Why Hunt’s holiday home crackdown could leave tourist hotspots in ruins

Holiday home owners could lose an average of £2,835 a year in a tax raid that risks ruining tourist hotspots.

Chancellor Jeremy Hunt is reportedly considering abolishing the preferential treatment for furnished holiday lets in this week’s Budget, in a move that would raise an estimated £300m for the Treasury.

However, it could force holiday let owners out of the sector and leave tourist towns with a gaping hole in their economies, the industry has warned.

There are around 70,000 second homes registered as holiday homes in the UK, according to the latest Census data, visited by 200,000 holidaymakers every year.

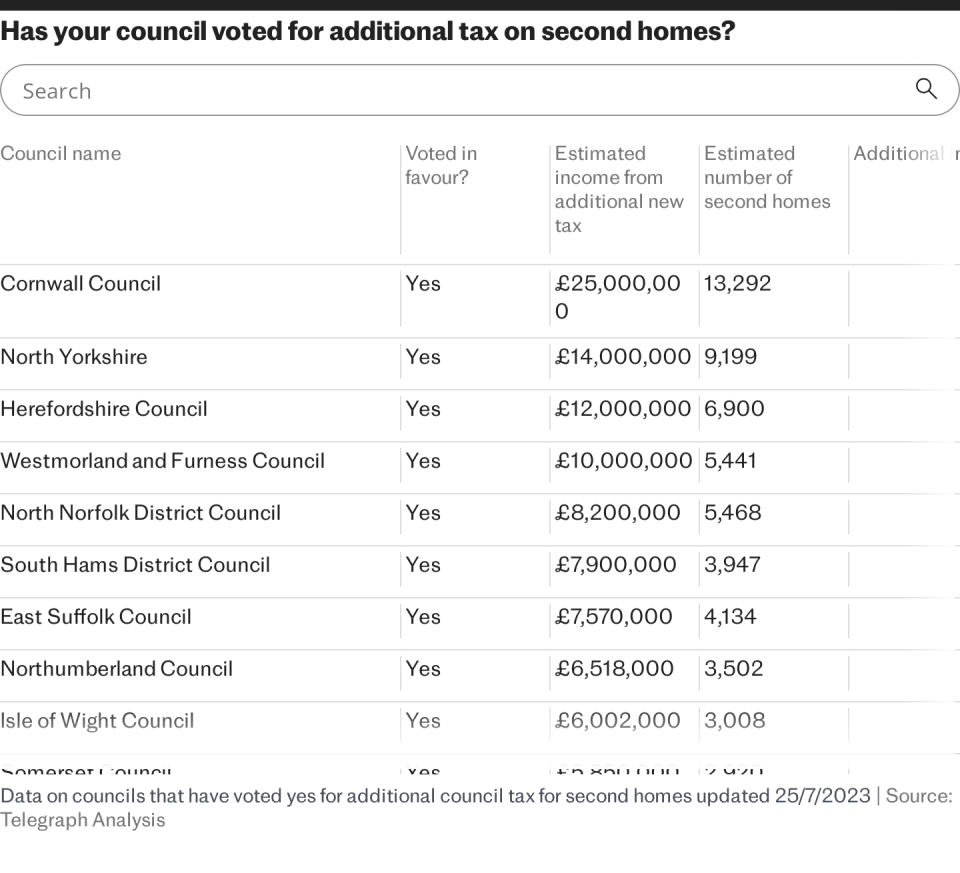

In some areas of England and Wales, more than one in 10 homes are used as holiday homes, with the greatest concentrations around coastal areas and national parks including the Lake District and Dartmoor.

Currently these property owners enjoy a more favourable tax regime than owners of long term rental properties, including mortgage interest relief that allows borrowers to offset their interest payments against their profits. Income from holiday lets is classed as net relevant earnings for pension purposes, allowing you to make tax-advantaged pension contributions.

Calculations by wealth planning firm Quilter show that holiday home owners could be nearly £3,000 worse off, thanks to increased tax costs. The calculations are based on a property purchase price of £350,000, with an annual mortgage rate of 4.5pc and £20,000 rental income.

Shaun Moore, tax and financial planning expert at Quilter, said: “For owners of holiday lets this could lead to a significant reduction in their net income.

“Should they lose the ability to deduct mortgage interest in full (in favour of a 20pc deduction), alongside the potential increase in capital gains tax, this could make the holiday-let business less financially attractive.

“This might result in a reduction in the number of properties available for holiday lets, which could impact local tourism.”

Squeezing the businesses that keep tourism alive

Critics argue that the change will unfairly penalise business owners over those with second homes that are left vacant for large parts of the year, and conflating the two risks harming local economies.

Tim Martindale, 61, has run Beach Haven holiday cottage at Bude, Cornwall for the past 10 years alongside his full time job as a photographer in the tourist industry.

The four-bedroom house was his and his wife Maria’s home for over 20 years, before they moved into his parents’ family home and set up the holiday letting business as their pension. It currently offers them an annual return on investment of 6pc.

Having set up the Cornwall and Devon Independent Self-Caterers Association a few years ago, he is worried that the burden of regulation on holiday-let owners is becoming too costly. Last year a new fire safety requirement meant expensive upgrades for many properties.

“There will be a lot of people vacating the business,” said Martindale. “There is a shortage of residential letting, but whether the owners will convert to that or not is another matter. I suspect they will just sell. They may sell to people who want a second home from London and aren’t bothered with letting it out. So there is no guarantee you are going to improve the situation.”

Furthermore, he warns that this exodus will also impact local economies which rely on out of season tourism to support jobs and businesses.

Last month, the Government announced the introduction of a register of short term lets and a requirement for planning permission for any property rented out for 90 days or more a year.

Martindale argues that the 90-day threshold acts as a loophole, allowing second home owners renting out only occasionally to slip under the radar while professional lettings will leave the market.

Importantly, the 90 days covers the peak holiday times leaving those homeowners to cash in, while the off market is left unsupported.

Stays at booking platform Airbnb supported over 107,000 jobs in the UK last year, across a diverse range of sectors, ranging from local bakeries to pubs, cleaners, and tour guides.

Martindale said: “Government policy does not successfully draw distinction between these two very discreet sectors and this causes a host of issues for our industry, punishing those who are genuinely trying to create an income and generate year round economic benefit for the community.”

David Barnes, from Kent, owns a five-bedroom holiday let in Porthcothan Bay, Cornwall. He renovated the property in 2017, taking out a £500,000 mortgage to do so.

When interest rates soared in the wake of the mini-Budget, Mr Barnes’s monthly payments jumped from £675 to £2,200 a month. But this is currently covered by the tax allowance.

Should Mr Hunt remove the furnished holiday let tax break, it would inflict a “double whammy” on Mr Barnes’s business, he said.

Mr Barnes, 57, estimates he will pay 40pc tax on £10,000 of his mortgage repayments and 20pc on the remainder – a total of £7,280 a year.

“The house sleeps 10 – that’s 440 people a year using local cafes, pubs and restaurants,” he said. “If worst comes to worst and I sell, which is likely because those costs would make it unviable.”

Rental yield from the holiday let is the sole income for Mr Barnses’ wife, and also provides work for local laundrettes and gardeners, he said. If he sells the property, Mr Barnes expects it will be snapped by a wealthy buyer as a second home and not a local.

He said: “Jeremy Hunt wants to make an example of holiday let businesses to generate a headline – to show he’s doing something about the scourge of second home owners.

“I am a Tory voter, but this will definitely make me not vote Tory – I imagine Labour would do something similar anyway – so I’ll probably vote Reform because they support business-friendly policies.”

However, they are not the only ones concerned by the plans and the adverse impact it may have on local economies.

Added pressure on a squeezed sector led by small businesses

The news of the possible change comes on top of a slew of regulation already faced by small business owners running holiday companies.

Ben Edgar Spier, head of regulation and policy at Sykes Holiday Cottages, said holiday let owners are already facing pressure from higher mortgage rates, energy prices and lower spending power of visitors.

“Squeezing them will not solve the housing crisis but will stifle the very businesses that support tourism spend and employment in communities across the country,” he added.

It won’t solve the housing problem

The proposals also fail to consider locals who run holiday lets, argues Craig ab Iago, Plaid Cymru local councillor and cabinet member for housing on Gwynedd council in North Wales, a holiday hotspot.

In his local area, ab Iago says many of the holiday businesses are owned by locals as a way to supplement their own income. “We have numerous groups who have holiday homes in our area. The ones I would like to stop are ones like a guy from Kent who saw homes are cheap here so wanted to buy a whole village.

“We want to stop that as it is predatory and homelessness is high here.” However, he describes the current suggestion as a “blunt tool” that won’t solve the housing problem as homes going up for sale as a result will likely be bought by outsiders.

He questions the logic that holiday let owners will become full time landlords in the wake of the tax increases.

“It is a completely different market and a completely different set of responsibilities. If the homes were turned over to the local authority, what a brilliant result that would be but that isn’t going to happen is it?”

Recommended

How to build a successful holiday let business