Whitney Tilson: Lessons from my investment in Amazon 2 decades ago

As part of preparing to teach Amazon as a case study in my Lessons from the Trenches: Value Investing Bootcamp, I took a look back at my history with the stock and discovered that I had owned it for nine months in my first year of managing money professionally, nearly two decades ago at the peak of the internet bubble from mid-1999 to early 2000. (I had forgotten that I had ever owned it — probably because my brain was protecting me from the pain of knowing I’d sold one of the greatest stocks of all time!)

It’s a fascinating case study, with lessons that are just as true today as they were then.

As background, below is an email that I sent on Oct. 5, 1999 to my friend and journalist, Herb Greenberg, who was bearish on Amazon’s stock, explaining my thesis for why I owned it. It was a remarkably prescient analysis, highlighting that Amazon had “made tremendous strides toward becoming a broad-based e-commerce company and positioning [itself] to go after the $5 trillion global retail market,” its growth, brand, management, “top-notch customer service,” and its ability “to leverage its brand and customer base far beyond simple retailing.” I concluded: “This is going to be an entertaining ride, which I plan to stick out for the long run.”

In contrast to my bullishness, I also found an email (below) that my friend and fellow hedgie Chris Stavrou sent to me seven weeks later on Nov. 29, 1999, warning me to sell the stock because, despite expressing admiration for Bezos, he felt that “it’s over for AMZN.”

[I’ve also created a pdf with all of Jeff Bezos’s annual letters going back to 1997, which you can download here.]

At the time I emailed Herb, the stock was at $78 and had risen to $94 when Chris emailed me his warning so, given that it’s around $1,650 today, they were wrong and I should be doing a victory dance, right? Not so fast…

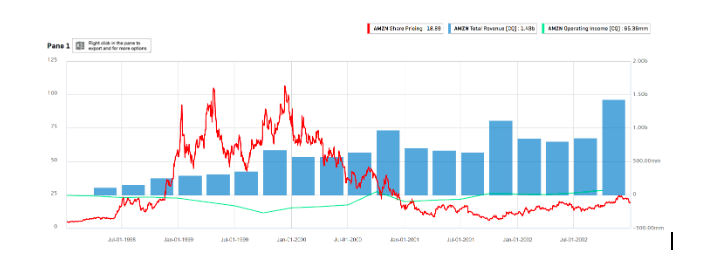

Interestingly, all of us were both very right and very wrong, depending on your time frame. Indeed, the stock has been a monster, but Herb and Chris were proven 100% correct over the two years after they warned me as the stock fell by more than 90%, as this chart shows:

The stock (red line, left axis) was in the mid-single-digits in mid-1998 and then exploded to the upside, going over $100 in April 1999 and again in December of that year, driven by its rapid revenue growth (the blue bars; right axis), general investor enthusiasm for the company (which I shared, as outlined in my email to Herb), as well as the absurd internet bubble. (I’d first purchased it around $50 in June 1999.)

It peaked at $107 in December 1999 and then, as the internet bubble burst and the company continued to lose money (the green line in the chart is quarterly operating income), the stock began a sickening slide, eventually bottoming below $6 at the end of September 2001, a 94% decline!

Fortunately, I got out in time, selling at $64 on March 9, 2000, the day before the Nasdaq peaked, to buy more Berkshire Hathaway at its nadir, making it 30% of my fund — one of my best trades ever!

The greatest whiff of my investing career

But I more than made up for this brilliance by almost completely failing to take advantage of the incredible bargains that presented themselves amidst the carnage of one of bursting of one of the biggest bubbles in history. There were countless stocks that went up 10x and some far more: for example, Amazon is up 269x since it bottomed, Apple is up 231x and Booking Holdings (formerly Priceline) is up 285x.

This was the greatest whiff of my investing career.

I wouldn’t beat myself up so much if I had done the work and concluded that these companies were outside of my circle of competence (as many were) or that I couldn’t value them (which was hard). But I didn’t. Instead, I did two things: 1) congratulated myself for having very publicly nailed the internet bubble and selling my tech stocks like Amazon and AOL in the nick of time; and 2) I wrote off the entire tech sector as uninvestable because it was too hard to predict and therefore the stocks were too hard to value.

Indeed, it’s true that much of the tech sector was and still is beyond my ability to understand and value.

But that isn’t (and wasn’t) true in the case of Amazon. Its business, especially at that time, wasn’t particularly difficult to understand and I could see, as a customer since almost day one (even before it went public), that it was a fabulous company with a very compelling service, as I outlined in my email to Herb.

Ah, but it was losing money and could have gone bankrupt, right? That was true until the fourth quarter of 2001, when the company turned operating profit positive (it’s never looked back, growing revenues 20%-50% each quarter and maintaining operating profitability almost every quarter since then).

But I failed to see this turn, in part because the stock had more than tripled to nearly $20 and in the back of my mind I was saying to myself, “I missed it” — the three most dangerous words in investing.

Had I wiped my memory clean and re-done my work, I’d like to think I could have seen that Amazon was worthy of at least a modest-sized position in my portfolio.

Now, instead of dismissing the most bombed-out, hated sectors, I look there for the next monster stocks. The problem is, nearly a decade into a long, complacent bull market, there aren’t many such sectors/stocks. From what little I understand of blockchain technology, there’s a lot of promise there, but first the cryptocurrency bubble has to fully burst (there’s quite a bit more downside I think). Ditto for marijuana stocks. You gotta be patient! Just remember the old saying: “What’s the definition of a stock down 90%?” Answer: “One that’s down 80% — and then gets cut in half!”

Happy hunting!

———————————–

Email I sent to Herb Greenberg on Oct. 5, 1999 (stock price: $78)

Herb,

Another notch in your belt on your dead-on call on Mattel and TLC. Kudos!

Re: AMZN (I have a small long position), I heard Joe Galli’s presentation (he’s the new President and COO from Black & Decker) at the BofA Securities conference in SF last week (where I also had the pleasure of meeting your colleague, Adam Lashinsky). I was really impressed. Here are the highlights:

1) From a year ago, AMZN has moved from being solely a book seller to a) selling toys, music, vidoes, electronics, etc.; b) having auctions, including an investment in/partnership with Sotheby’s; c) expanding to the UK and Germany; and d) taking stakes in many categories (Drugstore.com, pets.com, gear.com, homegrocer.com, della & james). In short, in only one year, AMZN has made tremendous strides toward becoming a broad-based e-commerce company and positioning AMZN to go after the $5 trillion global retail market.

2) AMZN added 2.3M new customers last quarter and 7 million in the past year to reach 11M, by far the largest in e-commerce. eToys has had 500,000 total customers. AMZN’s annual sales are 3.5x that of its main competitors as a group (B&N, Reel.com, eToys, and CDNow), and 8x that of its single largest competitor.

3) 70% of its revenues in Q2 came from existing customers.

4) AMZN is the 16th most trusted brand in America according to a survey, and the company is only four years old.

5) AMZN has made huge progress in building a world-class management team. In addition to Galli, it hired Warren Jenson from Delta as CFO and Jeff Wilkie from Allied Signal to head operations.

6) Galli rebutted the critics of AMZN’s new warehouses by pointing out that a) AMZN has ALWAYS controlled its own logistics, to ensure top-notch customer service; it’s just adding to its two warehouses that were at capacity last Xmas (Nevada and Kansas are now operational and three more are on the way); and b) the warehouses don’t change AMZN superior economic model relative to bricks-and-mortar retailers. He gave the following statistics for AMZN vs. a typical bricks-and-mortar retailer doing $8B in sales:

AMZN Traditional

PP&E $400M $2B

Inventory $320M $1.6B

By consuming much lower amount of capital to support each dollar of sales, AMZN offers the potential (key word) for much higher returns on capital.

7) In the five categories with AMZN is active (and AMZN is quickly moving into new categories), there is room for huge growth in the US and world markets:

Category US Market Size AMZN Share World Market Size

Books $29B 3% $80B

Music $12B 1% $40B

Videos $9B 1% $16B

Toys $28B <1% $70B

Electronics $79B <1% $180B

Finally, here are my own thoughts on zShops: I’ve always felt that the greatest potential for Amazon is less as a retailer than as a BRAND. The greatest businesses in the world (Coke, McDonalds, etc.) involve licensing a brand, whereby others put up the money and do all the work, and the licensor simply rakes in the money. I view zShops as the first of what I believe will be many steps by AMZN to leverage its brand and customer base far beyond simple retailing.

Regardless, this is going to be an entertaining ride, which I plan to stick out for the long run.

Best regards,

Whitney

———————

Email exchange with Chris Stavrou, Nov. 29, 1999 (stock price: $94)

Subj: Re: Amazon’s Risky Christmas

Date: 11/29/1999 2:30:15 PM Eastern Standard Time

From: Chris Stavrou

To: Whitney Tilson

Dear Whitney,

You are one of the most pleasantly prolific human beings on earth. Even if one doesn’t want to read most of what you say, your unrelenting shotgun-for-a-pen, must examine everything approach is so effective that one must read at least something of what you say, and that something is invariably of interest or worthy of debate.

The Amazon article in the Times Sunday (For Amazon a Holiday Risk: Can it Sell Acres of Everything?– This in apposite opposition to today’s Times’ E-Commerce report, Nightmares Before Christmas) was indeed read by the undersigned Fuddy Duddy Curmugeon. Due to laziness and lack of focus I did not buy Amazon, nor even take the usual small flyer, the day I did some serious thinking about it when it hit 18 (down from the opening price of 40, which was up 100% from the new issue price of 20), in other words the day it hit its all-time low.

Furthermore, at our annual stock picking contest (at my Electronics Analysts’ Group– would you believe they have any reason to have a non-techie like me as a member?) last December, I, along with 4 others recommended AMZN as my favorite short. Five guys recommended E-Bay as the favorite short. This is out of say 25 guys and gals present, nearly all wizened characters like myself. AMZN was then 35, adjusted, if memory serves. It is now 94, down from a high of 111. Our thinking was merely, hey anyone can do it. There’s no barrier. First to market won’t stop a cheaper second to market. The service is too fungible. Once they stop clicking on AMZN, it’s all over. Not to mention the problems associated with growing 100% plus a year. The idea that you can grow 100% a year plus in retail with no incremental cost because you don’t need warehousing stretches the credibility, and AMZN is de facto conceding this by its building program.

While I can’t predict a calamity, I can say that the risk of its happening is too great for my drying bones — namely, Bezos has tapped the naive well of “animal spirits” (that was the phrase used during the Congressional Hearings that led to the creation of the SEC) Wall street once, big time, and it won’t be tapped again without AMZN showing earnings, Barnes and Noble and half the world of bookdom are coming after AMZN with knives cutting the air, AMZN has gone from virtually no warehouse space (remember the virtual store? Does that also imply a virtual warehouse?) to 3 million square feet, where each order is touched umpteen times. They’ve broadened their offerings from books to everything. The point of my harangue is that something could go wrong. Wrong big time. Why single out AMZN? To the good, Bezos is a very bright fellow. He’s a fellow nerd so I must love him. He’s hired top people. To the bad is he in effect is selling product at 2/3 of cost, calling the expansion/marketing ventures nonrecurring expenses. I confess I have not actually gone out to visit AMZN, which I really should before opining as I am. I am opining as I am because every year I see 20% of all hedge funds explode because their Kamikaze managers buy Wall Street fables before anything material shows up. I don’t rail against the fabulists — on the contrary, it is wonderful that in this country they can spin fables and people put up capital to make the fabulists’ dreams come true. But most of the time, it doesn’t work, and I don’t want to see you go the way of the Kamikazes.

After saying all of the above, I come back to the real key reason I think AMZN is too risky—I’ve seen an AMZN “model” before and it came to a bad end. Due to senescence, I can’t remember the name of the company, but its specialty was X-mas gifts like Paul Revere Silver. The President, Lenny (I can’t remember his last name), was the X-mas Gift King. Demand was growing like crazy because he was promising timely X-mas delivery to everyone. He had a secret weapon. He was building the largest automated warehouse in the industry. And he wasn’t even giving everyone phony option paychecks, which are only good as long as the stock keeps going up. One day, the warehouse started routing things wrong. One day, the truckers became unhappy. One day the whole thing unhinged and very soon thereafter the gift king chaptered.

So when read about AMZN’s giant warehouses, I say, hey watch out. Is our Jeffrey a real-world execution whiz? Are those warehouses the same thing as manipulating 0s and 1s in cyberspace?

My danger here is I’m only theorizing. Any fool can theorize. Only the spy on the warehouse floor knows for sure. And only the guy who has done the detective work knows what the spy knows, and I haven’t done that work.

Good luck with it. My guess, my theory, is that it’s over for AMZN.

———–

Chris,

Thanks for taking the time to spell out your concerns about AMZN. They’re legitimate and I agree there is a high degree of risk for the company. That said, I’m a believer — and believe me, I’ve read and tried to digest every bearish argument I can find.

Unlike the jokers who blow up investing in this kind of stuff though — or more likely, in the case of AMZN anyway, shorting it — I recognize the risk and only invested 3% of my fund in it (now up 65%, it’s 4.8%). As new money comes into my fund, I won’t be investing more, unless the stocks drops quite a bit.

I’ve marked today’s price for AMZN. In three years, if it beats the S&P by 5% annually, you owe me dinner. Otherwise, I own you. Done?

WT

Whitney Tilson founded and for nearly two decades managed hedge fund Kase Capital. He is now teaching the next generation of investors via his new business, Kase Learning.