Why savers are rushing to buy I Bonds in the last days of April

Savers might be looking at making $50 in interest in the next year if they set aside $5,000 in a one-year certificate of deposit.

Or you could grab an I Bond soon and make around $418 in interest in a year on $5,000 in savings.

Big difference. Who wouldn't want to make roughly eight times more money on the same amount of savings? Now you know why many people keep talking about some oddball thing called I Bonds.

Inflation-indexed savings bonds are a trendy topic in 2022 as inflation is soaring to heights not seen in 40 years.

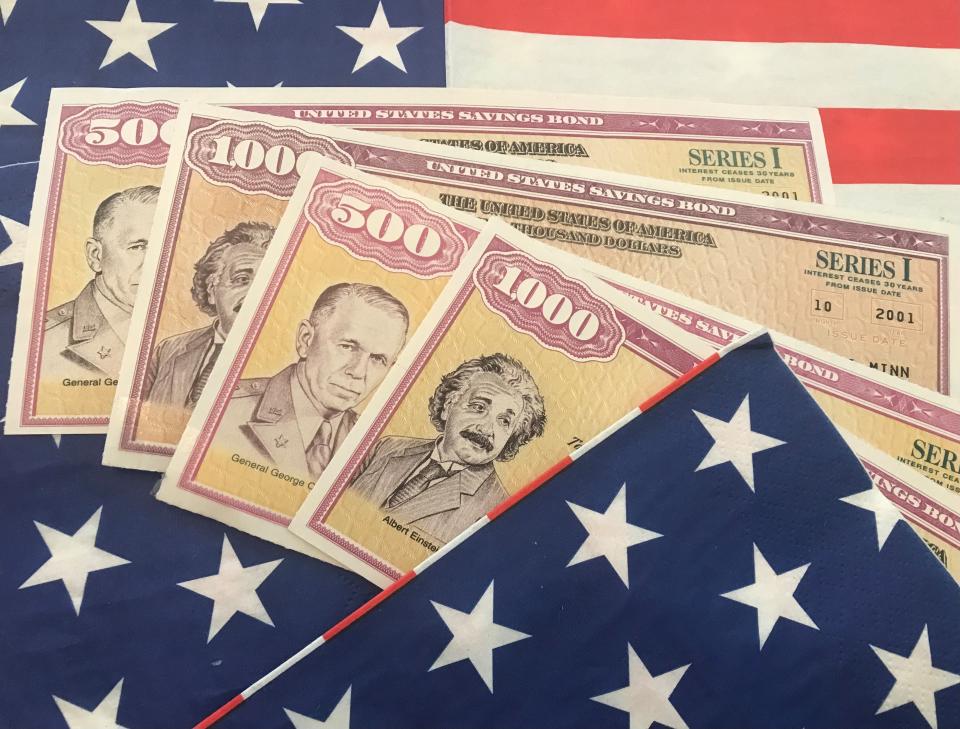

Yes, we're talking about a U.S. savings bond but nothing like the traditional savings bonds Grandma gave you for your birthday so many years ago.

Series I Bonds are a bit more complex, a bit harder to buy than the old bonds you bought at the bank. But they're getting plenty of buzz, thanks to eye-popping rates when savers are basically getting nothing on their money.

What's the big deal?

Everyone knows you're not making much money at all in a typical savings account.

You'd need to shop around a bit for a one-year certificate of deposit to find better-than-average rates around 0.75% to 1.2% in late April.

By contrast, savers are seeing a 7.12% annualized I Bond rate that applies to the first six months for anyone who bought I Bonds from Nov. 1, 2021, through April 30, 2022.

Given that high rate, many savers are putting money into I Bonds now. You'd want to make a move by April 28 or so to give enough time for processing and lock in very attractive rates for one year.

A new, even higher rate will be announced officially on May 1 and apply to bonds bought May 1 through October. The inflation-adjusted rate for I Bonds changes again Nov. 1 and then every May 1, 2023.

The new annualized rate is likely to be around 9.6% for a six-month period, according to Daniel Pederson, a Monroe-based savings bond expert and founder of www.BondHelper.com.

If you bought I Bonds in April, you'd get that annualized rate of 7.12% for the first six months. And then the higher rate in the 9.6% range would apply for the next six months.

The result: The average rate would end up being 8.36% over next 12 months.

On $5,000 in savings, you'd be looking at making $418 in interest in the first year. Even if you cash out at the end of that year, you'd still get $298 in interest after a three-month penalty.

How do you buy I Bonds?

There are only two ways to buy I Bonds. You'd typically need to set up an online account at TreasuryDirect.gov. Or if you had a federal income tax refund coming to you, you could file Form 8888 when you filed your tax return to direct up to $5,000 in income tax refund cash into I Bonds in a year.

The purchase limit is $10,000 in I Bonds that can be bought each calendar year per person via TreasuryDirect. But you can add another $5,000 if you're able to use that tax refund trick.

Do you need $5,000 or more to buy I Bonds?

No. Savers who have far less money can set aside as little as $25 in an online account at TreasuryDirect.gov.

Smaller savers might want to note that you can use the system at TreasuryDirect to set up weekly purchases automatically.

TreasuryDirect only offers savings bonds through online accounts now, not old-fashioned paper savings bonds.

The tax refund trick with Form 8888 offers an option of paper bonds or having money directly deposited into an electronic account at TreasuryDirect.gov. The only way to get paper bonds is through that tax refund.

What if inflation goes down?

If the inflation rates fall in the months ahead, it is possible that the next I Bond rate announced in November could be lower than 9.6% or so. We don't know, though, if we'll see high inflation for another few years.

Many analysts anticipate that inflation could be with us for a while. If so, that would help boost future returns on I Bonds.

The fixed rate on the current I Bonds is 0%. The inflation rate is added to that floor and will fluctuate every six months after you bought your bonds.

While a 0% fixed rate sounds bad, many savers are making very little at the bank in regular savings accounts and right now the odds are good that I Bond rates in the future could stay strong with inflation.

What some are getting wrong

Reading only the headlines, you might think you are guaranteed nearly 10% in interest for a year or more if you buy I Bonds on May 1 or after. Wrong.

I Bond rates only last for six months after you buy a bond and will fluctuate over time.

"If you're buying after May 1, we don't know what the second six months will be," Pederson said.

To be sure, an annualized 9.6% rate would be rock solid for the next six months. Even if we saw no inflation adjustment beginning Nov. 1 — and that's unlikely — you'd still get 4.8% over the first year, Pederson said.

What happens if you need the money in six months?

You cannot cash I Bonds until you've held them at least 12 months. As a result, you cannot treat this savings as emergency money at least in the first year.

You would want to keep what money you need to buy new tires in six months or cover an emergency visit to the vet in a regular savings account.

You can cash out of I Bonds after the first year, but you'd lose the most recent three months of interest if you redeem the I Bonds within the first 5 years.

If inflation drops significantly in two or three years and you cash out then, you'd lose whatever rate the bond is paying then -- not the high rates you'd be receiving now.

The fact that the penalty is on the most recent rate gives you control as a bond owner, Pederson said, to review what's in your best interest if you want to cash out.

Are the bonds hard to buy?

It is a do-it-yourself project. Savers need to go to TreasuryDirect.gov to set up their own online account. But TreasuryDirect.gov has instructions and an FAQ.

To obtain the annualized 7.12% rate for six months, the transaction would need to be processed before the end of April. You'd need to move a few days before April 30, say on or before April 28. It takes 24 hours for transactions to process because of the Automated Clearing House process and April 30 is a Saturday so waiting until the 29th isn't a good idea.

You'd want to have the I Bonds issued as of April if you want to lock in the higher rates that would average out to 8.36% for a year. The new higher rate — announced May 1 — would apply in October for bonds bought in April.

Some experts call the online system a bit clunky and you can get timed out or cut off. Trying to go back to a previous page, for example, by using a back arrow can make you need to log back into the system.

While some say it's not the easiest account to set up, it is doable.

You will need your Social Security number and an email address where you will receive information during the process.

To transfer money from your bank account to your online savings bond account, you'd need the bank routing number and your checking account number.

The process calls for picking a personalized image to help you know you're on the authentic Treasury site. And you're going to need to choose three security questions.

Keep a record or file somewhere to track your bonds. The government is not going to be sending you paper statements or even email alerts to remind you that you have money sitting in I Bonds online.

I must admit that I bought $25 in I Bonds for myself online back in 2012 as a test for a column to show how to set up an online account. I completely forgot that I did that until last fall when I Bonds became a hot topic. I also bought $25 each for my niece's two children as a gift, and she forgot about that money, too. These things happen.

My tip: Keep track of what you're doing.

You want to give yourself enough time to carefully type in numbers, write down answers for security questions, and retrieve two e-mails from Treasury for the account number and onetime password.

Make sure you save information in a file so that you can easily access your account again in the future.

It also is a bit tricky to figure out how to add a second person to the ownership. But you can set up a secondary owner online.

Once you set up an online account, it can be relatively easy to buy more bonds in the future.

More: I Bond hacks on tax returns and more as inflation hits 8.5%

More: I Bond rates can be an inflation hedge: Why you should consider buying now

More: How to throw more money at inflation hedge with year-end hack

Do not dump old I Bonds

While most people are buying I Bonds now in online accounts, I Bonds were readily available in paper form for decades. I Bonds first appeared on the scene in 1998.

It is even possible that Grandma bought you some I Bonds if you're in your early 20s or younger.

I Bonds bought before Nov. 1, 2001, for example, are the best of the bunch and have a fixed rate of 3% or higher. The highest fixed rate was 3.6% for I Bonds issued from May 2000 through October 2000.

You're getting the inflation-adjusted rate on top of that fixed rate. As a result, savers holding older I Bonds with a fixed rate of 3% or higher would see an annualized rate of around 12.6% or more once that estimated May 1 rate kicks in.

Contact Susan Tompor via stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: Inflation sent I Bonds to nearly 10%; how some savers are buying now