World stocks mixed amid China news, weak earnings

BEIJING (AP) — World markets were mixed Tuesday, torn between news that China's central bank will act to help growth and concern over weak corporate earnings.

Markets were uneasy the day before after China's fourth-quarter growth declined slightly from the previous quarter but confidence rebounded after the central bank promised extra liquidity in the financial system. The move comes ahead of the Lunar New Year holiday, when credit often is tight.

"This will reduce the credit crunch fears and assure funding continues to flow into the Chinese economy over this period," said strategist Evan Lucas at IG Markets in a report.

Sentiment was knocked later in the day, however, by earnings reports that caused a drop in the shares of Johnson & Johnson, Travelers and Verizon.

In Europe, France's CAC-40 closed the day flat at 4,323.87 and Germany's DAX rose 0.2 percent to 9,730.12. Britain's FTSE 100 ended roughly unchanged at 6,834.26.

On Wall Street, however, the Dow fell 0.8 percent to 16,322.03 and the broader S&P 500 shed 0.3 percent to 1,833.36.

Looking ahead, investors will keep paying attention to corporate earnings, which have so far been mostly disappointing, and the Federal Reserve's next meeting Jan 29.

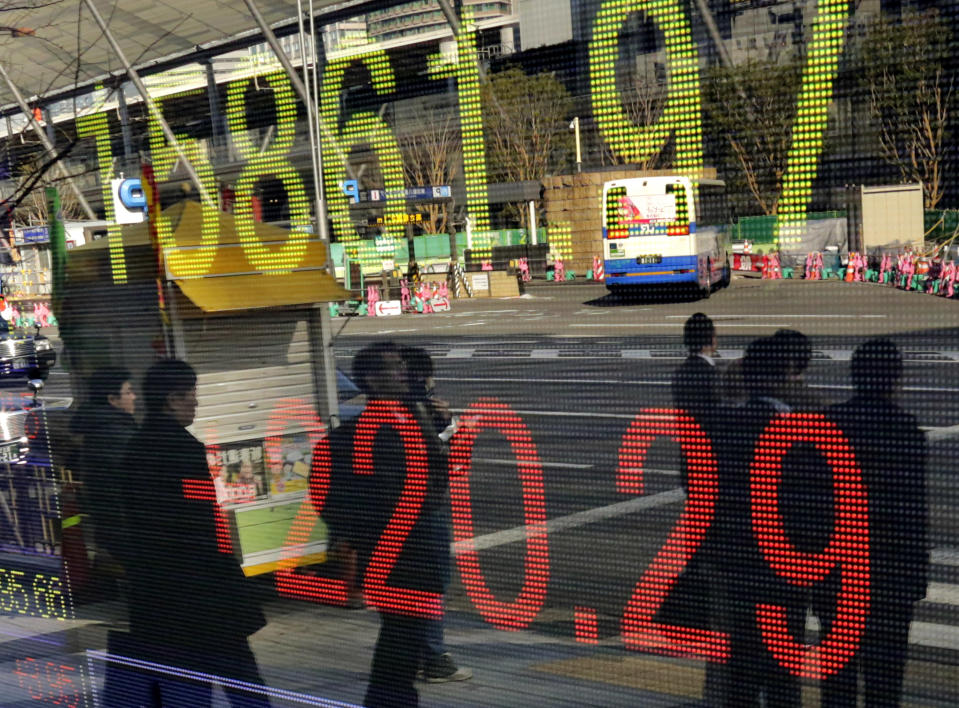

Earlier, in Asia, China's benchmark Shanghai Composite Index rose 0.9 percent to 2,008.31 and Tokyo's Nikkei 225 jumped 1 percent to 15,795.96.

Hong Kong's Hang Seng gained 0.5 percent to 23,033.12 while Seoul's Kospi rose 0.5 percent to 1,963.89. Sydney's S&P/ASX 200 rose 0.7 percent while India's Sensex added 0.2 percent. Indexes in Singapore, Bangkok, Jakarta and New Zealand also rose.

In energy markets, benchmark crude for February delivery was up 64 cents at $94.60 a barrel in electronic trading on the New York Mercantile Exchange.

The euro was barely changed at $1.3558 while the dollar shed 0.1 percent to 104.11 yen.