Wounded by Sales Decline and Weak Guidance, American Outdoor Brands' Stock Staggers

- By Sydnee Gatewood

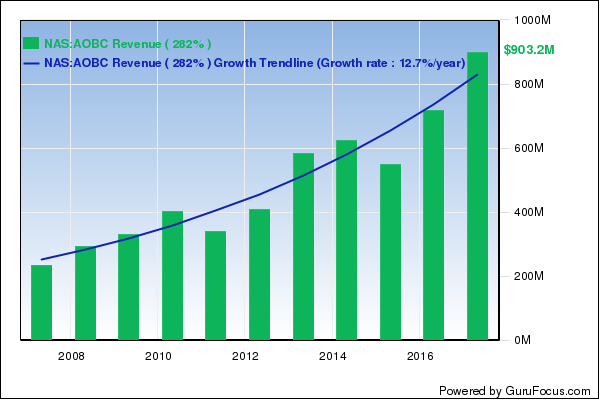

Firearms manufacturer American Outdoor Brands Corp. (AOBC) reported disappointing third-quarter 2018 earnings after the market closed on March 1, sending shares down more than 20% to hit a 52-week low.

The Springfield, Massachusetts-based company, which makes Smith & Wesson firearms, posted adjusted earnings per share of 9 cents, beating Thomas Reuters' estimates of 8 cents. The company said its earnings were boosted by a one-time tax benefit of $9.4 million related to the Tax Cuts and Jobs Act.

Warning! GuruFocus has detected 6 Warning Signs with AOBC. Click here to check it out.

The intrinsic value of AOBC

Quarterly revenue decreased 32.6% to $157.4 million, missing Thomas Reuters' expectations of $173.2 million.

CEO James Debney attributed the alarming sales decline to "challenging market conditions in the consumer market for firearms" said that he expects "may continue for some time."

"Lower shipments in our Firearms business were driven by a reduction in wholesaler and retailer orders versus the prior year, and were partially offset by double-digit revenue growth within our Outdoor Products and Accessories segment," he said. "Overall, our long-term strategy remains focused on being the leading provider of quality products for the shooting, hunting, and rugged outdoor enthusiast."

The company's earnings forecasts further dampened shareholders' spirits.

For the fourth quarter, American Outdoor expects adjusted earnings between 9 cents and 11 cents per share on revenue between $162 million and $166 million. Thomas Reuters had previously projected fourth-quarter earnings of 38 cents on $205.6 million in revenue.

"Going forward, we will operate our business under the assumption that the next 12-18 months could deliver flattish revenues in Firearms," Debney said. "Should market conditions change, our flexible manufacturing model would allow us to quickly ramp production."

In the wake of a recent school shooting, gunmakers, along with the National Rifle Association, have been hammered by gun control activists and investors alike. On Wednesday, retailer Dick's Sporting Goods (DKS) sent shares sliding even further after it announced it would no longer sell "assault-style rifles" and threw its support behind stricter gun laws. On Thursday, however, Sturm Ruger (RGR) closed higher at $45.20 before falling after hours. Vista Outdoor Inc. (VSTO) closed 0.35% lower at $17.17, but was up 0.33% in after-hours trading.

American Outdoor closed at $9.41 on Thursday, up 4.56%. GuruFocus estimates the stock declined 37% in 2017. Year to date, it has fallen 30%.

Ian Atkins, chief financial analyst at New York City-based FitSmallBusiness.com, commented on the industry's current environment and the possible implications of stricter gun laws.

"American Outdoor Brands has been mired in the same 'Trump Slump' that all gun manufacturers have been in. National Instant Criminal Background Check System (NICS) data shows background checks were down again during the months of October to December 2017, suggesting there's been no change in demand," he said.

"And, if the performance of its competitors, Vista Outdoor and Ruger, are any indicator, investors shouldn't have reason to believe that makers of firearms and firearm accessories have turned a corner yet."

Despite this recent pressure, Atkins believes the renewed interest in gun legislation may be good for companies that manufacture weapons.

"Historically, firearm sales increase when potential customers interpret the likelihood of regulatory action as more likely," he said. "With the 2018 midterms on the horizon, the gun debate is sure to stay in the national spotlight, and potential customers might be motivated to make purchases prior to perceived regulatory changes being enacted."

While these regulatory changes are being discussed in Washington, Atkins said he does not believe they pose an "existential threat" to manufacturers.

"The only bill with much bipartisan support is the Fix NICS Act," he continued. "If passed, this bill would increase enforcement of the existing law and increase the requirements for record keeping and reporting."

Recent decisions made by big-box retailers like Dick's Sporting Goods and Walmart (WMT) in response to the school shooting in Parkland, Florida, however, may prove to be a different story.

"Bass Pro Shops and Cabela's (CAB) are the only major national retailers left selling MSRs like Smith & Wesson's AR-15," Atkins said. "Corporate America, meanwhile, has shown a willingness to cut ties with brands that they feel associate them too closely to the firearms industry."

During the earnings call Thursday, Debney issued a brief statement about the Feb. 14 school shooting that left 17 people dead.

"We share the nation's grief over this incomprehensible and senseless loss of life and we share the desire to make our community safer," Debney said. "Through our membership and work with National Shooting Sports Foundation we will continue to support the development of effective solutions that accomplish that objective, while protecting the rights of the law-abiding firearm owner."

Disclosure: No positions.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 6 Warning Signs with AOBC. Click here to check it out.

The intrinsic value of AOBC