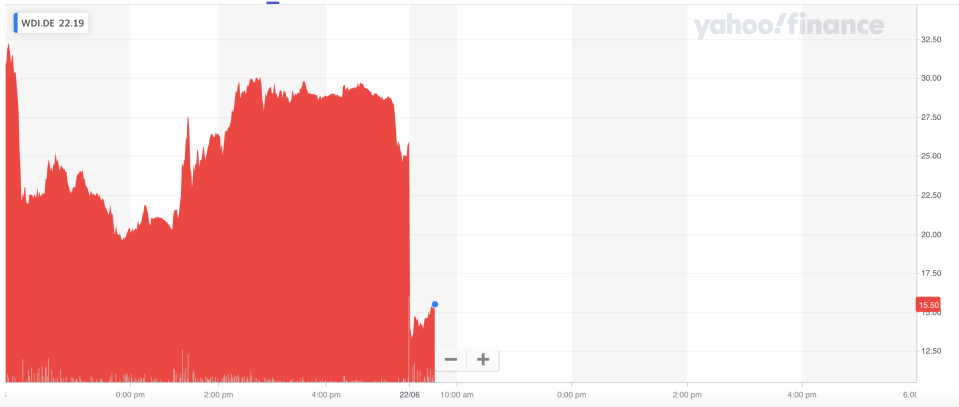

Wirecard falls another 40% as it says missing €1.9bn doesn't exist

Wirecard’s (WDI.DE) vertiginous stock slide resumed on Monday morning, as the company admitted the missing €1.9bn (£1.7bn, $2.1bn) at the heart of its accounting scandal probably doesn’t exist.

“There is a prevailing likelihood that the bank trust account balances in the amount of €1.9bn do not exist,” the German tech company said in a statement on Monday.

It comes after banks in the Philippines said documents produced by Wirecard appeared to be false. Over the weekend, the Philippines central bank also denied the money ever entered its financial system. Wirecard had claimed the €1.9bn was held in a trust account in the country.

READ MORE: Wirecard can't rule out 'considerable fraud' as billions go missing

Wirecard said it was unsure whether its third party acquirers — international partners who handle card transactions on its behalf — had actually conducted the business they said they did.

Wirecard withdrew its preliminary 2019 results, first quarter 2020 results, and forecasts. The company said previous years’ accounts may also be affected.

The stock dropped 43% in Frankfurt.

Wirecard was plunged into crisis last week after auditors EY refused to sign off on the company’s 2019 accounts, saying they could not verify the existence of €1.9bn Wirecard claimed to hold in trust accounts overseas.

Chief operating officer Jan Marsalek was temporarily suspended. Chief executive Markus Braun said he couldn’t rule out the company being the victim of “fraud of considerable proportions.” Braun stepped down on Friday.

READ MORE: Wirecard CEO quits after billions go missing from balance sheets

Short sellers have for years alleged issues at Wirecard, a digital payment company that has grown into one of Germany’s biggest tech success stories. The Financial Times has also reported extensively on alleged accounting issues at the company’s overseas operations. Wirecard consistently denied any issues, insisting it was sound.

The company was valued at €24bn at its peak and was part of Germany’s DAX 30, the elite ranking of top listed businesses. Stock in the company has now fallen 85% since the issues emerged last week and Wirecard is now worth €1.9bn.

The missing money has created serious financial issues. Wirecard warned last week that credit lines worth €2bn could be withdrawn if the missing €1.9bn could not be located.

READ MORE: Central bank says Wirecard's missing funds didn't enter Philippines

Wirecard said on Monday it “continues to be in constructive discussions with its lending banks.” It has also hired investment bank Houlihan Lokey to come up with “a sustainable financing strategy for the company.”

Wirecard said it is considering “restructuring, disposal or termination of business units and products segments” as part of efforts to cut costs and raise cash.

Yahoo Finance

Yahoo Finance