Why the TUR ETF Is the Perfect Way to Play the Dip In Turkey

Things are a mess in Turkey right now. The currency is hitting record lows. Inflation is hitting record highs. The stock market is in free fall. Borrowing costs are sky-high. Trade relations are weakening, especially with the U.S. The debt situation isn’t pretty.

In other words, nothing is going right for Turkey, and that is reflected in the performance of the iShares MSCI Turkey ETF (NYSEARCA:TUR). The TUR ETF is down 50% in 2018 alone.

But, the TUR ETF has shown some signs of life recently. It is up 15% over the past two days. Moreover, my analysis suggests that this is much more than just a dead cat bounce. My numbers suggest that the Turkish stock market has actually bottomed, and that the TUR ETF could be in store for a big bounce back rally over the next twelve months.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Here’s a deeper look.

The One Chart Everyone Should Be Looking At

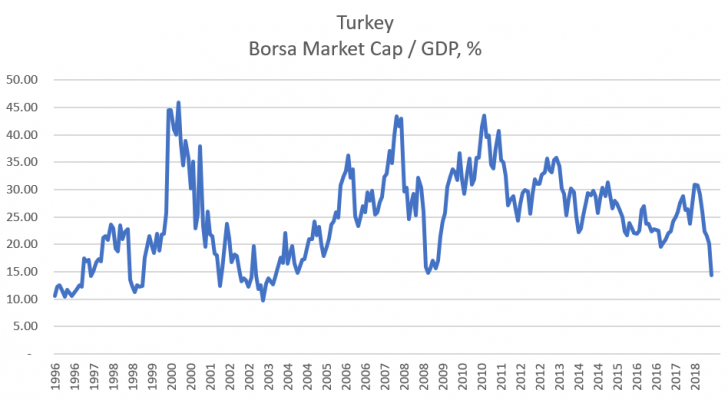

Legendary investor Warren Buffet once said that the single best indicator for stock market valuation is market cap to GDP. In that analysis, all you do is simply sum the market capitalization of all the stocks in a certain country, and divide that number by the country’s GDP. The net result will yield a percentage which, if above 100%, implies that the market is overvalued. Meanwhile, if the number is below 50%, the market is likely undervalued.

The situation is a bit different in Turkey. Due to its unique economic circumstances, Turkey’s market-cap-to-GDP almost never gets above 50%. But, it almost never gets below 15%, either. And whenever it does drop below 15%, the market usually bottoms, and then proceeds to rally in a big way over the next twelve months.

Guess where the recent plunge in Turkish stocks has sent the market-cap-to-GDP ratio today? Below 15%, even by conservative estimates. The current market cap of the Borsa (Turkey’s stock market) is roughly $115 billion. GDP last year was $850 billion. Assuming that drops to $800 billion this year, then the Borsa’s market-cap-to-GDP ratio is still below 15%.

This drop to below 15% market-cap-to-GDP has only happened four times before over the past two-plus decades. Each time, Turkey’s stock market bottomed, and proceeded to rally in a big way over the next twelve months, most recently bouncing back from 2008 recession lows.

Why the TUR ETF Could Rally Big

History says that the TUR ETF could stage a 30%-plus rally from here over the next twelve months.

Over the past twenty-plus years, Turkey’s market-cap-to-GDP ratio has fallen below 15% four times. Each time, the Borsa rallied by more than 25% over the next twelve months. Here are the specific examples:

Late 2008: Borsa market-cap-to-GDP plunged below 15%. Borsa market cap was around $110 billion. A year later, the Borsa market cap was around $250 billion (+130%).

Mid 2002: Borsa market-cap-to-GDP plunged below 15%. Borsa market cap was around $30 billion. A year later, the Borsa market cap was above $40 billion (+33%).

Late 1998: Borsa market-cap-to-GDP plunged below 15%. Borsa market cap was around $37 billion. A year later, the Borsa market cap was above $50 billion (+35%).

Early 1996: Borsa market-cap-to-GDP was below 15%. Borsa market cap was around $25 billion. A year later, the Borsa market cap was around $45 billion (+80%).

The big picture? Every time the Borsa has become this cheap relative to GDP over the past twenty years, the market has proceeded to rally by more than 30% over the subsequent year.

Bottom Line on TUR

I think it is time to buy the TUR ETF. This trend of bottoming at 15% market-cap-to-GDP appears to be in tact as the Turkish stock market (and the TUR ETF) have bounced back big over the past few days after market-cap-to-GDP plunged below 15% for the first time since 2008.

If history repeats itself, then the TUR ETF could be in store for a huge, 30%-plus rally over the next twelve months.

As of this writing, Luke Lango was long TUR.

More From InvestorPlace

The post Why the TUR ETF Is the Perfect Way to Play the Dip In Turkey appeared first on InvestorPlace.