Yahoo Finance Answers: Why did we hype the market 'correction'?

Financial media got frothy on Feb. 8, when stock markets closed at their lowest point of the year. The S&P 500 index officially entered “correction” territory, meaning it had fallen 10% or more from the prior peak, which it hit on Jan. 26.

But markets have since recovered, with the S&P now down less than 5% from the Jan. 26 peak. When we asked our audience what questions they wanted us to answer this week, this one bubbled to the surface:

“When a missile goes off-line, I say it needs a correction. But if the stock market drops 10 percent, then returns soon after, why not just say a decline? I feel misled.”

It’s a fair question, and it highlights the extent to which we in the media can sometimes overreact to developments that seem dramatic in real time, but aren’t, really, when placed in broader context.

But measuring market corrections is still a useful exercise. For one thing, nobody knows if a correction will stop at 10%, or keep going. A correction is halfway to a bear market, which is a 20% decline, and when stocks hit bear-market territory, real people are losing real money. A lot of real money.

Markets run on psychology, and shifts in sentiment have a lot to do with whether money flows into the market or out of it. Investors seem to have viewed the latest correction as an opportunity to buy rather than sell. Hitting that correction point may even have stirred the “buy” impulse among some investors who otherwise might not have noticed.

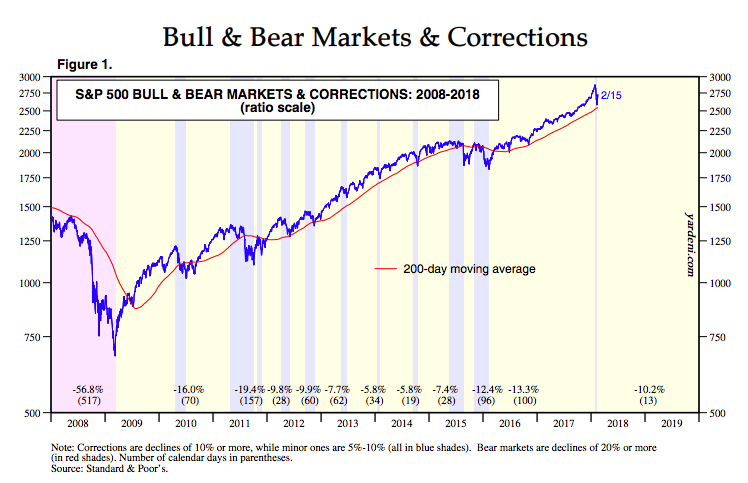

But perhaps the best reason to take note of corrections is to provide historical context. There have been 5 corrections during the current bull market, which kicked off in March 2009. This chart produced by Yardeni Research shows all the declines of more than 5% since 2009, which includes 5 corrections of 10% or more (including the latest one) and 6 smaller declines:

Understanding these types of market gyrations can help when a big selloff is underway, and you’re trying to figure out whether to hold on, or capitulate. During the last decade, corrections haven’t really been a big deal, since the market has regained lost ground relatively quickly, in most cases. That should help investors maintain the confidence to simply hold on and sit tight. And if we hit bear-market territory, it would help in a similar way to examine the history of bear markets.

Is the current correction over? Nobody knows, but we shouldn’t take for granted that it is. A spate of selling triggered by technical factors seems to be over, but it’s still not clear if markets have fully adjusted to new expectations of slightly higher inflation, and the attendant consequences. There can be market upswings inside corrections, as we know from looking at the past. Which is always worth doing.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn