Zoe's Kitchen (ZOES) Posts In-Line Q3 Earnings, Lags Sales

Zoe's Kitchen, Inc. ZOES reported mixed third-quarter 2016 financial results, wherein earnings were in line with the Zacks Consensus Estimate but revenues lagged the same.

Consequently, the company’s shares declined nearly 5% in after-hours trading on Nov 14, following the release of these numbers.

Earnings and Revenue Discussion

Zoe's Kitchen’s adjusted earnings of 4 cents per share were in line with the Zacks Consensus Estimate. Notably, the figure decreased 20% from the prior-year quarter earnings of 5 cents, on the back of lower restaurant contribution margin.

Revenues of $67.3 million lagged the consensus mark of $68 million by over 1% but improved 19.4% year over year backed by a 2.4% comps increase.

Behind the Headline Numbers

Comparable restaurant sales increased 2.4% driven by a 2.9% price hike, partially offset by a 0.5% decrease in transactions and product mix. However, the figure compared unfavorably with the prior-quarter comps growth of 4%.

Restaurant contribution margin contracted 240 basis points (bps) to 19.1% due to increases in labor and store operating expenses. The increase in labor and store operating costs can be attributed to the dilutive effect on margins from the company’s new restaurants which, on an average, initially operate at less than system-wide average sales volumes.

2016 Guidance

Zoe's Kitchen slashed its guidance for restaurant sales and comps for full-year 2016. Restaurant sales are likely to be in the range of $276–$277 million as against the prior guidance of $277–$280 million. Also, the company trimmed the upper end of its comps outlook and now anticipates comps to grow in the range of 4–4.5%, (earlier 4–5%).

Further, the company predicts restaurant contribution margin in the range of 20.0%–20.3% (earlier 20.5%–20.8%).

The company projects adjusted general and administrative (G&A) expense margin of approximately 11.0%, lower than previous expectation of between 11.5% and 11.7%.

Additionally, 37 to 38 company-owned restaurant openings are expected in the year (previously 35 to 36).

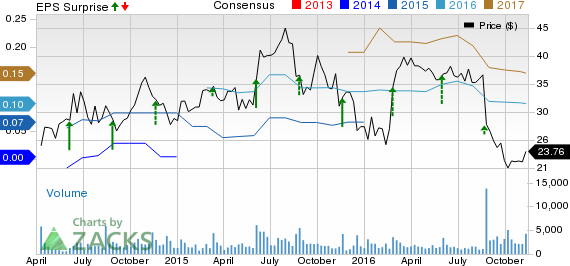

ZOES KITCHEN Price, Consensus and EPS Surprise

ZOES KITCHEN Price, Consensus and EPS Surprise | ZOES KITCHEN Quote

Zacks Rank & Stocks to Consider

Zoe's Kitchen has a Zacks Rank #4 (Sell).

Better-ranked stocks in this sector include Domino’s Pizza, Inc. DPZ, Papa John's International Inc. PZZA, and The Wendy’s Company WEN.

Domino’s Pizza recently posted robust third-quarter 2016 results wherein both the top and bottom-line beat the respective estimate. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Papa John’s has a positive earnings surprise in each of the trailing four quarters, recording an average beat of 11.31% and carries a Zacks Rank #2 (Buy).

Wendy’s also has a positive earnings surprise in each of the trailing four quarters, with an average beat of 28.38% and carries a Zacks Rank #2.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks' private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DOMINOS PIZZA (DPZ): Free Stock Analysis Report

WENDYS CO/THE (WEN): Free Stock Analysis Report

PAPA JOHNS INTL (PZZA): Free Stock Analysis Report

ZOES KITCHEN (ZOES): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research