China data lifts shares, doubts creep in over Fed

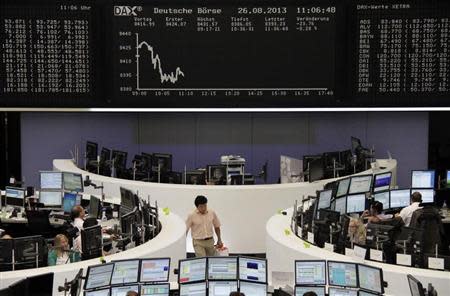

By Richard Hubbard LONDON (Reuters) - An upswing in Chinese exports lifted world equity markets on Monday, though worries about Syria and uncertainty over when and by how much the U.S. central bank will cut its stimulus program saw investors hedge their bets. In Europe the differing views over the prospects of an early reduction by the U.S. Federal Reserve of its bond-buying stimulus after Friday's disappointing payrolls report sent equity markets lower, though German 10-year bond prices also fell. The dollar held steady against most major currencies, caught between the view that the Fed's tapering and resulting further rises in U.S. bond yields would start soon, and talk a move could be delayed by the weak jobs data. "Most people felt that September was nailed on for Fed tapering and it was only a question of the amount," Daragh Maher, currency strategist at HSBC. "It's looking slightly more dubious now. "Ultimately they are going to taper, they are moving towards the exit whereas the ECB and the Bank of England are saying if anything there is pressure for additional easing," he added. Further improvement in the U.S. labor market is the key for the Fed to begin scaling back its $85 billion a month of bond purchase, but Friday's August jobs report showed employers had hired fewer workers than expected last month. This was partly offset by comments from two Federal Reserve officials over the weekend suggesting the tapering plan is still on track. Esther George, the Kansas City Fed's consistently hawkish leader, said she favored trimming the bond-buying program. Chicago Fed President Charles Evans said he could be swayed towards a pullback. The 10-year U.S. Treasury yield stood at around 2.9 percent on Monday, off a two-year high of just above 3 percent hit on Friday though hanging onto the sharp gains linked to the tapering talk of recent months. A Reuters poll on Friday taken after the jobs report found economists at a majority of U.S. primary dealers still expect the Federal Reserve to announce a cut in bond purchases at a policy meeting on Sept 17-18. "The big picture is that the Fed will reduce the amount of liquidity in the market," ING rate strategist Alessandro Giansanti said. TOKYO GLOW Tokyo's victory in the bidding to host the 2020 Summer Olympics boosted Japanese share prices and weakened the yen; the two have been inversely correlated in recent months. The Nikkei share average rose 2.5 percent reaching a five-week high with sentiment aided by an upward revision in April-June gross domestic product. The Australian dollar touched a three-week high around $0.9222, after the strong Chinese trade data added to evidence that the world's second-biggest economy may have avoided a sharp slowdown. China reported its exports had grown by 7.2 percent in August, well above market expectations and also said consumer inflation had held steady in August. The data boosted MSCI's broadest index of Asia-Pacific shares outside Japan by 0.9 percent, with both Hong Kong's Hang Seng Index and Seoul's Kospi hitting their highest level in about three months. China publishes industrial production and retail sales on Tuesday. The gains in Asian markets helped MSCI's world equity index rise 0.2 percent, its sixth successive day of gains as evidence of a global economic recovery mounts. U.S. crude oil futures slipped slightly but stayed near two-year highs supported by concerns a possible military strike against Syria could stir broader conflict in the Middle East and disrupt oil supplies. The global benchmark for oil Brent crude, which rose 1.9 percent last week, fell 0.24 cents to $115.84 in European trading. (Editing by Patrick Graham)