You might not be able to get last-minute deal on I Bonds after Treasury website slowdowns

The 9.62% annualized rate for I Bonds proved too hot to handle for a last-minute rush on the Treasury Department's website.

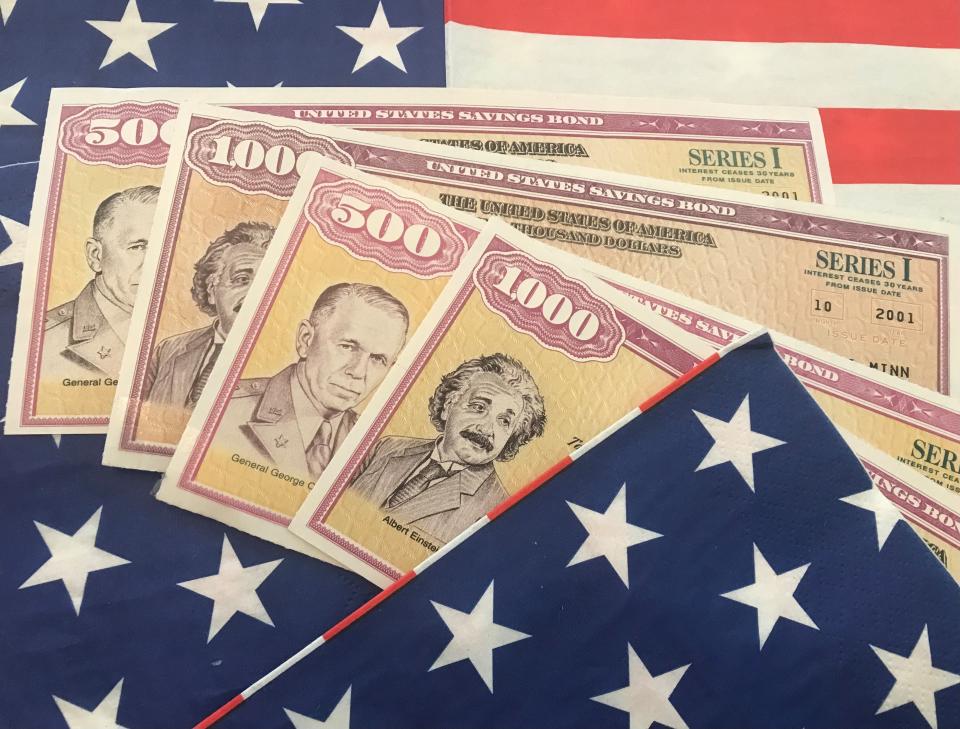

The I in I Bonds stands for inflation. And red hot inflation has driven up the interest rates dramatically on inflation-indexed U.S. savings bonds. While prices at the grocery have not fallen, the interest rates will be high but going down a bit for I Bonds issued in November through April 30, thanks to a recent downward trend in some inflation data.

Hence, the rush to lock up rates now in October.

Perhaps no surprise, but the TreasuryDirect website noted it has seen "unprecedented requests for new accounts and purchases of I Bonds."

If you waited until Thursday or Friday to buy I Bonds, you're likely going to end up screaming at your computer and you might not get what you want. Then again, you might get lucky. Who knows?

On Thursday, the TreasuryDirect website declared: "Due to these volumes, we cannot guarantee customers will be able to complete a purchase by the October 28th deadline for the current rate. Our agents are working to help customers who need assistance as quickly as possible."

It could be hard to complete a purchase if there are continued trouble spots and slowdowns in the system. You receive a confirmation email if you've completed a purchase. You should print out details of the purchase, as well, from your computer screen when it's made.

Early Friday morning, one reader reported making a successful I Bond purchase at around 4:18 a.m. Other attempts to get into the system around 6:30 a.m. and 7:30 a.m. worked, as well.

What savers must understand is that it can take a few or even several attempts at times to get into the system right now. And there are several steps as part of the process that must be followed. You can't rush. Some regulations apply. So, honestly, you should never really expect buying savings bonds online to be as easy as buying a pair of shoes.

That said, it's clear the system wasn't built for this kind of inflation-crazy, last-minute frenzy, either.

If you complete the purchase by Oct. 28, though, the Treasury Department says that you will still get the higher rate. But you need to be aware that all things are clearly not running smoothly.

The Treasury Department posted earlier that Oct. 28 was the final date to buy I Bonds in to lock in an annualized rate of 9.62% for six months after the bond is issued. A new lower rate for the next six months will be announced by Treasury on Nov. 1.

Most people want to buy in October so they can end up with an interest rate of about 8% over 12 months, after combining the 9.62% rate for the first six months and what's expected to be the new 6.48% annualized rate for the next six months.

More: I Bond frenzyI Bonds can bring big deals for savers: Why you should buy before Oct. 28

With an 8% rate, you're looking at $800 in interest on $10,000 in I Bonds. Interest is compounded semiannually.

Some faced trouble logging into the TreasuryDirect.gov site on Wednesday, including after 9 p.m. Wednesday evening.

“Due to exceptionally high traffic, the TreasuryDirect website has experienced intermittent slowdowns today. We are in the process of adding to the system’s service capacity and taking other steps in the hopes of resolving the issues quickly,” according to a statement emailed to the Free Press on Wednesday night by the Treasury Department.

I tried to log in myself on Wednesday night with no luck. I couldn't even get the website to come up. I also could not get the site to come up about 3 p.m. Thursday.

Then again, I began to wonder if you really want to attempt anything dealing with your money at a time when a site is so clunky.

More: Frustrated saversI Bonds identity, account issues become headache for last-minute buyers

John Rizzo, senior spokesperson, public affairs for the U.S. Department of the Treasury, said unprecedented volume has put significant strain on the 20-year-old TreasuryDirect system.

“We have tripled TreasuryDirect’s capacity in the last day and continue to see customers successfully create accounts and purchase bonds at record levels,” he said in an emailed statement to the Free Press early Thursday evening.

But Rizzo noted that any additional updates — or even delaying the Nov. 1 rate change — now would pose significant risks to the operational integrity of the system.

“This risk includes compromising our customers’ ability to manage their account in the coming days, such as securely and accurately making purchases and redeeming securities.”

Savers can buy I Bonds for as little as $25. But many are putting in the maximum of $10,000 per person given these exceptionally high rates.

The eye-popping rate was announced May 1 and I've written plenty about why it was a good idea to buy I Bonds for savers who didn't need access to the money for 12 months. You cannot cash out of an I Bond in the first 12 months.

You’d lose out on the last three months of interest on your I Bonds if you redeem a bond within the first five years of buying it. But the current rate, experts say, may be attractive enough to even lose a bit of interest if you need to sell the bonds in two or three years.

Plenty of people bought I Bonds this year, though I wrote in an earlier column this week that some savers saw incredible hurdles trying to open their accounts because they had to go through extra steps verifying their identity, steps that add several weeks to the process.

More than $24 billion in I Bonds were sold via TreasuryDirect during this year through Oct. 14, according to the Treasury's data. That's up from about $5 billion in 2021. That amount is net of any returned money that is over the limit allowed for purchase in a year.

The last-minute crush, though, seems to have thrown the system for a loop. Kind of like inflation, eh?

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: I Bonds rate deadline: TreasuryDirect website slowdowns hamper buying