Zimmer Biomet (ZBH) Q4 Earnings Top Estimates, Margins Grow

Zimmer Biomet Holdings, Inc. ZBH posted fourth-quarter 2019 adjusted earnings per share (EPS) of $2.30, surpassing the Zacks Consensus Estimate by 1.8%. The figure also improved 5.5% year over year.

On a reported basis, EPS came in at $1.54 against the year-ago loss of $4.42 per share.

For the full year, adjusted earnings improved 3% to $7.87 from the 2018-level and also exceeded the Zacks Consensus Estimate by 0.5%.

Revenue Details

Fourth-quarter net sales of $2.13 billion increased 3% (up 3.9% at constant exchange rate or CER) year over year. The figure also exceeded the Zacks Consensus Estimate of $2.11 billion by 0.8%.

Full-year net sales of $7.98 billion increased 0.6% from the 2018 figure (up 2.2% at CER). This too topped the Zacks Consensus Estimate by 1%.

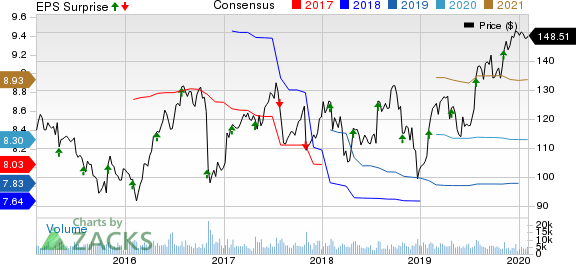

Zimmer Biomet Holdings, Inc. Price, Consensus and EPS Surprise

Zimmer Biomet Holdings, Inc. price-consensus-eps-surprise-chart | Zimmer Biomet Holdings, Inc. Quote

During the fourth quarter, sales generated in the Americas totaled $1.29 billion (up 2.4% year over year at CER) while the same in EMEA (Europe, the Middle East and Africa) grossed $471 million (up 1.4% year over year at CER). Asia-Pacific registered 8.6% growth at CER to $367 million.

Segments

Sales in the Knees unit improved 4.9% year over year at CER to $761 million. Hips recorded a 3.2% increase at CER from the prior-year quarter’s $511 million. Revenues in the S.E.T. (Surgical, Sports Medicine, Foot and Ankle, Extremities and Trauma) unit rose 3.1% year over year to $474 million.

Among other segments, Spine & CMF (Craniomaxillofacial) inched up 0.2% at CER to $197 million while Dental rose 5% to $109 million. Other revenues were down 7.7% to $74 million.

Margins

Gross margin after excluding intangible asset amortization came in at 72.6%, reflecting an expansion of 78 bps in the fourth quarter. Selling, general and administrative expenses dropped 11.7% to $882.2 million. Research and development expenses rose 19.7% to $121.1 million. Adjusted operating margin grew 669 bps to 25.4% during the quarter.

Cash Position

Zimmer Biomet exited the year with cash and cash equivalents of $617.9 million compared with $542.8 million at 2018 end. Long-term debt at the end of 2019 totaled $8.22 billion, reflecting a reduction from $8.94 billion at the end of 2018.

Cumulative net cash provided by operating activities at the end of 2019 was $1.59 billion compared with $1.75 billion a year ago.

2020 Guidance

The company provided its 2020 guidance. Full-year sales growth is projected in the range of 2.5-3.5% compared with the 2019 expectation. Management noted that there will be an overall neutral impact from currency movement in 2020 (expectedto be negative in the first half of the year and slightly positive in the second half). Adjusted EPS for 2020 is envisioned in the $8.15-$8.45 band.

Our Take

Zimmer Biomet ended the quarter on a strong note with better-than-expected results. The company witnessed strong sales growth across all geographies, such as the Americas, the Asia Pacific and EMEA regions. Most operating segments also registered strong growth at CER. However, the company’s sluggish Spine & CMF sales at CER disappoint.

Zacks Rank & Key Picks

Zimmer Biomet currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks, having reported solid results this earning season, are Stryker Corporation SYK, Accuray Incorporated ARAY and AmerisourceBergen Corporation ABC.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Revenues of $4.13 billion also surpassed the Zacks Consensus Estimate by 0.7%. The company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, comparing favorably with the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outshined the Zacks Consensus Estimate by 0.3%. The company sports a Zacks Rank #1.

AmerisourceBergen’s first-quarter fiscal 2020 adjusted EPS of $1.76 beat the Zacks Consensus Estimate of $1.67 by 5.4%. The company has an expected long-term earnings growth rate of 7.4% and a Zacks Rank of 2.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.7% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research