Why Trump's talk of 6% US economic growth is unrealistic

In the third presidential debate on Thursday, Republican candidate Donald Trump defended his seemingly unrealistic growth forecasts for the US economy, which has expanded at a tepid pace in recent years.

In response to moderator Chris Wallace’s question that Trump’s economic numbers don’t add up, Trump defended and even amplified his out look for US GDP growth.

“We’re bringing GDP from really 1%, which is what it is now,” he said. “We’re bringing it from 1% to 4%. And I actually think we can go higher than 4%. I think you can go to 5% or 6%,” Trump said.

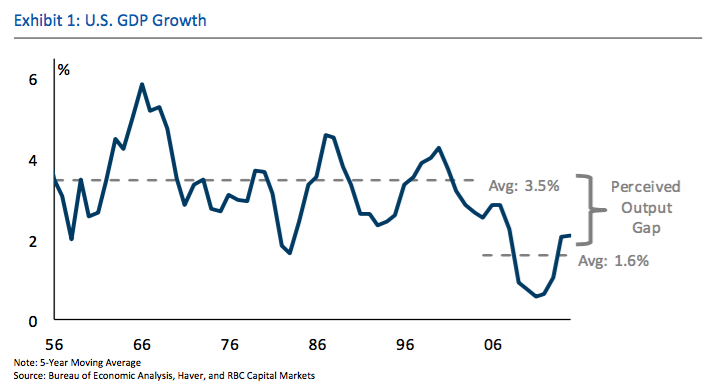

Over the last decade in the US, GDP growth has slowed to 1.6% annually, compared to an annual pace of 3.5% from 1956 to 2006.

So how realistic is Trump’s promise for growth?

The US is not likely to hit those targets, according to RBC’s Jonathan Golub.

Demographic drivers

The main reason? The US population is not growing at levels it used to, putting downward pressure on labor force workforce growth.

Trump pointed to higher growth levels in other countries.

“I just left some high representatives in India. They’re growing at 8%. China is growing at 7% and that for them is a catastrophically low number,” he said.

But Trump’s comparison of the US (with 320 million people) to developing nations like China (with 1.4 billion people) and India (with 1.3 billion people) may not add up either.

The US population is growing at 4.7%, according to RBC, lower than China’s 5.4% growth and India’s 13.0% growth.

This doesn’t even factor in labor force growth higher than population growth from China and India—both developing nations—as large groups move from rural areas to urban areas. (Meanwhile, the reliability of Chinese economic data continues to be scrutinized).

The US, meanwhile, has to grapple with opposite dynamics. As Golub explained, the labor force expanded more rapidly than the population from 1960 through 2006, as women entered the workforce in increasing numbers, a trend that is now tapering.

Productivity upside?

Currently, productivity in the US remains depressed, as shown in the chart below.

More normalized productivity levels of 1.5-2% would not give the US the boost necessary for a big shift in growth.

“Even if productivity were to improve meaningfully, it is hard to see how economic growth could achieve its prior heights given this decline in workforce growth,” Golub said.

Protectionism

And while some of Trump’s proposed economic policies—including decreasing taxes, increasing incentives and reigning in regulation—could boost productivity, Golub said that the candidate’s protectionist policies could counteract some of these efforts.

The emergence of China helped US growth, according to Golub, as US exports increased. As industrial activity has slowed in China since 2003, this has impacted US growth negatively—something that would be more significant if trade is hindered.

Lower leverage

Meanwhile, the US has to contend with a “new normal” of lower leverage.

As Golub explained, it was the introduction of mortgage-backed securities (MBS) and collateralized mortgage obligations (CMO) in the early 1980s that resulted in a dramatic increase in debt-financed construction activity.

“This paved the way for a multi-decade housing boom, an enormous contributor to US GDP,” Golub said.

The bottom line: Trump’s outlook for super-sized GDP growth may not be realistic, especially when combined with protectionist policies.

Please also see:

Why a rate hike won’t save the banks

Dismal start to earnings season becomes market driver

How the Mexican peso became tied to the whims of the American voter