Worcester Board of Health: Time for state Legislature to raise alcohol tax

WORCESTER — Calling alcohol a public health challenge, plus noting it kills more Massachusetts residents yearly than opioids, the city's Board of Health voted unanimously to support an increase in the state’s excise tax on alcohol.

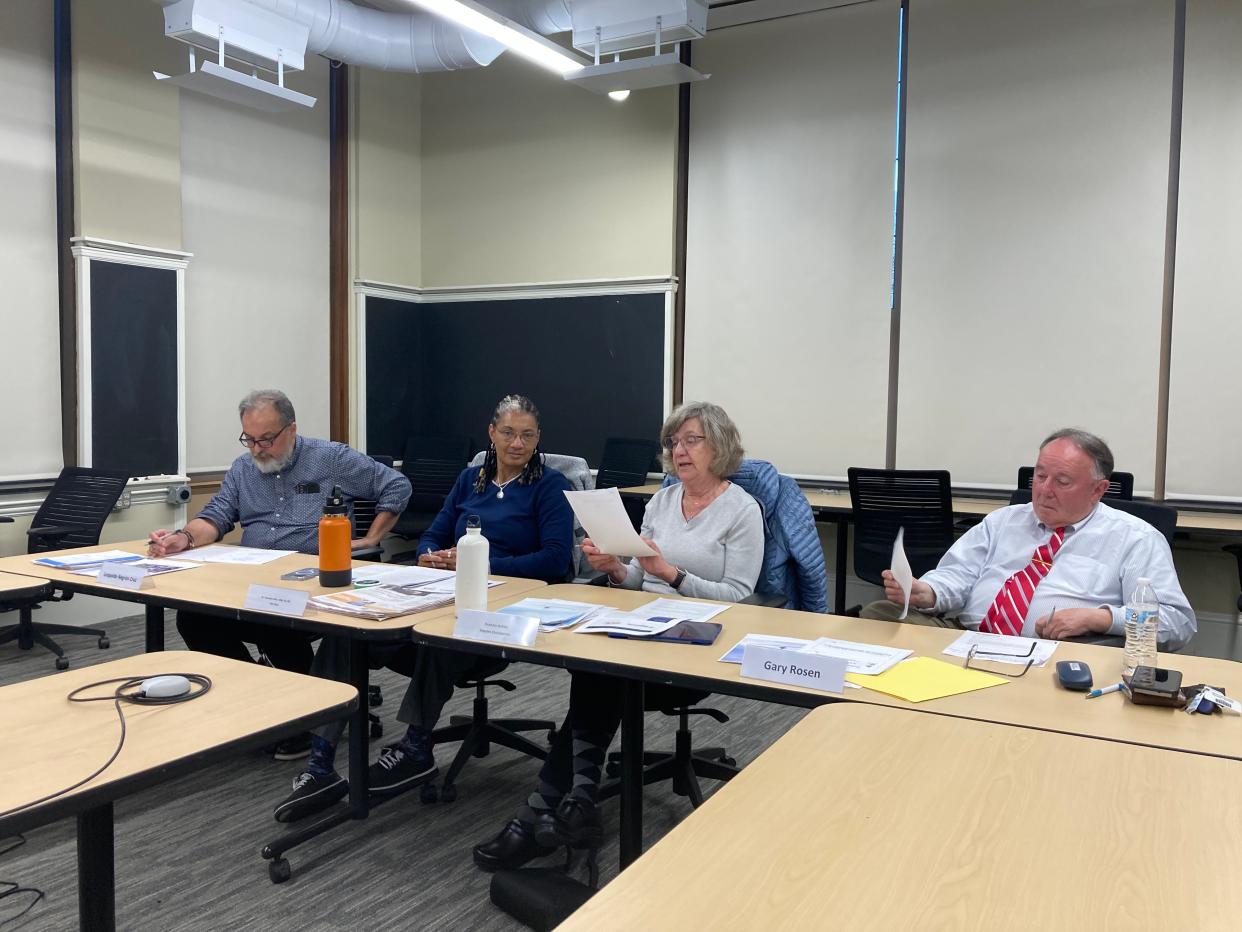

Monday's 4-0 vote sends a message to state lawmakers that they need to raise the tax as one way to curb dangerous drinking connected to thousands of deaths every year in Massachusetts.

The vote came after a virtual presentation by David Jernigan, a professor in the Boston University School of Public Health. Jernigan is on a mission to build broad public support to pressure lawmakers to tighten up the state’s alcohol policies

“My political view is the two bills in the Legislature this session to raise the alcohol tax are not going to go anywhere,” Jernigan told the board. “They’re fairly timid bills. We need a broader coalition to get behind this.”

Numbers tell deadly story

Figures presented by Jernigan included 3,101 alcohol-attributable deaths (5.15% of all deaths statewide) in Massachusetts in 2019. The total number exceeds the number of confirmed opioid-related deaths (2,331) statewide in 2022. The number jumps to 2,359 when accounting for the number of unconfirmed deaths, representing a record number in Massachusetts.

Meanwhile, tax revenue from alcohol sales is not nearly enough to cover what governmental bodies in Massachusetts spend on alcohol-related expenses, according to Jernigan’s report.

The average per person cost of alcohol problems in 2010 (the last year data is available) was $861, amounting to a total cost of $5.6 billion annually statewide. Less than half of that yearly total was paid out by governments in Massachusetts due to budget constraints. The payments for lost productivity, property damage, health care, criminal justice and other costs connected to alcohol consumption averaged $345 per person or $2.2 billion annually.

Meanwhile, the average per person revenue from alcohol excise taxes was $11 in 2020.

Increasing taxes 'most effective way'

To tackle the issue, Jernigan believes more money must flow into the government's coffers: "Increasing taxes to reduce and prevent alcohol problems is the most effective way."

He cited Maryland as an example of positive results from a hike in the alcohol tax. Jernigan’s report indicated Maryland raised nearly $90 million in revenues after it increased the state's alcohol sales tax by 3% in 2010. The extra millions paid for a host of health care programs. There was also an 11% drop in alcohol consumption from 2011 to 2016.

Across the board, Massachusetts checks most boxes for the lowest alcohol taxes among the six New England states, according to Jernigan’s report. Since 1980, which was the the last time alcohol taxes were raised in Massachusetts, they've lost 75% of their value due to not keeping pace with inflation, according to Jernigan.

For example, in the category of beverages over 30 proof, the current tax that has been on the books since 1980 is $4.05 per gallon. When adjusted for inflation, the tax should currently be $16.26 per gallon.

Some hesitancy

Moments before Monday’s vote, Board of Health Vice Chairwoman Chareese Allen told her fellow members in open session that she was hesitant and wondered what impact a vote would have.

Allen explained her hesitancy moments after the meeting, when Jernigan told the board it was the first local Board of Health in Massachusetts that he presented his report to. He also noted it was the first one he’s aware of that voted to urge the Legislature to raise the excise tax.

Allen described the board’s vote as vague on specifics of what needs to be done, adding, “(Jernigan) doesn’t really have, from the sense I gather, he doesn't really have much support behind it."

She continued: "He's basically trying to gather the truth before he actually puts it forward. So I think we’re really in the early, early phases of where we’re going with this. That was my hesitancy on it.”

Allen, who works as a doctor of nursing practice at Family Health Center, called the numbers Jernigan presented “staggering.” She was unaware more than 3,000 Massachusetts residents died in connection to alcohol in 2019.

She noted two sources that present a challenge in Massachusetts. One resulted after former Gov. Charlie Baker lumped liquor stores in the category of essential services when Massachusetts declared a statewide emergency at the outbreak of COVID-19 in March 2020. That declaration allowed liquor stores to stay open, and Allen said some residents used alcohol to numb their fear and depression. The result, she said, contributed to addictions.

The second challenge, noted Allen, is the state’s large supply of colleges and universities, where drinking alcohol is part of the culture.

“How do we get to those populations and make them realize the seriousness of this is what alcohol can do to you,” said Allen.

When asked if state lawmakers will vote to raise taxes, Allen appeared skeptical. “I think we have a serious uphill battle,” she said, with likely opposition coming from businesses that sell alcohol because they’ll see it as an attempt to cut into their revenues. Some lawmakers may also oppose higher taxes, said Allen, because it could result in fewer sales and less revenue for the state.

'It's not going to change behavior'

All a higher excise tax will do is drive more people to tax-free New Hampshire or make illegal purchases on the internet for cheaper alcohol, said Robert Mellion, executive director of the Massachusetts Package Stores Association.

“It’s not going to change behavior. It’s going to make people buy somewhere else," said Mellion.

The State House is full of bills calling for higher taxes on alcohol, but they’re not going to pass, said Mellion, because “these people want to be reelected.”

State Sen. Michael Moore, D-Millbury, sits on the state's Joint Committee on Revenue and said given the current cost of living, now isn’t the time to raise any taxes.

If it happens to alcohol, Moore said some people in Worcester will take the short drive to Rhode Island to buy cheaper booze, and that will take business away from the city’s retailers. Also, buying and consuming alcohol in Rhode Island and driving back to Worcester could present public health hazards on the roadways, said Moore.

While he supports looking at ways to limit alcohol consumption, Moore said let's do it through education, not higher taxes. "At what point does the government or the individual have the role to monitor themselves?"

Bills died in Legislature

State Rep. Kay Khan, D-Newton, filed numerous bills since 2011 to raise the alcohol excise tax and establish an alcohol sales tax in Massachusetts.

“I wish I had the answer,” said Khan when asked why the bills died in the Legislature. A statewide referendum in 2010 repealed a 6.25% sales tax on alcohol approved by the Legislature the year before that Khan said generated nearly $170 million in revenue.

She’s heard the comments that some residents will go to New Hampshire, Rhode Island or the internet to buy alcohol if Massachusetts hikes taxes, but that doesn’t mean it shouldn't happen. More revenue, said Khan, will result to help those suffering with alcohol abuse and to educate youth about how to responsibly manage alcohol.

"Nobody likes to talk about raising alcohol taxes,” said Khan. “Alcohol is a sacred cow in some ways, but there’s a lot of alcohol abuse. There's an opportunity to raise some funds that will be helpful that are put into a health education fund.”

More meetings, more discussion

The Board of Health also voted unanimously to hold a public meeting with state lawmakers whose jurisdictions include Worcester in order to build support for raising the state's alcohol excise tax.

It also voted 4-0 to hold a separate public meeting with the city’s License Commission. The commission regulates Worcester’s alcohol licenses, and the health board thinks a meeting is an opportunity to study the city’s number of outstanding liquor licenses and whether it's the right amount.

Currently, 293 liquor licenses are issued in Worcester, including 231 classified as on-premises retail and 62 more classified as off-premises retail.

Anthony Vigliotti, the city’s License Commission chairman, is open to a meeting with the health board. He wants to study Jernigan’s report first, and said he doesn’t know why anyone would call for higher taxes now.

“All restaurants and bars are struggling to stay in business,” said Vigliotti. “Now is not the right time to raise taxes on those particular businesses.”

Worcester doesn't limit the number of liquor licenses it issues, said Vigliotti, except when it comes to package store licenses.

In March, the License Commission voted to allow bars and restaurants to offer full liquor bottle service for events. Worcester had allowed the purchase of wine and beer bottles from bars and restaurants but had restricted liquor bottle service since 2018.

Contact Henry Schwan at henry.schwan@telegram.com. Follow him on X: @henrytelegram.

This article originally appeared on Telegram & Gazette: Worcester Board of Health urges hike in state alcohol tax