Yellen speaks, Nike reports — What you need to know for the week ahead

This is Yahoo Finance’s preview of the week ahead in markets. For Myles’ thoughts on millennials’ exposure to the stock market, scroll down.

—

In the final week of the second quarter and the first full week of summer, the economic and corporate calendar will be a bit fuller than this past week, which saw Uber in the news again, the Senate release a draft of its new healthcare bill, and stocks finish higher across the board.

This week we will see a final reading on first quarter GDP, consumer confidence updates, and a reading on inflation.

On the corporate calendar, earnings will pick up a bit with results expected from S&P 500 members Paychex (PAYX), Monsanto (MON), Conagra Brands (CAG), Micron Technology (MU), and Nike (NKE).

Additionally, Fed Chair Janet Yellen is scheduled to speak in London on Tuesday and markets will look to see if the Chair has any additional color on the Fed’s thinking around its decision earlier this month to raise interest rates for the third time since December.

“We expect Yellen to reiterate the message that the global economy is improving but that ‘gradual’ removal of policy accommodation (at least in US) remains appropriate,” writes Deutsche Bank economist Brett Ryan.

“In other words, while the global economy is far from showing signs of overheating, crisis-level monetary stimulus may be less necessary at this point.”

Economic calendar

Monday: Durable goods orders, May (-0.6% expected; -0.8% previously); Dallas Fed manufacturing index, June (16 expected; 17.2 previously)

Tuesday: Case-Shiller home prices, April (+0.5% expected; +0.9% previously); Conference Board consumer confidence, June (116 expected; 117.9 previously); Richmond Fed manufacturing index, June (1 previously)

Wednesday: Pending home sales, May (+0.6% expected; -1.3% previously)

Thursday: First quarter GDP, third estimate (+1.2% expected; +1.2% previously); Initial jobless claims (240,000 expected; 241,000 previously)

Friday: Personal income, May (+0.3% expected; 0.4% previously); Personal spending, May (+0.1% expected; +0.4% previously); “Core” PCE, May (+1.4% expected; +1.5% previously); Chicago PMI, June (58.0 expected; 59.4 previously); University of Michigan consumer sentiment, June (94.5 expected; 94.5 previously)

Millennials might not love stocks enough

Here is a chart that will make financial advisors have a lot of thoughts.

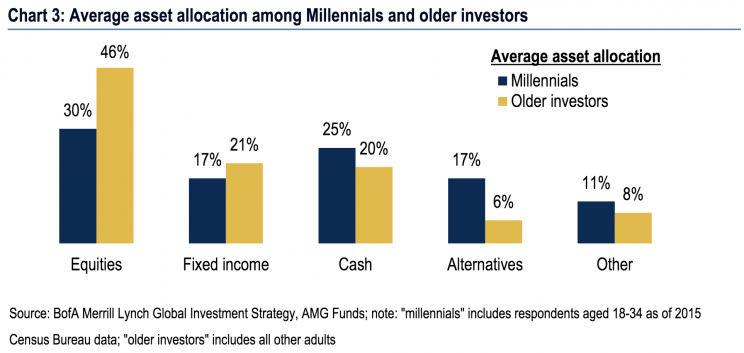

Bank of America strategist Michael Harnett, who authors the widely-read “Flow Show” report for the firm, highlighted this chart in his latest note to clients. It shows that millennial investors, defined as those between the ages of 18-34, are allocating just under one third of their portfolios to stocks, while fully one quarter of their investments are in cash and 17% of investments are in “alternatives.”

Hartnett, who outlined in his latest “Flow Show” note why we are not seeing a blow-off top in the stock market right now, writes that, “you‘ll know it‘s the ‘big top’ when Millennials start buying (new investors a classic late-cycle signal).”

Josh Brown, the CEO of Ritholtz Wealth Management, wrote Friday that this chart is simply, “backwards.” Adding that, “It’s also the reason God sent financial advisors into the world.”

Younger investors, because their investing time horizon — that is, the time between now and when they need their investment income to fund retirement — is longer than older investors, can accept the risks posed by the stock market.

As we’ve written, most every year sees the market fall 10% from a recent high, and yet over the last century the U.S. stock market has, on average, returned about 7% per year. Some years, of course, will be better. Some will be worse. But the longer your time horizon, the more you can endure these swings in order to capture the rewards.

So while Hartnett sees millennials allocating 30% of their portfolio to stocks and thinks an inflow will be the tell that we’re about to enter a blow-off top which leads to a market crash, others like Brown see a young investor class that has simply not been educated correctly. Younger investors should be allocating more money to stocks, plain and simple.

Most anyone who has been offered a 401(k) plan through their employer has been shown the investment quilt, a simple visualization of why diversification works: when some assets go up, others go down. Owning all of them keeps you on an even keel.

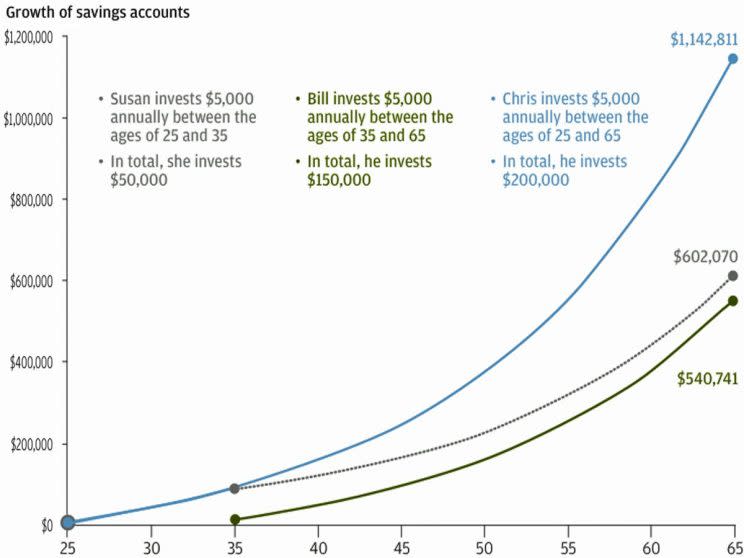

But these quilts leave out that the younger you are as an investor, the more risk you not only can afford to take on but ought to take on. Yahoo Finance managing editor Sam Ro highlighted this chart from JP Morgan years ago showing the benefits of starting investing younger. In short, being invested longer allows the magic of compounding to give an even bigger advantage to your portfolio. And stocks are likely to be the biggest compounders.

Now, some will argue that millennials keeping 25% of their investments in cash makes sense.

After all, it is good as a young person to retain some financial flexibility, to allow yourself a margin of safety around the trials and tribulations of starting out your career (getting laid off, quitting a job you hate, taking a job you like more but that pays less money, and so on).

This could, to use investing parlance, be like keeping some “dry powder” available to invest not in financial assets but yourself.

But Hartnett’s chart, which also shows millennial investors keeping 28% of their total portfolio either in “alternatives” or “other” investments — double the 14% that all investors over the age of 34 allocate to these categories — broadly indicates that young people just don’t love stocks.

Anyone who graduated high school or college from about 2007-2012 will no doubt remember seemingly endless news headlines about the financial crisis, the ensuing market crash, and the shaky foundations upon which our economy reportedly rests.

This was, no doubt, an emotionally scarring period for young people about to become the retirement savers of tomorrow.

But successful investing, and successful saving for retirement, calls for overcoming our fears and anxieties and letting math and history come to the forefront of our process. It might be an uncomfortable or inconvenient truth that stocks for the long run have, for decades, proven to be the best way to grow wealth for someone who works a job and puts a little bit away each month.

But that something doesn’t meet a preconceived notion of what’s right doesn’t make it wrong. At least when it comes to investing.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: