Why so many companies are rounding up your spare change

Last weekend, taxi app Lyft took out a full-page ad in the Sunday New York Times to announce a magnanimous new program it will roll out soon called Round Up & Donate. “Opt in and we’ll automatically round up your fare to the next whole dollar and push the difference toward issues impacting everyone everywhere, from climate change to the pursuit of equality.”

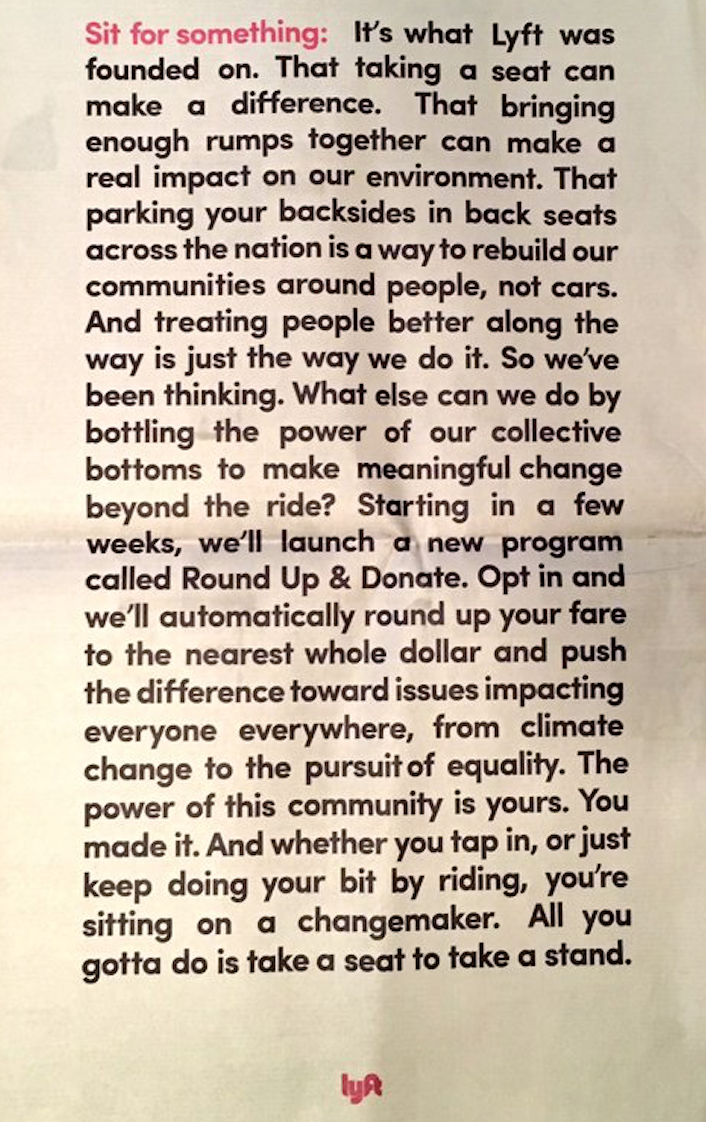

Yes, it’s fair to see it as another effort to capitalize while Uber, its biggest competitor, has been beset by scandals for nearly two months straight. And the language of the ad (“Sit for something. It’s what Lyft was founded on.”) led many to roll their eyes. (The New York Observer said the ad is “really just a big f*ck you to Uber,” while an Adweek reporter wrote on Twitter, “You’re a ride share company. Get over yourself.“)

But Lyft is simply hopping on board a trend that has already caught on with big names like Bank of America, Barclays and GoDaddy.

The concept of “roundups” in mobile tech does not belong to Lyft, nor has Lyft added any original twist to it. But enabling charity roundups is an easy way for any company to quickly add a layer of social conscience—and that’s why so many are doing it.

GoDaddy first added a charity roundup option in 2011, specifically to benefit Haiti relief, but now has a broader program called Round Up for Charity. Amazon launched AmazonSmile in 2013—it isn’t roundups, but it’s a variation on the theme, where Amazon donates 0.5% of every purchase to a charity of the customer’s choice. Bank of America has a program called “Keep the Change” that rounds up purchases from your debit card and transfers the money to a savings account—not for charity, but it could easily add that option.

Doing roundups for charity is a newer subset of the larger spare-change roundup trend, which has become very popular in new mobile tech. Investing app Acorns, which launched in 2012 and has raised $63 million in funding, rounds up each transaction on your linked credit card and puts the difference in an investment portfolio. The idea is for you quietly amass some savings without really noticing it.

An app called Lawnmower took the same concept and applied it to bitcoin—round up your spare change and use it to buy digital currency. (The bitcoin news web site CoinDesk recently acquired Lawnmower for its research and data.) Bstow, a charity roundup app incubated by Barclays Techstars in Tel Aviv, launched to consumers last year, but CEO Jason Grad says the roundup concept has gotten so popular so fast that Bstow pivoted to become a business-to-business developer of charity roundup platforms for non-profits and larger corporations. (Bstow says it is building one for Barclays.)

Grad says the reason companies like the roundup concept so much is that millennials take to it quickly. There’s low friction for users. “Roundups are a low-barrier way that people can help causes they care about without breaking the bank, and without having to make a big, researched decision about where they should donate,” he says. “There is an enormous movement to make financial decisions more seamless for millennial professionals so that they can create good habits while they are young.”

A comment from Lyft about why it’s adding roundups would appear to bolster Grad’s point about making millennials feel they are doing good. “We deeply believe in participation,” a Lyft spokesperson tells Yahoo Finance. Roundup programs are about as easy for a consumer to participate in as charity efforts get. And the company offering the opportunity gets to look like it has a social conscience.

But it doesn’t hurt that it was also an instant way to look nice while Uber tries to clean up its mess.

—

Daniel Roberts is a writer at Yahoo Finance, frequently covering fintech.

Read more:

These 3 very different apps helped me save up money

Uber has had 5 major scandals in just 2 weeks

Uber’s competitors in NYC are growing like crazy