Why 2017 Was a Year to Forget for Frontier Communications Corporations Corp.

2017 has not been kind to investors in Frontier Communications (NASDAQ: FTR). Share prices have plunged 85% lower, triggering a couple of desperation moves along the way. And the regional telecom's troubles show no signs of ending anytime soon.

What's wrong?

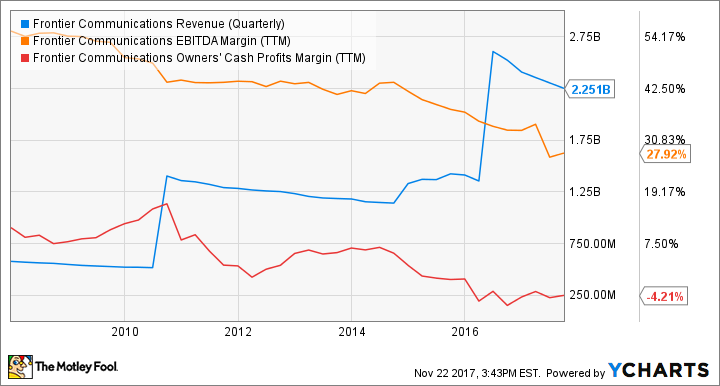

Frontier has struggled with structural problems for many years. In an effort to shore up falling revenues, the company has resorted to making large, splashy acquisitions of network territories where the original owner had given up on profitable growth. And each time, Frontier's quarterly sales spiked only to start sliding downward again. And profit margins have rarely moved upward, despite the acquisition-boosted economies of scale:

FTR Revenue (Quarterly) data by YCharts

The latest megadeal saw Frontier pick up Verizon Communications' (NYSE: VZ) landline operations in California, Texas, and Florida (CTF) for the princely sum of $10.5 billion. That buyout was closed in the spring of 2016, financed by $8.1 billion of additional long-term debt and $2.7 billion of dilutive stock sales. Frontier also shouldered $600 million of Verizon's CTF-related debt instruments.

The company's annual interest payments more than doubled to $1.5 million, driving Frontier's GAAP earnings deep into red-ink territory. Management worked through several refinancing efforts over the summer of 2017, addressing loans and bonds with short expiration dates. But Frontier's corporate credit rating is only getting worse, which leads to high interest rates on the new debt. This is nothing but a temporary fix to keep the company afloat until...

Image source: Getty Images.

Until what, exactly?

All of this would be fine if Frontier could hold on to its acquired customers, or even start to grow in its new territories. But that's not the case.

In the recently reported third quarter of 2017, Frontier had 4.9 million total customers on the books. That's down from 5.6 million accounts a year earlier and 5.8 million at the close of the CTF deal. Consumers and businesses alike are fleeing Frontier's voice, data, and TV services by the truckload.

So Frontier overpaid Verizon for a large but struggling chunk of business and is now hamstrung by the twin headaches of crippling debt and shrinking sales. I don't see a turnaround coming, and the endgame will probably be a pennies-on-the-dollar buyout or an even deeper discount in a bankruptcy auction. Fellow fool Erik Volkman agrees with my gloomy outlook.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Verizon Communications. The Motley Fool has a disclosure policy.