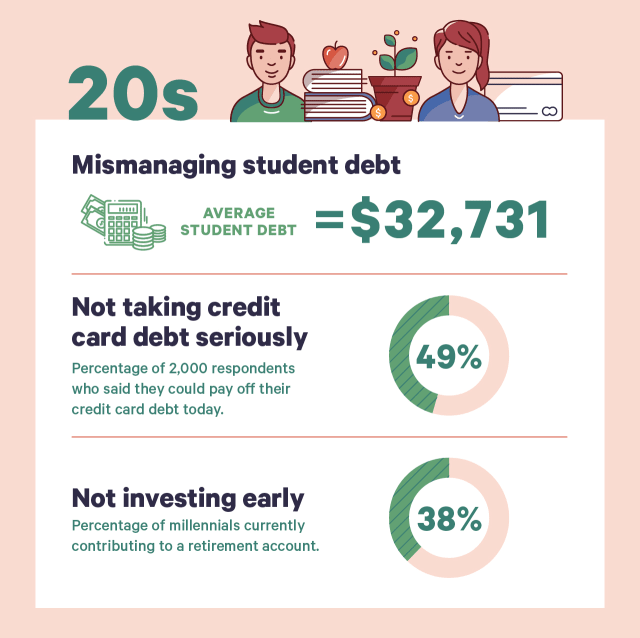

Your 20s

Sources: The Federal Reserve Bank of New York, ValuePenguin, TD Ameritrade

Mismanaging student debt

Student loan debt is notoriously high in the U.S., and unfortunately not going anywhere fast. The burden of these loans weighs heavily on borrowers long after they’ve left school. Some folks have trouble making monthly payments that are set too high for their budget, and some may forget or choose to ignore paying back their loans altogether. Either way, not addressing the problem can be a costly mistake.

If your monthly payment is too high, communicate with your loan servicer. Many lenders offer flexible repayment plans that can help lower your monthly payments. And if your interest rate is too high, or you’re struggling to manage multiple loans at once, you may want to consider consolidating or refinancing your loans.

Missing payments altogether is risky as some loan servicers charge a late payment fee. Additionally if your payment is over 30 days late, your lender can report it to the credit bureaus, therefore impacting your credit score.

If your loans are in deferment or forbearance, don’t make the mistake of leaving them there. If you’ve been granted a deferment or forbearance on your loans, that means you don’t have to make your monthly payments for the stated amount of time.

Both options can be good tools for borrowers returning to school or experiencing financial hardship, but in the long term can cost you as the interest on your loans continues to accrue. This means whenever you start paying again, you’ll owe more than when you stopped.

Not taking credit card debt seriously

Your 20s are a great age to address credit card debt because you have time on your side—time to replace poor spending habits with better money management as well as time to pay off your debt before it becomes a major problem.

“It's much easier to pay off $2,000 at age 20 than $30,000 at age 30,” said Sophia Bera, a financial planner and founder of Gen Y Planning.

Not investing early

Many twenty-somethings are also intimidated by the idea of investing because they think they don’t have enough money to get started or they don’t understand how it works. But having a savings portfolio that includes a retirement plan, an emergency fund and liquid assets is vital for a secure future.

At this stage, it’s a great idea to automate your savings by allocating a small percentage of your paycheck into a 401(k) or a Roth IRA. Even a small amount at this time can grow exponentially over the years before you’re ready to retire.

Your 30s

Focusing too much on budgeting vs. earning more

If you arrive at your 30s and you’re in the same job you got right out of college, or you haven’t been promoted or negotiated a significant raise, it could be time to make a move.

Check in on your salary. Job markets change all the time, so if you started on the ground floor of an industry that later exploded, you may not even be getting paid the current market standard. Additionally, if you did not negotiate your salary when you first started, there’s a good chance for you to be earning more.

Your career trajectory should point upward most of the time. Even if you’re at a company or a job you love, if you’re not making enough money to support your changing goals, take action. Ask for a raise or a promotion, and if you’re denied, explore other options.

Succumbing to lifestyle inflation

Whether having kids, buying a home or settling into a career, life can change dramatically for a lot of people in their 30s. With these major steps, a huge mistake many consumers in their 30s make is overspending to upgrade their lifestyles.

That can mean any number of things, but financial planners often see people around this age group buying more house than they can afford and/or a more expensive car than they should. This mistake should be especially avoided if you are a thirty-something who is juggling other major costs like a wedding, a child or student loans.

“Owning a home doesn't have to be for everyone and several factors should be weighed when making this important buying decision,” Andrea Oliver, a financial planner based in Chicago told ValuePenguin.

Many planners add that even if you can afford the house, a lot of people make the mistake of not accounting for everything else like house maintenance, property taxes and homeowners insurance. If you are making a big financial move in your 30s, make sure you do your research to find out how much you can afford, and define priorities for yourself. You don’t necessarily have to walk away from your dream house or dream car, but if you can’t afford it at the moment, you should wait and find a plan to get there.

Your 40s

Sources: Payscale.com

Not ramping up your savings

The biggest mistake people tend to make in their 40s (and all the years prior) is not saving enough for retirement. It was one thing to save 3% or 5% or your pay when you were entry level and struggling to make ends meet. Now that you’ve entered your peak earning years, “it's time to ramp up those retirement contributions because you'll want to have options and flexibility when it comes to your retirement,” Bera said.

If you don’t have any retirement savings at this point, you should definitely start something that could still see some significant growth by the time you’re ready to retire.

Not asking for help

In addition to contributing to a retirement fund, the key to addressing this issue and others is having a plan for your money. “In your 40s, you have often built up some assets, have a higher income and higher taxes. You may be saving for kids' college or paying for college,” Oliver noted. “All these pieces can fit together in a way that is efficient and a financial planner can help navigate different scenarios to help you reach your goals.”

Whether or not you have a financial planner, it’s a good idea to look at the big picture of your finances at this stage. See what’s working and what isn’t, and make adjustments to put yourself, your family and your future in the best position possible.

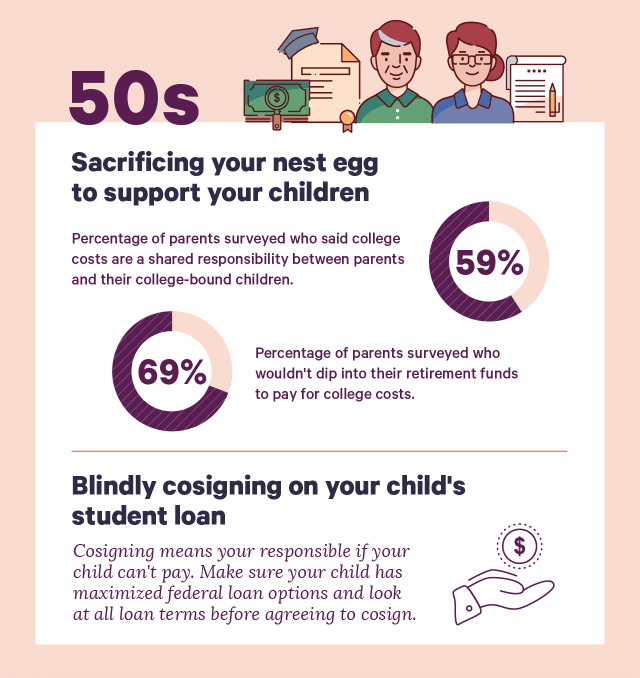

Your 50s

Sources: Sallie Mae and Ipsos

Sacrificing your nest egg to support your children

Most parents want to help their kids if they can, but many people in their 50s contribute too much to their children. That could mean paying for college out of pocket or with loans in their name when a child could take out the loan for themselves.

“There's nothing wrong with providing financial help to a child—even an adult child—when they're in need. But if it becomes a pattern, that's a huge red flag,” said the personal finance expert known as “The Money Coach,” Lynnette Khalfani Cox. The parent—especially if they are retired or on a fixed income—should encourage their child to take responsibility for their own finances.

This is not to say when the child is 18 cut them off, but that this child is an adult now and they need to understand the benefits and risks of taking out loans and other big money decisions. Of course, if you are a parent who can comfortably afford to pay for college out of pocket or by paying off a loan yourself, go for it! But if your options are pay for college or save for retirement, a financial planner will likely tell you to do the latter.

Blindly cosigning for your child’s student loan

On the other hand, if your child exhausts all other resources and still needs help paying for school, cosigning a loan might look like a great option for a parent. But parents need to be extra careful to know what their responsibility is.

First, make sure the student maximizes the amount they borrow in federal student loans before looking at options like private loans, which typically require a cosigner. If all options are exhausted and your child still needs a cosigner, understand that this comes with significant risk. As the cosigner, you will be on the hook if the student can’t pay back the loan.

60s and 70s

Sources: The National Bureau of Economic Research

Investing too conservatively

As most people head into retirement at this stage, there are still many mistakes to be made. In the past, folks who have been making investments in the markets over the years may consider taking it out at this stage.

However, as the life expectancy rate has risen, there’s less of an implied risk to keeping your investments in the markets a little longer than people did in the past. Keep your investing fairly aggressive at this stage, and you may very well see a bigger return.

If you did save enough for retirement, the next mistake you might make could be missing important deadlines for your retirement funds.

Taking Social Security earlier than you need to

The minute you turn 62, you might be chomping at the bit to tap into your Social Security benefits. Hold off if you can because your benefits get richer the longer you delay taking them.

To get your full retirement benefit, you need to wait until you are full retirement age for Social Security, which is between 66 and 67, depending on when you were born. For example, if you were born in 1960, your full retirement age is 67. So if you had a retirement benefit worth $1,000, but decided to tap into it at age 62, you would only receive $700.

“If someone is in this situation and can afford to wait before receiving all of their income streams it creates a period of time where income is low as is the corresponding tax rates,” said Jeff Burke, a financial planner from Eden Prairie, Minn.

Bottom line

Money management is a living and learning experience. Even if you start your journey with a considerable amount of financial literacy, mistakes can happen and they’re not always your fault. The best way to address them is to have an idea of what might happen and a plan to take action.

Nobody knows what life is going to throw at them. Any day you could get laid off or lose your home in a natural disaster. But it’s important to have a general idea of what to expect at each stage of life. This way, you can prepare in advance and minimize avoidable and costly mistakes.